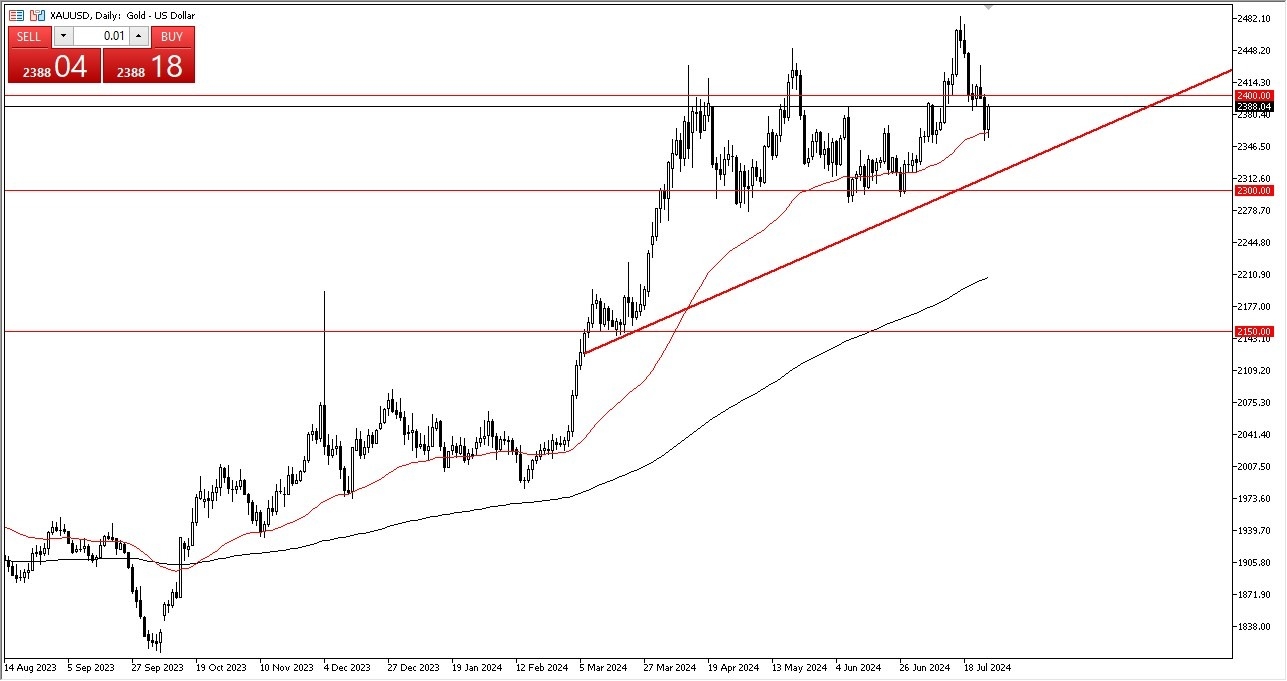

- I see that we are approaching the crucial $2,400 level.

- This is an area that you should be paying close attention to as it is a massive level just waiting to be broken.

- If we can break above the $2,400 level, then it's likely that we could go to the upside, perhaps going to the $2,475 level.

- This is an area that has been of massive resistance, and therefore it could make a target for the overly bullish traders out there.

At this point, I see the 50 day EMA underneath is massive support. And then after that, we have to look at this through the prism of perhaps the $2,350 level being a massive support level as well. Ultimately, interest rates have been dropping in the markets as of late, especially in the last couple of days. So with this, I think you've got a scenario where gold will do quite well as a result. Furthermore, you have to look at this through the possibility that geopolitics demands higher gold prices over the longer term. With all of that being said, the market is likely to continue to see a lot of choppy and noisy behavior. This is the same thing that you could say about various markets at the moment, not just this one.

Top Forex Brokers

Do Dips Offer Value?

So be aware of the fact that each dip probably offers a little bit of a pullback. If we do take off to the upside, I'm very cognizant of the $2,500 level being a massive barrier to overcome and obviously a nice target at the same time. I have no interest whatsoever in trying to short the gold market. After all, this is a market that I think will have a lot of volatility, but in the end, remains very positive given enough time. This market will always have questions asked of it, but in this environment, it makes sense that the market will continue to attract inflows.

Ready to trade our Forex daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.