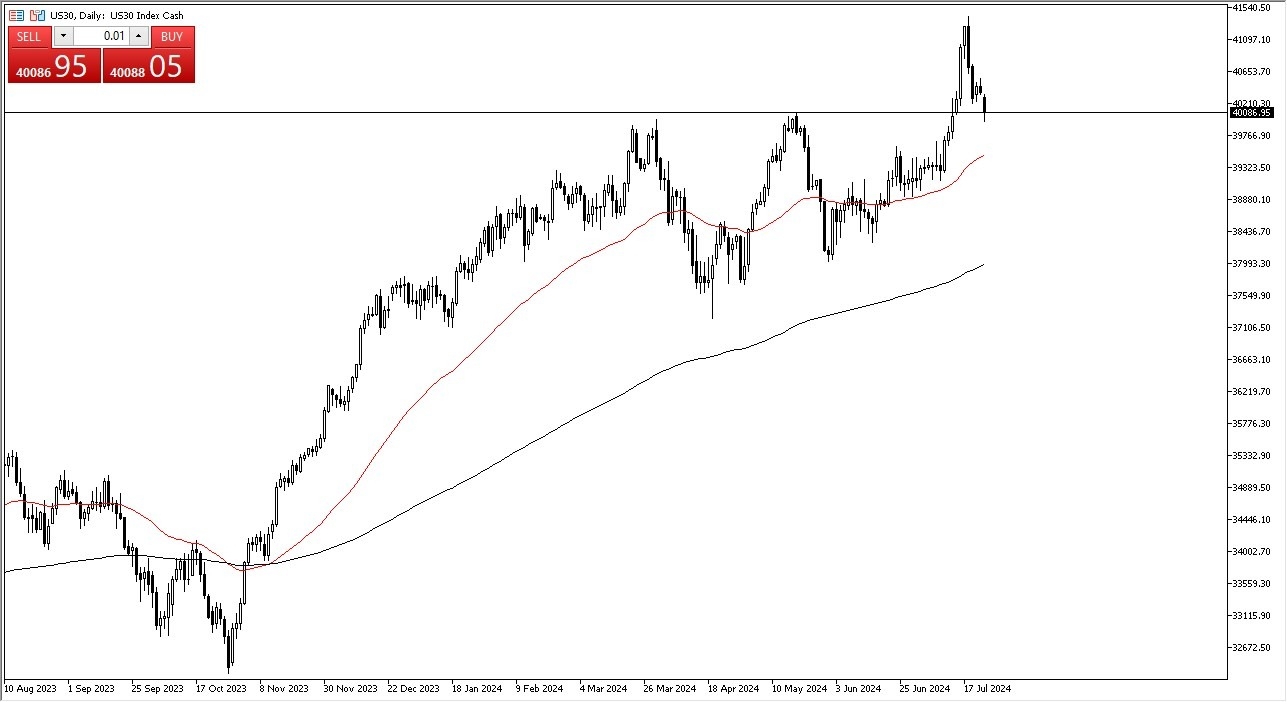

- I recognize immediately that we have seen a brutal sell-off, but quite frankly, I think we are a bit overdone.

- Keep in mind that the PMI numbers during the day were a bit of a mixed bag around the world, but sooner or later, traders are going to jump in and take advantage of what they think could be a green light for the Federal Reserve to start cutting rates.

If they do start cutting rates, then typically that benefits industrials because you will see large amounts of money thrown into things like infrastructure simultaneously. If that is going to be the case, then I think the Dow Jones 30 will continue to be a solid performer. It's worth noting that we tested the top of a swing high from several months ago and are starting to try to at least recover a bit.

Top Forex Brokers

I Think Rotation is Still the Thing

So, I think that shows more rotation as well. After the mixed PMI numbers for the session, I don't know that it changed the longer term outlook for stocks in the United States. As we had seen traders get away from the idea of artificial intelligence and start focusing on things like smaller companies, industrial companies, et cetera. We are no longer looking at things like Nvidia and Apple as being the only reason the market goes higher. That doesn't mean that it's going to be easy, but I do think that the Dow Jones 30 will bounce from here and eventually go looking towards the 40,500 level. If we can break above there, then the 41,000 level would be the next target. I certainly have no interest in shorting this market. It is far too bullish overall. And of course, it is an equal weighted index likes unlike so many others in the United States. So, it does make it a little bit different. But I think these are the stocks that people are going to be piling into.

Ready to trade our stock market analysis? Here’s a list of some of the best CFD trading brokers to check out.