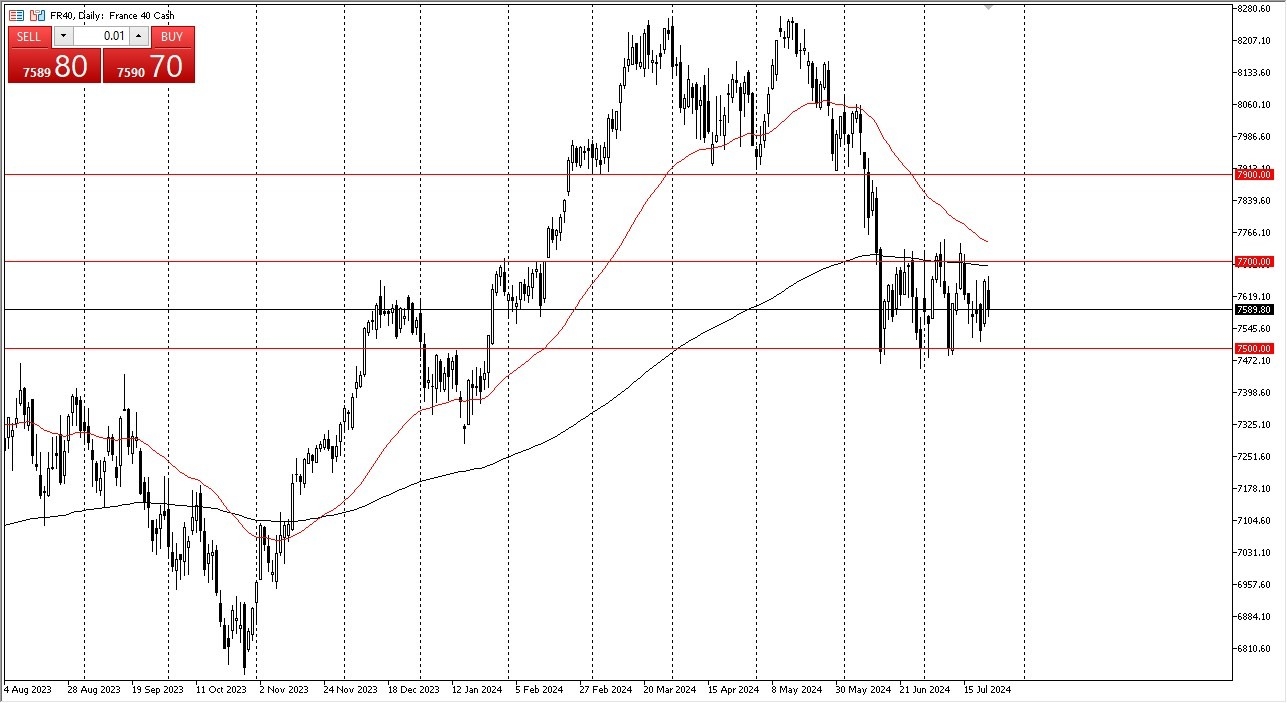

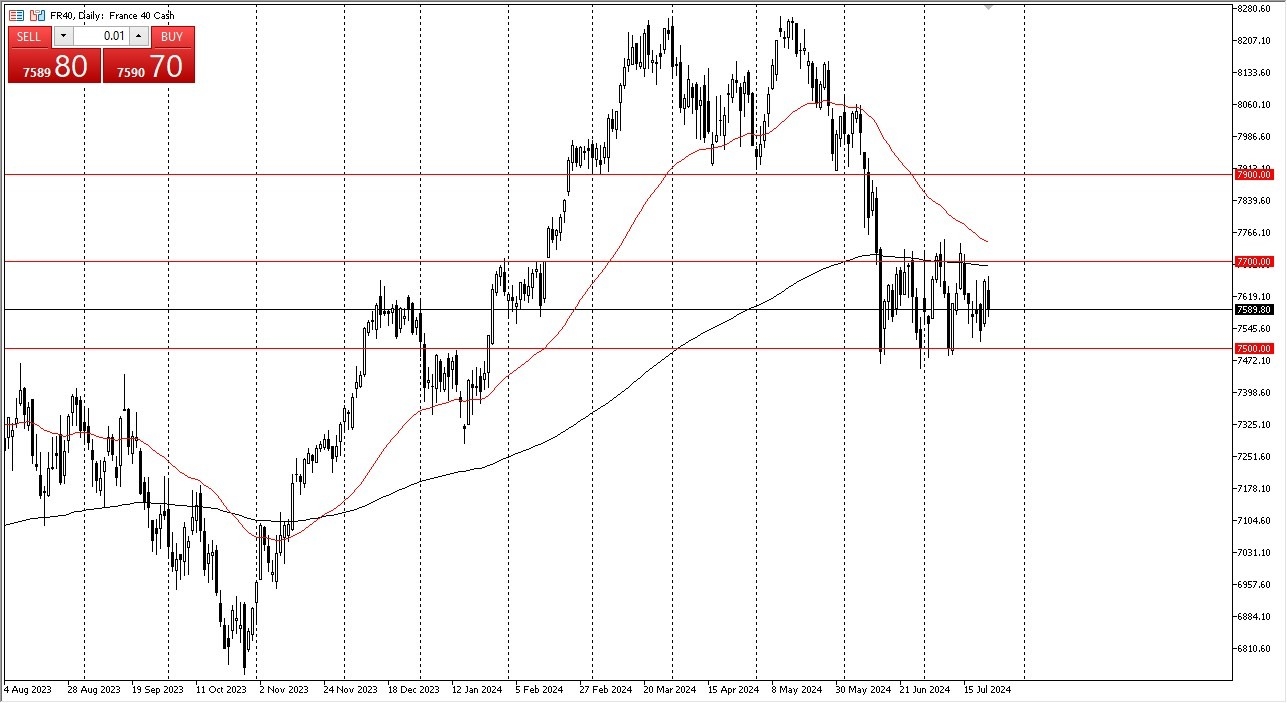

- The CAC had initially tried to rally during the trading session on Tuesday but gave back gains as the 200 day EMA continues to offer a little bit of resistance.

- Furthermore, you have to take a look at the €7,700 level as a potential barrier as well, as it has held true as far as resistance is concerned for some time.

- That being said, there is also significant support near the €7,500 level as well.

So, I think all of this being said, you are essentially looking at the market going sideways and consolidating, trying to determine whether or not the recent sell off is going to continue or if we're going to continue the longer term uptrend. It is probably worth noting that this is a market that, of course, won't operate in some type of vacuum, and therefore you need to pay attention to other indices around the world.

Top Forex Brokers

It's worth noting that the area that has offered support, the €7,500 level is also the 50% Fibonacci retracement level of the big move in Paris. If we can break above the €7,700 level, and perhaps even the €7,725 level, I think at that point in time it would be a very positive sign for the CAC. Furthermore, if you can get the Dax and maybe the FTSE 100 both rallying, that could drag Paris right along with it to the upside.

If We Fall from Here

If we break down below the €7,475 level, then we could drop down to the 61.8% Fibonacci retracement level, which is closer to the €7,325 level. This would obviously be a drastic move to the downside, but it is possible, so you need to keep it in the back of your mind. I believe at this point in time we are more likely than not going to see bullish pressure jump back into the market, but right now it also looks like traders are not willing to commit a lot of trading capital in the markets, and it's probably worth noting that this time of year is typically quite sideways in general.

Start trading the stock market analysis. Get our most recommended CFD Forex brokers here.