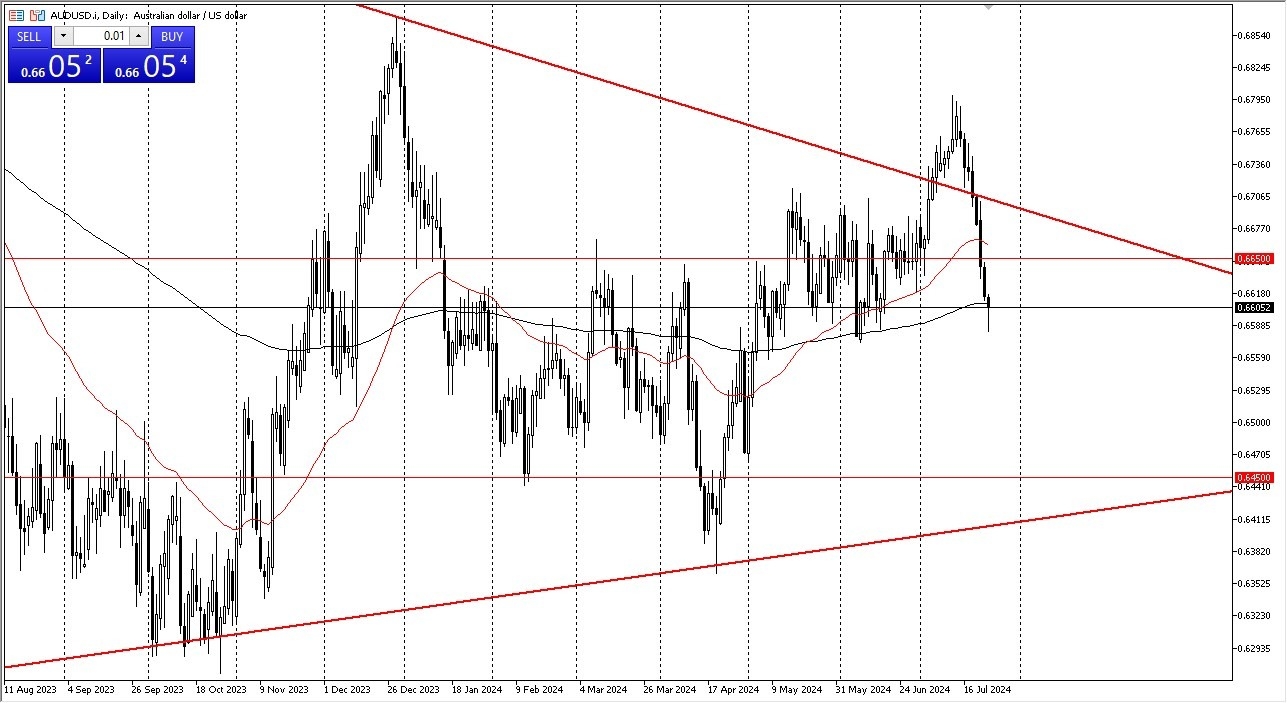

- In my daily analysis of the Australian dollar, it's easy to see that we had initially pulled back but have found a significant amount of support near the 0.6575 level.

- By doing so, it looks like the US dollar is going to be on its back foot, and that does make a certain amount of sense.

Considering that the PMI numbers were a real mixed bag coming out of America. Because of this, I think you've got a situation where a bounce is more likely than not. But I also recognize that there are a couple of barriers to overcome. The first one, of course, is momentum. Momentum has been horrific for the Aussie dollar over the last week or so.

Top Regulated Brokers

Is the AUD Oversold? Yes.

But at the same time, you can make an argument as to the market being so oversold that a bounce makes sense. If we can take out the highs of the trading session on Wednesday, it's very likely that we could go looking to the 0.6650 level above, which is also backed up by the 50 day EMA. The 50 day EMA of course, is an indicator that a lot of people pay close attention to, so it is something worth noting. Anything above there could lead this market back into the previous uptrend. On the other hand, if we were to break down below the 0.6550 level, then I believe that the Australian dollar drops pretty significantly. Perhaps looking for the 0.6450 level underneath, which has been massive support in the past.

Either way, you have to be somewhat fluid with your trading right now. There seems to be a lot of confusion and chaos on board. Most currency pairs and financial markets that I follow. I don't expect this one to be any different, as the Aussie is not only a commodities based currency, but it also a bet on Asian growth, which seems to be all over the place at the moment.

Ready to trade our daily AUD/USD Forex analysis? Check out the best forex trading platform for beginners Australia worth using.