- The euro has shown itself to be very strong against multiple currencies around the world, especially when it comes to emerging market currencies.

- With that being the case, the Mexican peso of course would be no different and this is a situation where the market is likely to eventually break out to the upside.

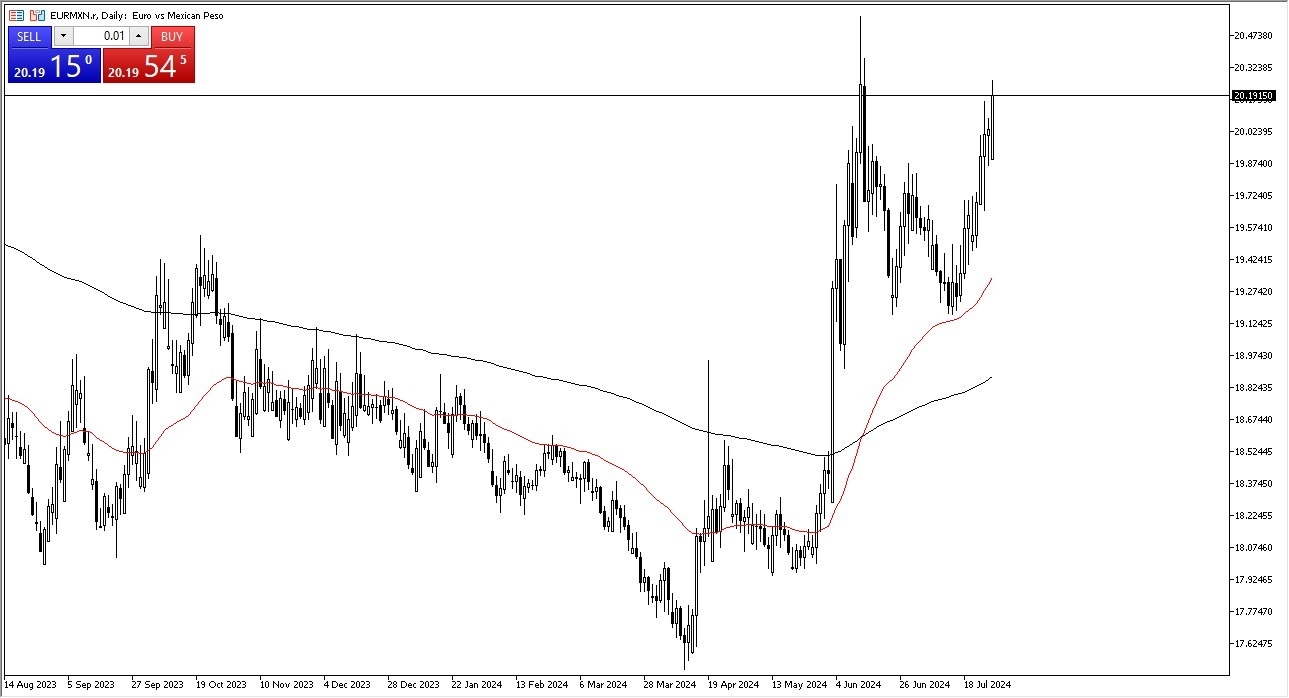

- The 20.33 area for me is an area that if we can break above, the market could go much higher.

- With this being the case, I like the idea of buying not only the breakout, but maybe the occasional pullback.

This EUR/MXN pair is a bit out there for a lot of traders and isn’t the first one you typically think of. However, as money goes running away from Mexico, this pair will behave very much like the USD/MXN market, and many others. Also, keep in mind that the Mexican Peso is also used as a gateway for Latin trading by a lot of currency traders, so it is reflective of a lot of other countries as well. At this point, it looks like risk is being cut back, and this will continue to work against the Peso overall.

Top Forex Brokers

20 is Important from a Technical Analysis Standpoint

I think the 20 level will be an area that a lot of people pay attention to, followed by the 50 day EMA, which is closer to the 19.33 level in general. This is a market that I think will struggle to fall apart because quite frankly, it looks like the world is running away from risk appetite right now. And therefore, any investment that had gone from the European union into Mexico would have been reversed. If we were to break down below the 50 day EMA, then things might change, but I would like to see the Mexican peso strengthen against its most notable counterpart, the US dollar, as it tends to be a major impact on how it trades everywhere else.

Ready to trade our daily Forex forecast? Here’s a list of some of the top Mexican forex brokers to choose from.