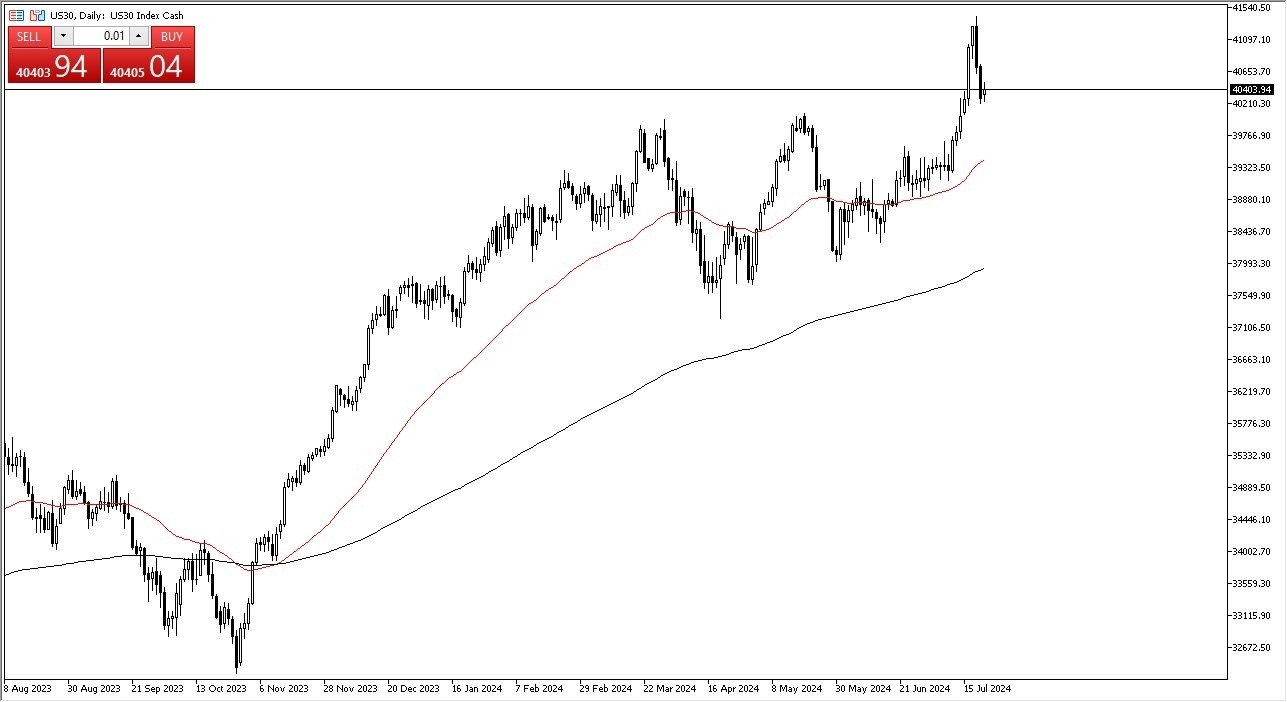

- In my daily analysis of the Dow Jones Industrial Average, it's easy to see that this asset had found a little bit of a floor in the early hours on Monday.

- The question now is whether or not it can hang on to that support.

- I do think we are in the midst of forming some type of base that we can rally from. The question is whether or not we can stay afloat.

The 40,000 level underneath me is a major support level and an area that we have to pay close attention to. It's the top of an ascending triangle and therefore a certain amount of market memory should come into play in this general vicinity. I do think eventually we will go looking to the 41,500 level and perhaps even higher than that.

Top Forex Brokers

That being said, the market fell apart for two sessions in a row, so a day that's somewhat quiet like this is actually much more bullish than it looks. If we can break above the highs of the trading session on Monday, that's a good sign, and I think at that point in time a lot of people will be willing to jump into the market and chase a certain amount of momentum. On the other hand, if we do break down below the $40,000 level, it's likely that we could test the 50-day EMA underneath. The 50-day EMA, of course, is a major indicator that a lot of people pay close attention to and therefore I think that also could offer a certain amount of support.

Rotation Continues?

In general, this is a market that I think continues to benefit from the idea of rotation in the stock market. And of course we are in the midst of earnings season, so that will have a major influence on what happens next as well. It's a huge uptrend line just waiting to be formed from the triangle. So even if we do pull back, I think significant support is to be found.

Want to start trading the stock market daily forecasts? Get our most recommended CFD Forex brokers to choose from.