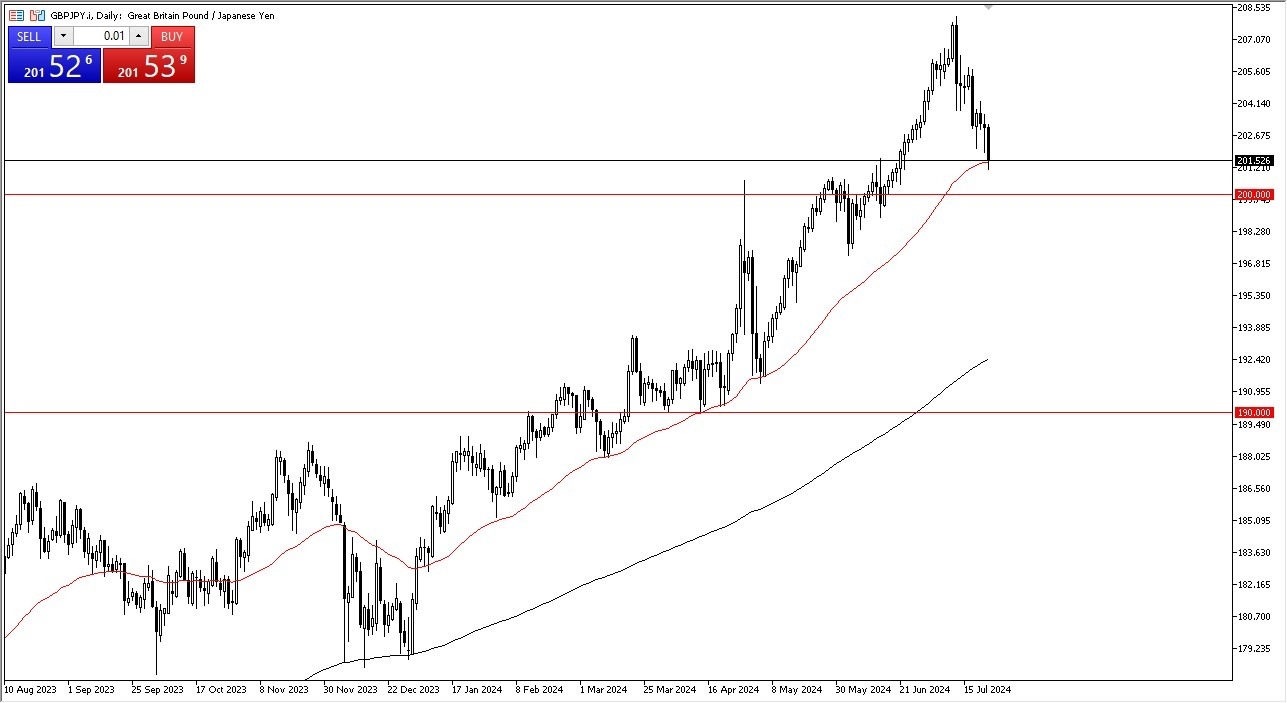

Potential signal:

- I am a buyer of this pair if we get anywhere near the 200 yen level.

- The stop loss would have to be at the 199 yen level.

- I would aim for the 206 yen area.

The pound has fallen a bit against the Japanese yen, as we have seen a bit of a risk off type of attitude around the world. With that being said, it is worth noting that we are currently threatening the 50 day EMA. But underneath there we have an even more important area in the form of the ¥200 level. This area is one that I find very important at this point in time.

Top Forex Brokers

The ¥200 level, of course, will have a lot of psychology attached to it, and therefore I think it will attract a lot of inflows. The ¥200 level was where the Bank of Japan had intervened in the market previously, and therefore, one would think that a lot of people will be interested in seeing how that plays out. Either way, this is a situation where I'm looking to buy dips in as the market continues to pay you for hanging on to the British pound against the Japanese yen.

The Interest Rate Differential Continues to Influence the Long-Term

The interest rate differential between the two currencies remains very wide, and the Bank of Japan is essentially stuck with the problem of massive debt that Japan simply cannot finance at higher levels of interest. With that being the case, it should remain a scenario where traders look at this through the prism of trying to get paid at the end of every day via the swap. The swap is something that a lot of traders make the mistake of ignoring over the longer term.

Ultimately, I do think that's how we approach this market in the longer term. And with that being said, I do think that this will offer an opportunity for people to take advantage of cheap pounds. This environment is one that prefers a little bit of value hunting. We had shot straight up in the air. We have pulled back a little bit. All of this is natural. I don't think anything has changed.

Start trading our daily Forex signals. Get our most recommended Forex brokers list here.