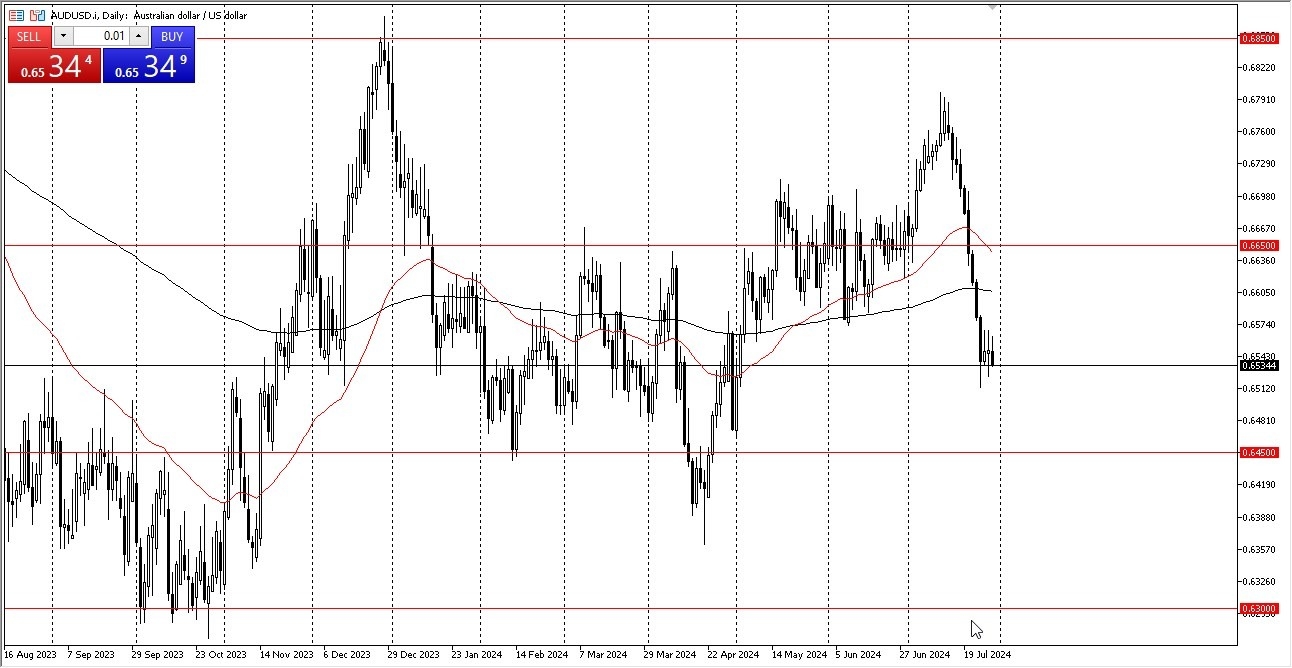

- It's easy to see that this currency is struggling a bit.

- That being said, it's also worth noting that the Australian dollar is at least hanging around the 0.6550 level, an area that probably attracts a little bit of attention.

- On the other hand, there are a lot of fundamental things going on this week that also would slow this move down in either direction.

Quite frankly, I think that one of the big drivers here is that the Federal Reserve has an interest rate decision on Wednesday, and therefore a lot of currency traders are just simply sitting on the sidelines. After the massive sell-off that we have seen over the last couple of weeks, it does make a certain amount of sense that the market would have to digest some of the gains by the greenback. The Australian dollar is quite often used as a proxy for China and it's probably worth noting that the Chinese have recently cut rates a couple of times albeit from a microscopic level to begin with. In other words, China could have some issues that the market has been sleeping through.

Top Forex Brokers

Aussie Dollar Will Continue to Be Noisy

The AUSD/USD market is a one that I think will continue to be very noisy. And I think at this point, if we continue to see weakness in Asia, we will probably drop to the 0.6450 level, an area that makes a significant amount of support just wait to happen due to market memory. On the other hand, if we turn around and break above the 200-day EMA presently sitting at the 0.6605 level, then it's likely that we go looking to the 0.6650 level where the 50-day EMA currently resides. I think more than anything else, the main takeaway from the versus US dollar chart is that we are simply waiting to see what the Federal Reserve will do and what it's going to guide towards as far as monetary policy going forward.

Ready to trade our Forex daily analysis and predictions? Check out the best forex trading platform Australia worth using.