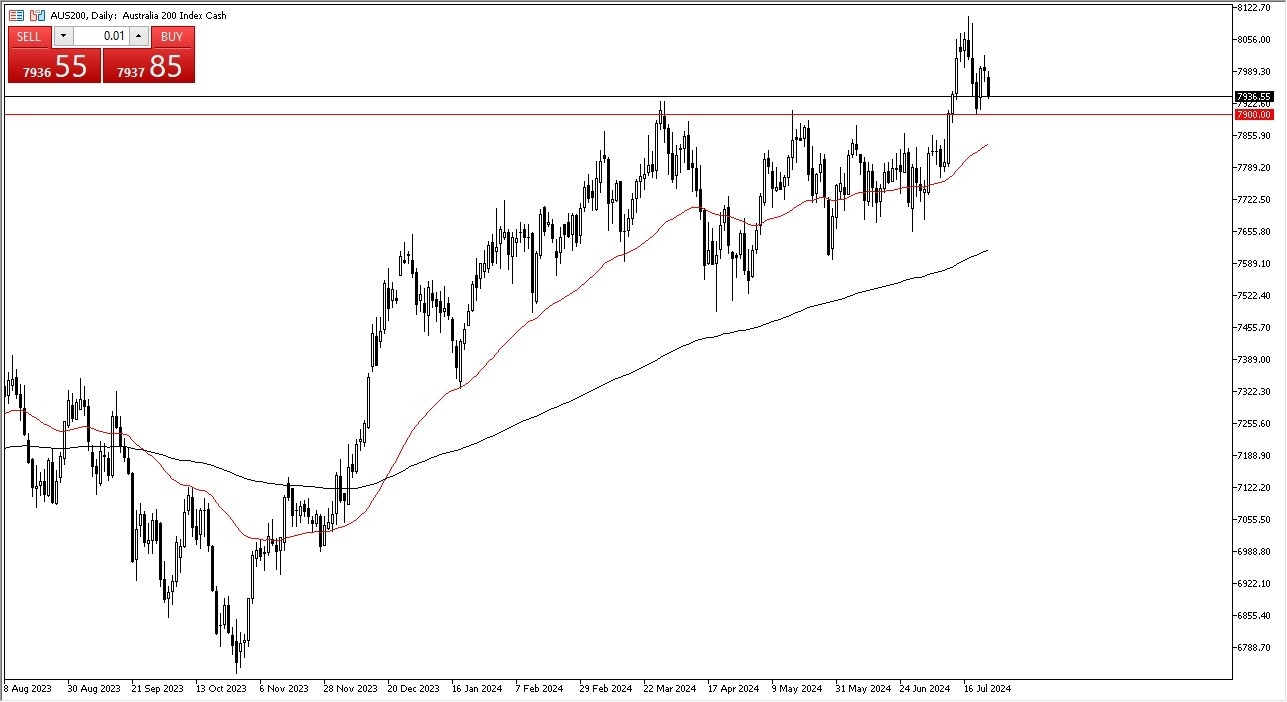

- I recognize that we are pulling back, but it's possible that we could also be approaching a massive support level that could turn things around.

- With that being the case, I think you need to pay close attention to the 7900 level as it was the top of a massive ascending triangle.

And therefore, I think it makes a certain amount of sense that it could be support on the way back down due to market memory. Keep in mind that the Australian dollar is a major influence as well, and it does look like we are starting to see a little bit of a recovery there. So perhaps money is willing to go into Australia over the next couple of days.

Top Forex Brokers

Wait and See? Maybe.

We are going to have to wait and see, but quite frankly, this is a market that quite often is very noisy but does tend to lag risk sentiment around the world. After all, we have recently seen several indices in the United States and the European Union take off to the upside while the ASX 200 was simply bouncing around in consolidation. Now the question is, will it play catch up? Will it start selling off? Or could it possibly lead the way? We just don't know yet.

I'm paying close attention to the $7,900 Australian dollars level and if it does hold, I think you could have a situation where traders come in and start to pick up cheap stocks after all. Keep in mind that BHP, Rio Tinto, Fortesque, and several other major mining companies are a huge part of the ASX 200 and therefore if they're looking to take advantage of cheap commodities, that might be one way they do it. Afterall, not everyone is willing to jump into the futures market, and will simply look into the companies that produces them, as it is easier to purchase stocks for the average investor.

Ready to trade the daily forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.