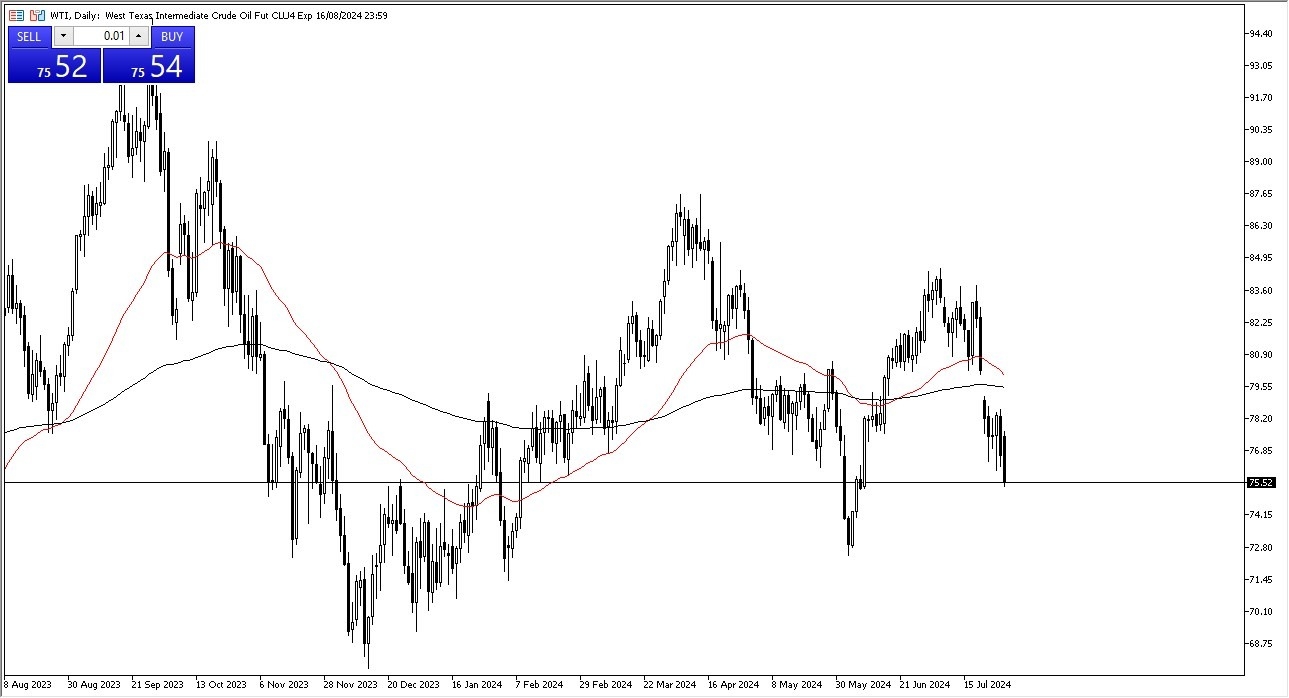

Potential Signal:

- I am a buyer of this dip.

- I will be buying the WTI/US Oil market in the 75.50 area, with a stop loss at the 73.40 level.

- I would be aiming for a move to the 81.00 level above.

The West Texas Intermediate Crude Oil Market, or the US oil market, fell significantly during the trading session, again on Monday, as it looks like we continue to see a lot of negativity out there. All things being equal, this is a market that typically is bullish this time of year, but we are starting to see traders price in the idea of a global slowdown. After all, oil is the life’s blood of the global economy, as demand is greatly influenced by the transportation of goods and services.

Top Forex Brokers

If that does in fact end up being the case, that is going to be a bit toxic for crude oil, as you would expect. And therefore, I think you've got a situation where traders are going to continue to look at this through the prism of whether or not there is growth. That being said, I do see a certain amount of support near the $73.50 level that more likely than not should be respected.

On a Pullback, We Look for a Bounce

If we pull back to that area and then bounce, I think you've got a real shot at things turning around. Nonetheless, this is a market that is a bit noisy at the moment. And if you zoom out on higher timeframes, you can make an argument for a massive symmetrical triangle that we are currently dealing with. Because of this, I think you've got a situation where traders look at this through the prism of whether or not we can break out of this area. I suspect there will be a little bit of a bounce sooner rather than later, but it is a short-term trade. It is not something that I think is going to change the markets anytime soon. We are in a relatively quiet time of year anyway, so it wouldn't surprise me at all to see this market just continue to range bound trade.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.