- Traders of the USD/PKR need to understand the costs of speculating on a brokers platform is going to have a lot of effect on the potential of the wager being profitable or not.

- Trading the USD/PKR needs a clear understanding that technical perspectives and patience are importantly.

- Equally important is the size of the speculator’s wager and ability to withstand movements which will test risk management limitations.

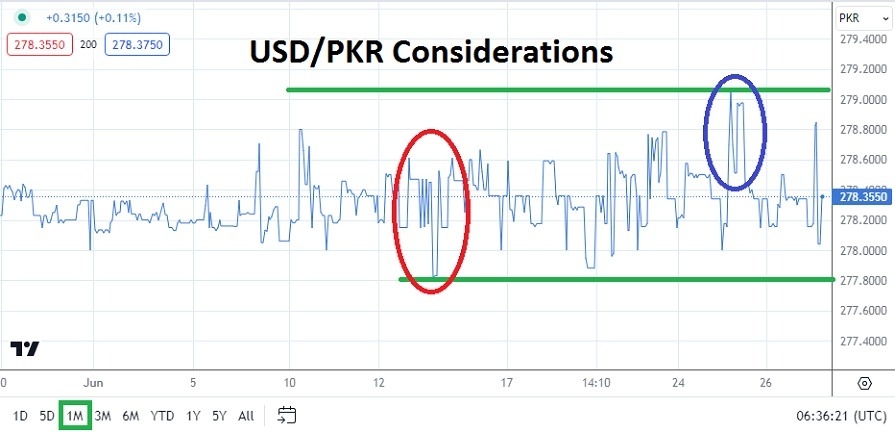

- The USD/PKR as of this writing is near the 278.3550 ratio.

The USD/PKR moves at a pace determined largely by the Pakistan Central Bank which sets the official exchange rate. There is not a lot of volume in the Pakistan Rupee and traders need to understand they may have to hold onto their trades overnight or even a few days to achieve a particularly target. Short-term traders should take a look at longer term technical charts to gain insights regarding the firmness of the value range in the USD/PKR.

Short-Term Wagers Based on Long-Term Charts

Typically it is important for day traders to watch short-term technical movements and decide on potential direction according to behavioral sentiment within financial institutions and possible daily outcomes. However with the USD/PKR it is important to know the tight range of the currency pair follows a philosophy set by the Pakistan government and is not exactly a free floating financial asset.

Intriguingly over the past week the USD/PKR has started to ebb slightly higher and broken through resistance levels per a one month chart (take a look at the chart provided please). This doesn’t mean the Pakistan Central Bank is allowing the USD/PKR to suddenly break free and move to higher ground, but does suggest forces within the currency pair caused the higher moves over the past few days. A high of around 279.0515 was touched this Tuesday. Support was then tested around the 278.1450 levels and then a bounce upwards again happened today challenging the 278.8500 vicinity before another reversal lower occurred. USD/PKR traders must not get overly ambitious regarding their wagers in the currency pair.

Top Forex Brokers

U.S Data is a Likely Non-Event for the USD/PKR

Today the U.S will release important growth and inflation numbers via the GDP reports, but none of this will likely have a big effect on the USD/PKR. The currency pair remains aloof and within its own trading landscape. The recent moves higher are interesting, but there are no guarantees the momentum will continue.

- Speculators of the USD/PKR either need inside knowledge of the Pakistan Central Bank, or to make decisions based on technical notions.

- USD/PKR traders need the skillsets of careful leverage selection, entering the market with precision, and having targets which have set goals – this while being able to withstand possible inactivity and waiting for results to be seen while being able to absorb transaction costs.

Pakistani Rupee Short Term Outlook:

Current Resistance: 278.4775

Current Support: 278.3000

High Target: 278.7000

Low Target: 278.0400

Ready to trade our daily USD/PKR Forex forecast? Here’s a list of some of the top forex brokers in Pakistan to check out.