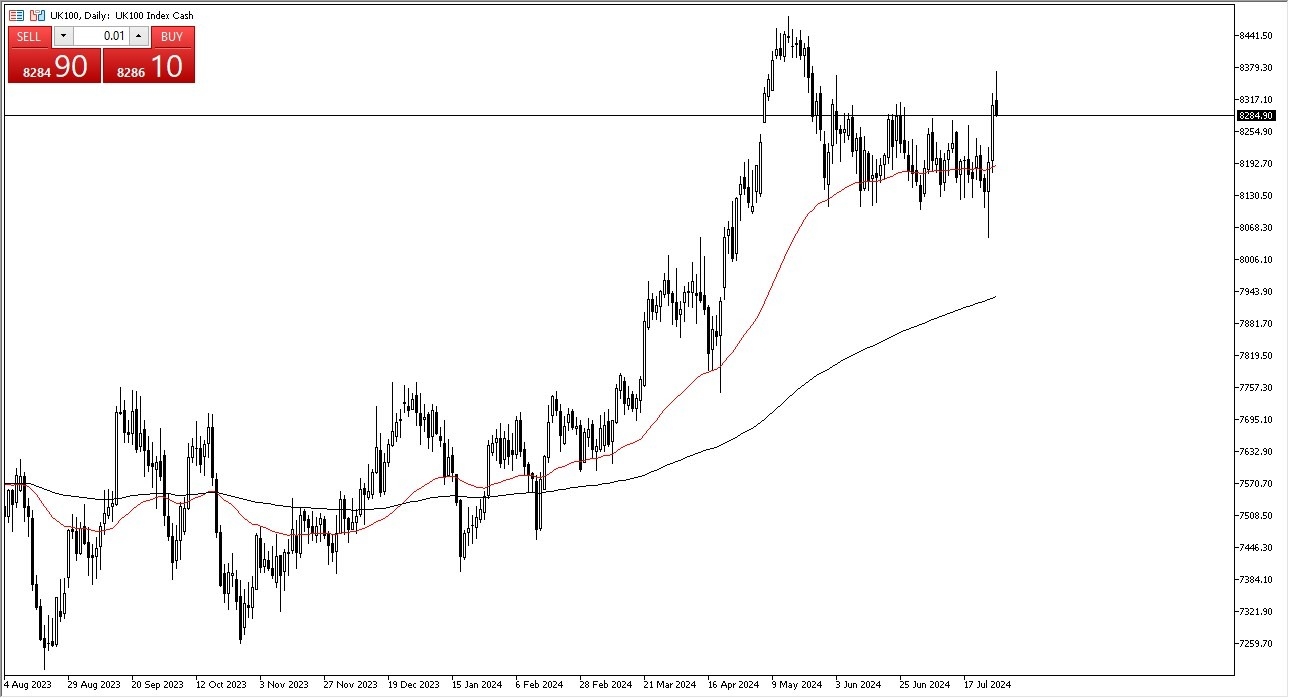

- The exchange in London initially tried to rally during the trading session on Monday, but it gave back gains rather quickly.

- With that being said, the market is likely to continue to look at the previous consolidation as an area that people should be paying attention to.

- I think the market will continue to look at dips as potential buying opportunities, especially with the 50 day EMA being right in the middle of the consolidation that we have seen over the last couple of months.

The Bank of England, of course, has a meeting this week. Because of that, I think we've got a scenario where we probably see a lot of volatility but given enough time, we could see people jumping into this market anytime they get a little bit of value presented. On the other hand, if we were to turn around and take out the top of the Candlestick for the trading session on Monday, that would be a very strong sign of continuation. And in that environment, I think you will see more FOMO trading.

Top Forex Brokers

Will We Continue to See Buyers?

This is a market that has been in an uptrend for a while. And therefore, I think it makes sense that we will eventually see the market rise over time with the 8,450 level above offering a bit of a ceiling. Underneath I do think that there is a massive amount of support right around the 8,100 level, so pay close attention to that. Anything that breaches that could have the state of the market in flux.

That being said, by the time we get to the end of the week we may see a massive turn around in momentum in one direction or the other period as things stand right now, I think you need to be a little bit cautious, but this is most certainly a stock market I will be paying close attention to for the rest of the week.

Ready to trade the stock markets analysis? Get our top Forex brokers for CFD trading here.