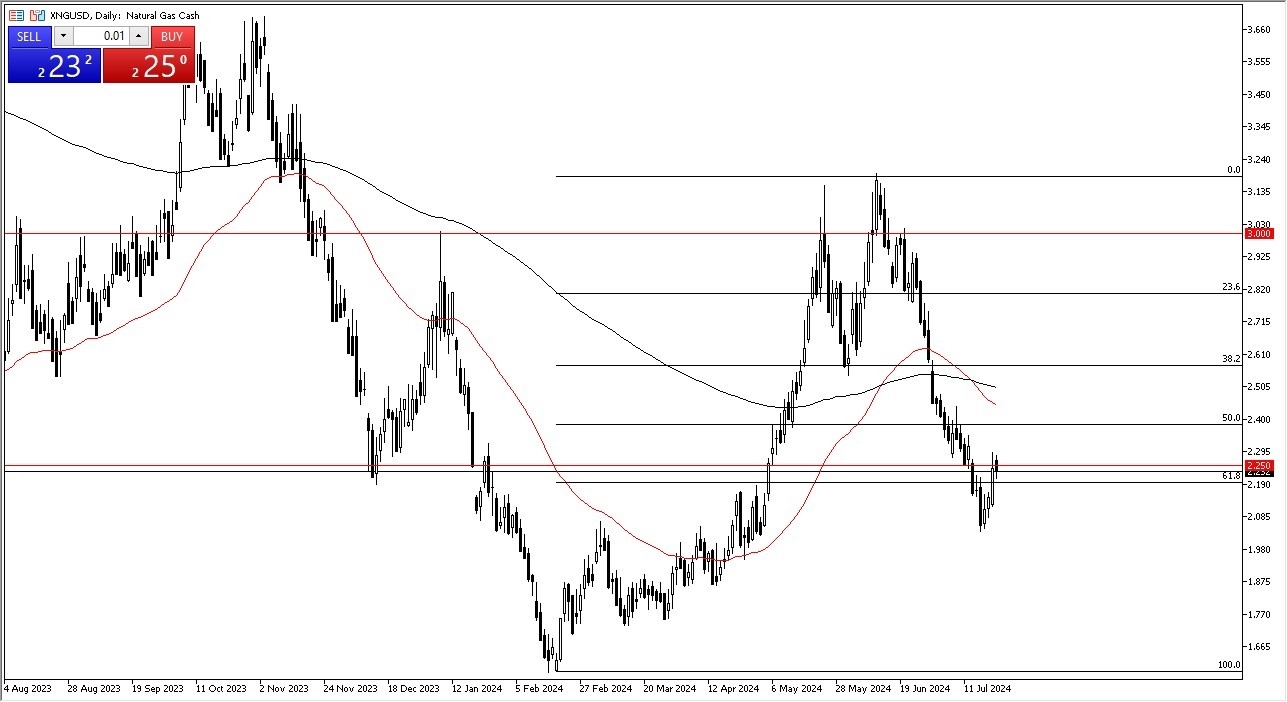

- It's hard not to notice that the market has pulled back a bit after that explosive day on Monday.

- That's not a huge surprise considering we had been in such a massive downtrend, but the question at this point is going to be whether or not we are in the midst of trying to form some type of flaw, or if we are just simply in a situation where the market has been noisy for no apparent reason.

Maybe it was a little bit of profit taking by those who sold either as possible, but I tend to look at this market through a cyclical time frame, and this time of year is typically pretty poor for natural gas. That doesn't mean that I don't buy it. What it means is I don't get levered in it. In other words, natural gas is a market that is very U.S. centric, and it generally focuses on the idea of heating, especially in the northeastern part of the USA.

Top Forex Brokers

There Can Be Bullish Moves in Summer

Now it can see a little bit of a pickup in demand in the middle of summer when you get the occasional heat wave. And it's probably worth noting that the West Coast right now is suffering under pretty significant heat. However, I don't think it's enough to really get the uptrend going quite yet. What I choose to do is buy non levered positions via ETF market this time of year and just simply dump them off once natural gas does its inevitable climb later this year, it's not a huge position. It's just a small poor portion of my portfolio. And I think that's really how you have to look at this as a part of a portfolio. It's not a market. You jump in and try to take advantage of every tiny micro movement. That's a great way to lose a lot of money and that's certainly not something you want to be doing here.

Ready to trade daily Forex analysis? We’ve made a list of the best commodity broker platforms worth trading with.