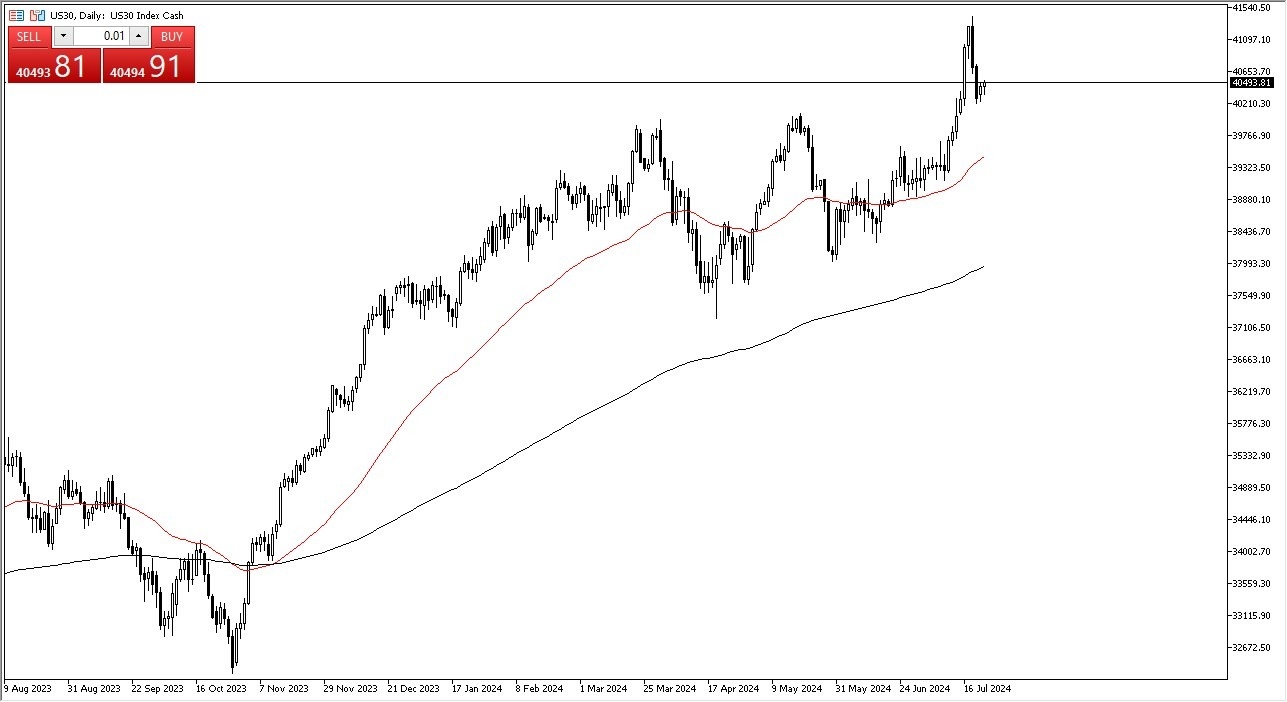

- It's hard not to notice the fact that even though we sold off in the early hours on Tuesday, the buyers came back to get involved and started pushing this market higher again.

- We had been in a massive uptrend, but recently had seen a pretty nasty sell off in the indices around the United States.

A lot of that had to do with rotation from some stocks to another. And therefore, I think you have a situation where it continues to be very noisy, but overall, we are still very positive. Keep in mind that if the Federal Reserve does in fact cut rates, a lot of people will be looking to put money to work in the industrials, as there is expectations that there will be more construction and infrastructure being built.

Top Forex Brokers

And that, of course, will directly influence the Dow Jones 30. Ultimately, it looks like the market is going to continue to pay attention to the previous breakout from a massive ascending triangle. And in fact, you could make a little bit of an argument that we have pulled back enough to get in that same general vicinity. And now it looks like we are ready to continue the overall uptrend in a basic breakout, pullback and continuation move.

Patience Will be the Way Forward

We will have to wait and see how that plays out. But I certainly think you've got a situation where traders could be looking at this through the prism of more continuation and perhaps a move up to the 41,000 level short term pullbacks. I think, continue to be invitations to buy the market as the, move previously had been so strong.

I have no interest in selling indices in the United States. They aren't equal weighted anyways, and that always lends itself to being a bullish market over the longer term. Because of this, I think that a lot of people are willing to get involved anytime there is a drop in price.

Ready to trade our daily forex forecast? Here are the best CFD stocks brokers to choose from.