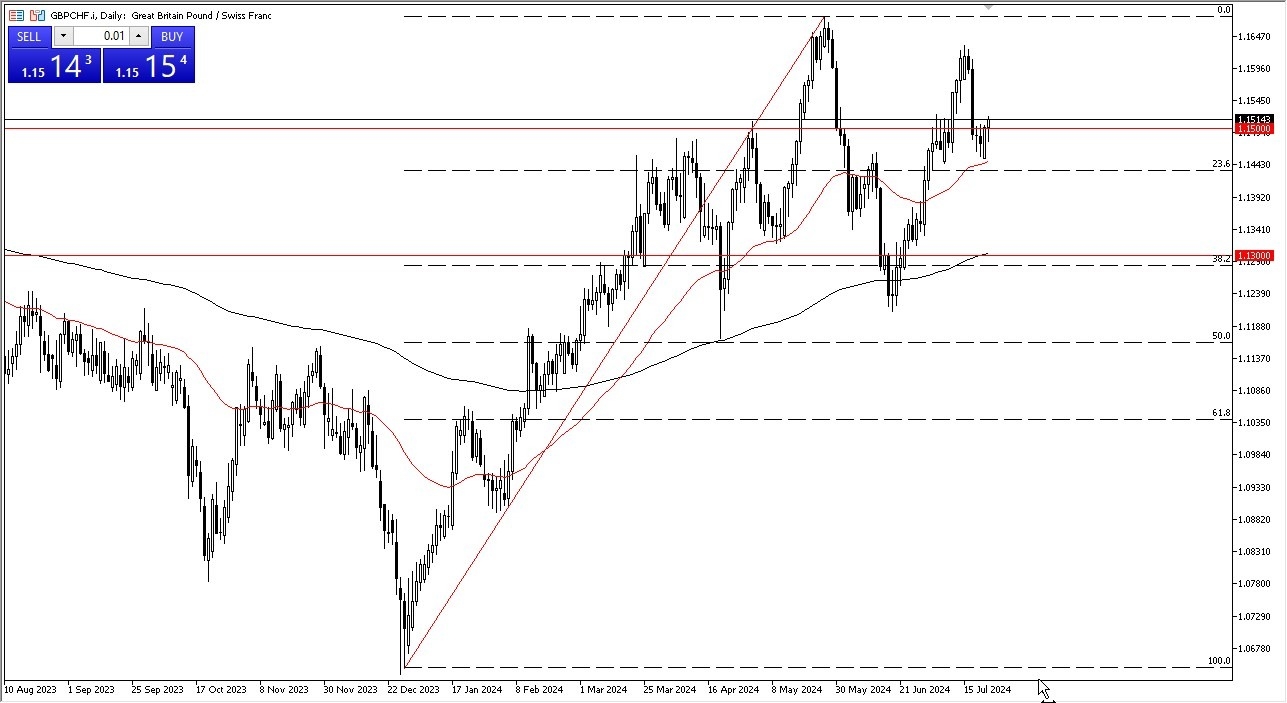

- The British pound initially pulled back just a bit during the trading session here on Tuesday, but then turned around to show signs of life.

- We now look as if we are getting close to breaking out to the upside, and if that does end up being the case, I think that the initial target might be the 1.1650 level above, and then eventually the previous swing high.

GBP/CHF is a pair that is highly sensitive to the interest rate differential. And it's probably worth noting that the interest rate differential is quite wide between the United Kingdom and Switzerland. Keep in mind that the Swiss National Bank has already cut rates, so therefore they have already begun their rate cutting cycle, unlike London. That being said, it's also worth noting that we had a bounce from the 50 day EMA during the last 48 hours and I think we could continue to go much higher.

Top Forex Brokers

Further Reasons to Think Support is Here

You should also recognize that the area is also at the 23.6% Fibonacci retracement level. And if we do in fact bounce from there, that normally means you have a lot of momentum behind the move and you go much, much higher. If we were to turn around and break down below the 1.14 level, then I think we could see the market dropping down to the 1.13 level where the 200 day EMA currently resides, and for a lot of technical traders would determine the overall trend.

In general, this is a market that I think continues to be very noisy, but I do think it favors to the upside due to the fact that you get paid at the end of every day to hold on to this pair. That being said, I remain very bullish, but I also recognize that this is an extraordinarily volatile currency pair at times. Because of this, always keep your position sizing reasonable, as you can find real trouble in this market if you are not careful. However, I would also like to point out that this pair is a favorite of mine in general, and I love the fact that when you get things correct – you know quickly.

Ready to start trading our Forex analysis and predictions? Get our Forex brokers for beginner's trading here.