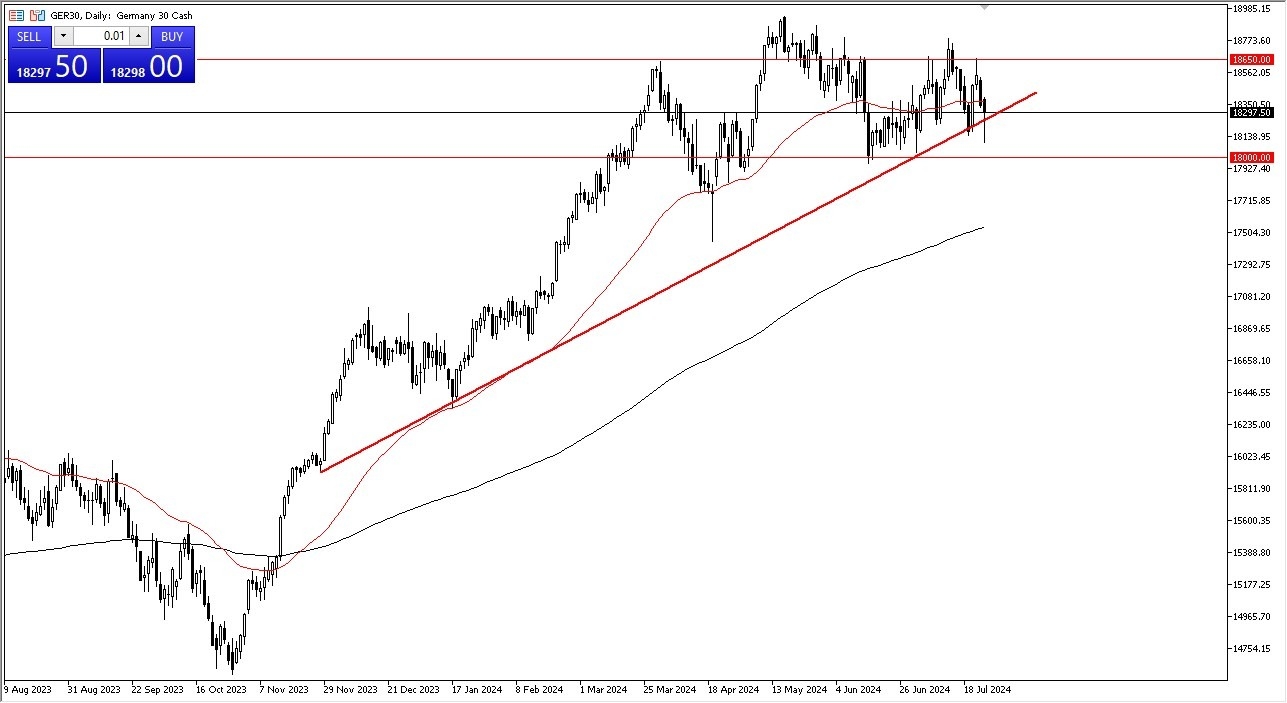

- In my daily DAX analysis, the first thing I notice is that we have recovered quite a bit of the losses early in the day.

- That tells me that there are still people out there willing to jump in and take advantage of cheap contracts.

- The 50 day EMA sits at the top of the daily range.

- If we can break above there, I think that the DAX has a real opportunity to continue going higher, perhaps reaching towards the 18,650 euro level.

Keep in mind, this is a market that like everything else, has been extraordinarily oversold in what probably could be best driven through as computerized panic selling.

I Do Favor Germany Overall

In general, I like the DAX as it is the blue chip index of the European Union, and this will be the first place money goes flowing to. Underneath we have not only the uptrend line, but we also have the 18,000 euro level, which is an area that a lot of people pay close attention to as it is a large round number and an area that's shown itself to be supportive multiple times.

Top Forex Brokers

If we can break above the 18,650 euro level, then it's likely that the market could go looking to the 18,900 euro level. If we can break that, then 19,000 euros, of course, would be the next target. In general, this is a situation where I think it's probably only a matter of time before you really see this thing start to pick up some momentum because it looks like central banks around the world are going to do everything they can to support stock markets, and that of course includes the European Central Bank.

At this point in time, I think you need to keep in mind that this index is one you should be paying attention to regardless, because it can give you a bit of a “heads up” as to what’s going on in the European Union. Overall, Germany is such a huge part of the European Union that it’s almost impossible for this market not to reflect what’s going on in the continent.

Want to start trading the stock markets? Get our most rated CFD Forex brokers to choose from here.