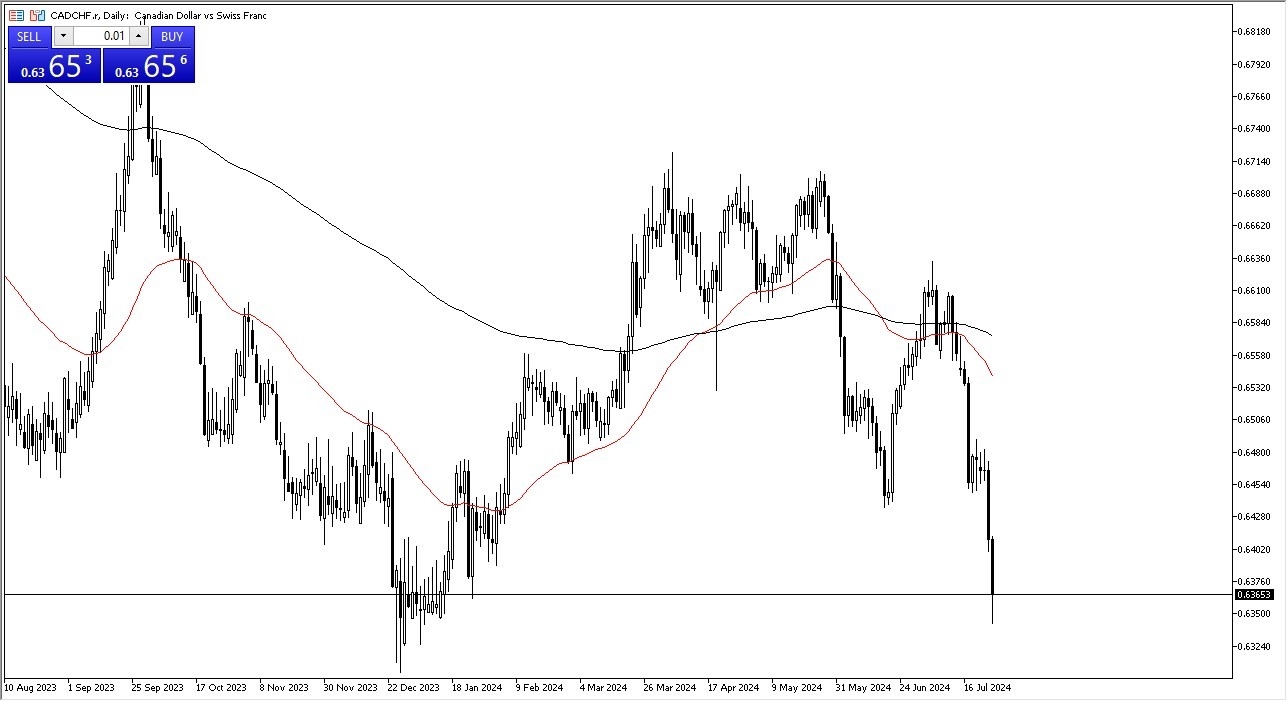

- In my daily Swiss franc against Canadian dollar analysis, it's easy to see that this pair continues to plunge lower.

- While we have seen a little bit of a risk attitude adjustment in the middle of the day, meaning that riskier assets have gotten a little bit of a boost.

This is a pair that has not bounced as much as many other assets. This does make a certain amount of sense considering that Canada has cut rates twice now and the Swiss have only done it once. Ultimately, this is a market that is highly influenced by risk appetite. And perhaps even you should think about the impression of crude oil in this market.

Top Forex Brokers

0.63 is a Major Level Worth Paying Attention To.

Ultimately, I do think that the 0.63 level is a major support level in this market, so you do need to mark that on your chart and pay close attention to it. But I also recognize that this is a bit of a a cross-pair that a lot of people will be watching. I'll be paying close attention to the 0.63 level, because if we do bounce significantly from there, it could be a turnaround on the monthly chart. We'll just have to see whether or not a double bottom occurs. One thing that you can do is perhaps put an oscillator on the chart to get an idea as to whether or not things are turning around.

So, the moving average convergence divergence indicator could be one that you use to back up the momentum question. Really at this point in time, it's not necessarily a pair that I'm willing to sell because there's a lot of support underneath, but I'm not ready to start buying it either. The reason I have brought this to your attention is this could be a move over the next couple of days. So, I want you to have the chart on your platform and to keep an eye on it.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.