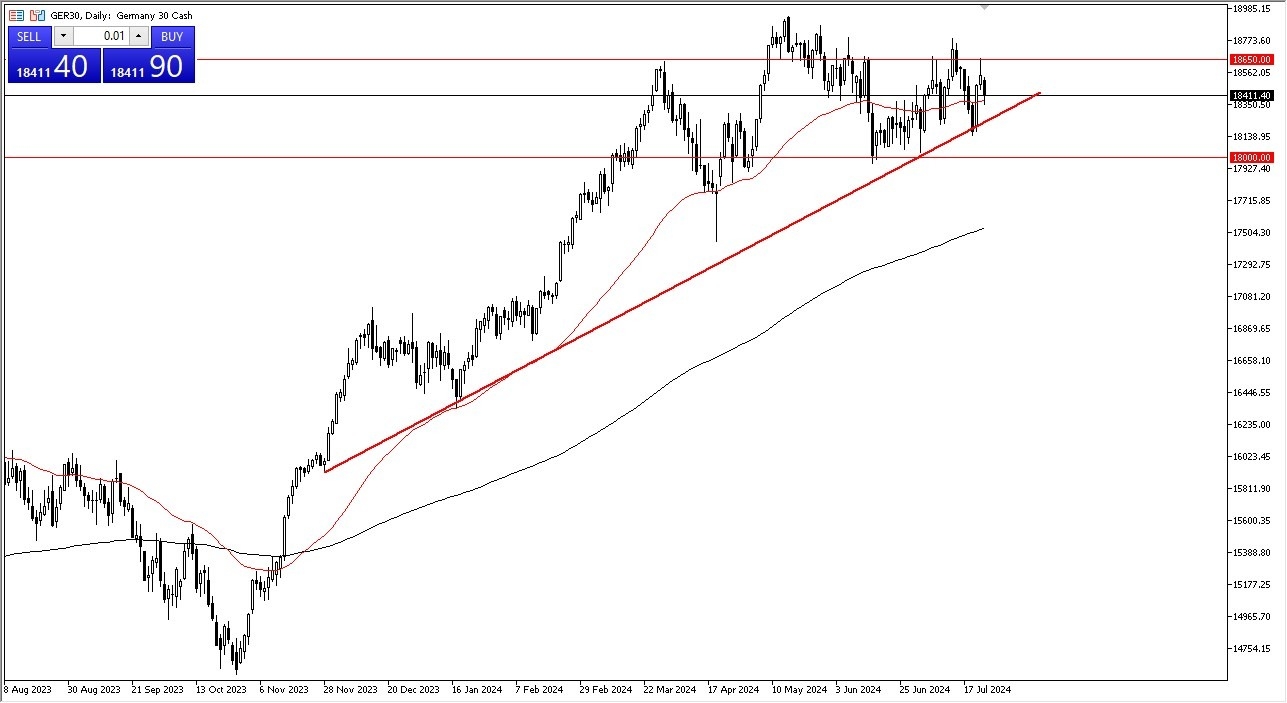

- In my daily DAX analysis, it's easy to see that the 50-day EMA continues to be very much in the minds of traders.

- It has offered a significant amount of support.

- I think at this point in time, it will be a technical indicator that a lot of people pay close attention to.

With that being said, I like the idea of perhaps trying to scale in on signs of momentum shifting to the upside. We'll have to wait and see when and if that occurs. But right now, on abouts, I'm very interested in this market. Over the longer term, I do believe that this is a market that will continue the longer term uptrend. And I do believe that eventually we will go looking to the 18,650 euros level again.

Top Forex Brokers

Bullish Over the Last Several Months

After all, this is a market that has seen a lot of choppiness as of late, but over the last several months it has been very bullish, and I think that will continue to be the case going forward. Underneath we have a major trend line that comes into the picture, and I think you have to keep that in the back of your mind as well. So, with all of that being said, I am a buyer of dips. I think this is a dip that you can start to nibble at, but you do have to recognize that the volatility could drive the DAX down lower.

PMI numbers around the world were a pretty mixed bag, and I think that might be part of what you're seeing here, but ultimately, this is a market that, given enough time, will, more likely than not, continue to grind higher, and not only reach the 18,650 euro level, but perhaps even reach as high as 18,900 euros, where we had the latest swing high. If we were to break above the overall swing high, this is a market that will start to take off, perhaps driven by the idea that the ECB might cut even more going forward.

Ready to trade our stock market forecasts? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.