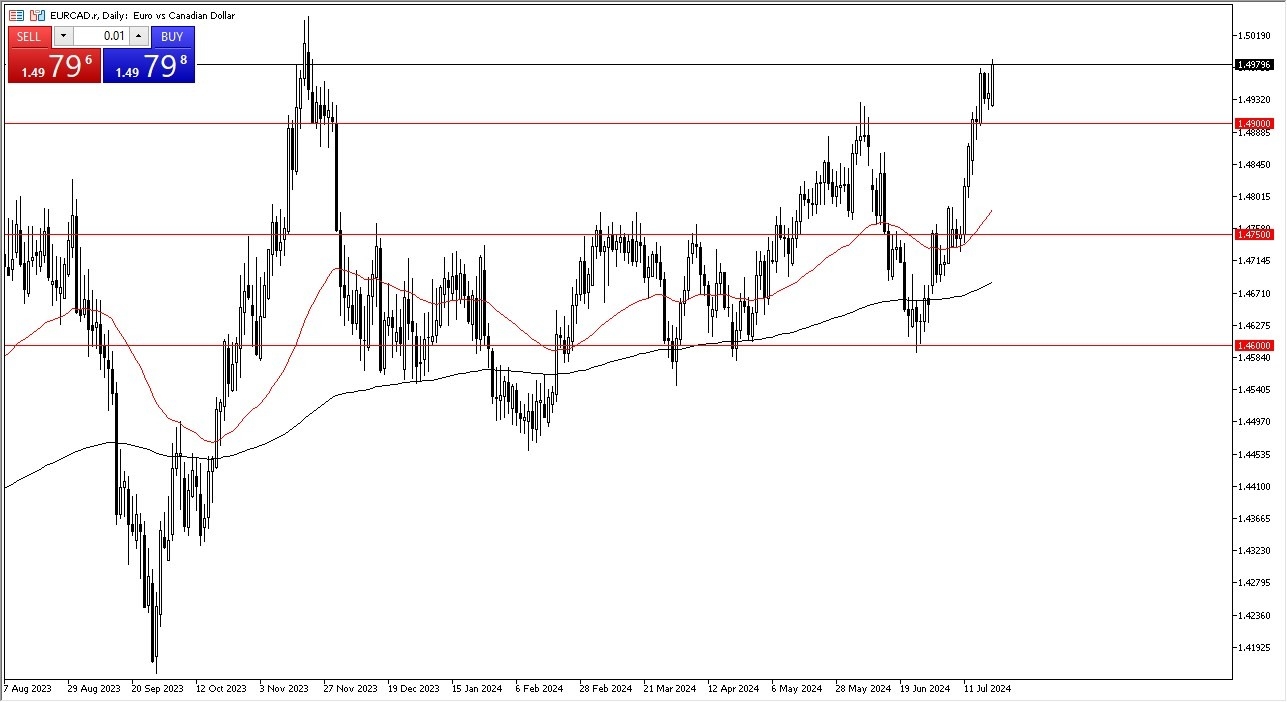

- I begin ask the question “Can the euro break out against the Canadian dollar?

- At this point in time, we are most certainly approaching a major inflection point in the form of the 1.50 level, and at this point in time, I think we are going to at least make a serious attempt to break above it.

If we were to do so, that would be a major break out for the euro against the Canadian dollar, which is also suffering due to the fact that the crude oil market has struggled. Ultimately, though crude oil market is a major driver of what happens with the Canadian dollar, except for when measured against the US dollar, or Norwegian krone.

Top Forex Brokers

Support just Below

The 1.49 level underneath should continue to offer a significant amount of support, as it had previously been resistance. At this point in time, it looks like there are plenty of buyers willing to get involved in this market in that general vicinity, and therefore I think you have to look at this through the prism of a market that is simply a “buy on the dip” scenario. If we were to break down below the 1.49 level, that doesn’t necessarily mean that the market is going to fall apart and everything is for not, it just means that we may need a bit of a deeper correction.

At this point, I’m not necessarily a huge fan of the euro, but I’m even less of a fan of the Canadian dollar, and that’s essentially what the market is all about anyway. We had previously shot straight up in the air, followed by a couple of days of sideways trading, followed by a breakout. Ultimately, if we can break above the 1.50 level, I anticipate that the market could go looking all the way to the 1.54 an area over the longer term, based upon the idea of “a measured move in the market.” As things stand right now, I don’t have any interest in shorting this pair.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers to choose from.