- This is a very interesting pair because we recognize that it could be the epicenter of a lot of volatility over the next couple of days.

- Wednesday hands the Bank of Japan and its interest rate decision, and perhaps more importantly than that, its press conference. But Thursday hands the Bank of England.

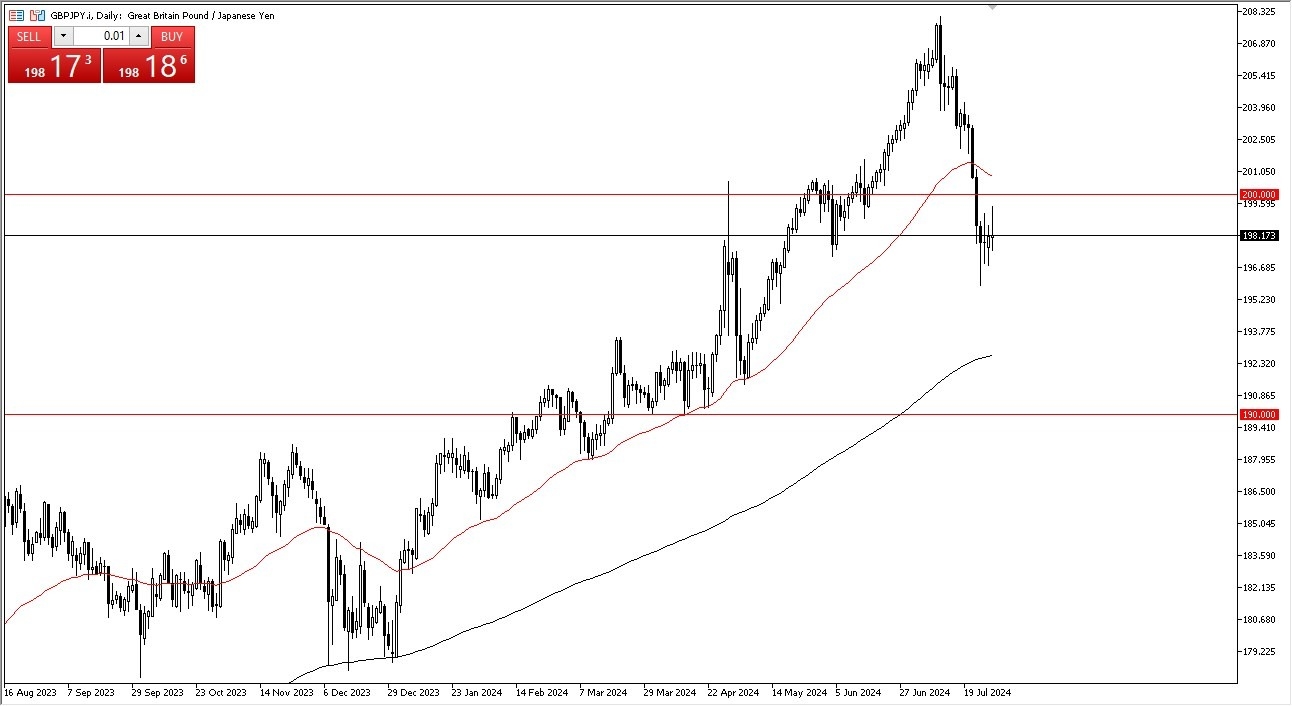

So, the interest rate differential continues to favor Great Britain, and it most certainly will after these next couple of announcements. But really, I think this is a market that's paying close attention to the 200 yen level above, which of course is a large round psychologically significant figure. If we can break above that level, the 50 day EMA gets tested and then it's likely that the market goes looking all the way to the 206 yen level. Short term pullbacks at this point in time will have to look at the hammer from a few days ago as potential support near the 96 yen level. If we were to break down below there, then you could go looking to the 200 day EMA for support.

Top Forex Brokers

Interest Rate Payments Matter

In general, this is a market that I think continues to see a lot of traders looking at this through the prism of being paid at the end of the trading session. But ultimately, this is a situation where you will continue to see a lot of back and forth and noisy behavior. But from a longer term standpoint, we are still very much in an uptrend.

In fact, you can even make an argument for a trend line going to the upside, going back to December of last year. We have held that so far. The next couple of days though, could change a lot of things, but all things being equal, this is a market that I think you continue to get paid at the end of every day. And that will continue to be a major factor here.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with