- It’s not hard to see that we are an extraordinarily bearish market at the moment, as the kiwi dollar is being sold off drastically.

- Quite frankly, this is a result of a massive amount of “risk aversion”, and I think you’ve got a situation where traders will continue to look at this pair through that prism.

- After all, the New Zealand dollar is highly sensitive to commodities and the idea of a global economy that’s growing.

On the other hand, the Swiss franc is one of the penultimate safety currencies around the world. Because of this, think you have to look at this through the prism of a market that is telling you exactly how traders feel about putting a lot of money to work. This is especially interesting due to the fact that we have seen the Swiss already cut interest rates, and yet people are still willing to throw money at them.

Top Forex Brokers

Technical Analysis

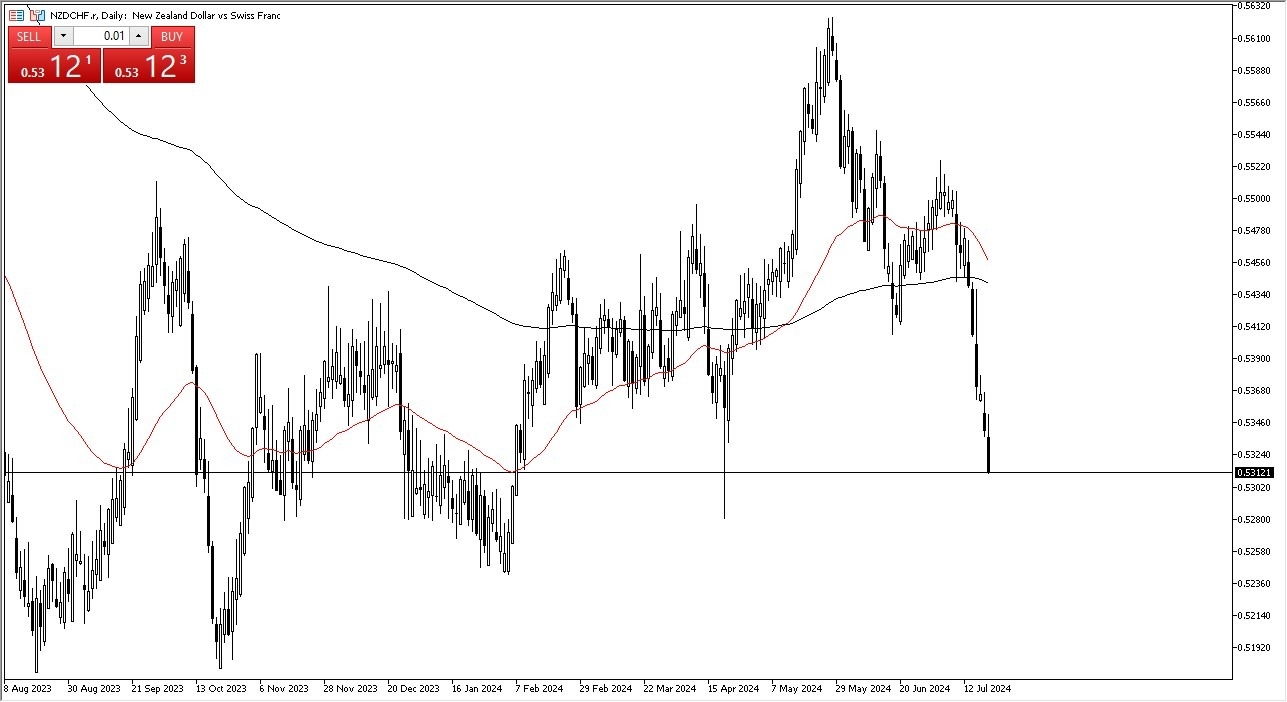

At this point in time, there is not much doubt out there that we are in a massive downtrend. We have dropped almost a full handle over the course of the week, and a pair that is typically quite choppy more than anything else. That being said, you also need to keep an eye on the 50-Day EMA, because it is starting to fall rapidly, and we may be getting close to forming a so-called “death cross”, when it drops down below the 200-Day EMA, a technically bearish signal.

That being said, there is a massive amount of support near the 0.5275 level, and I think that’s an area that I would be paying close attention to. Quite frankly, it’s very difficult to short this pair at the moment, as you would be about 4 days too late. With that, I’m waiting to see if there’s any hint or chance of a turnaround, and I think at this point you need to pay close attention to not only this chart, but the NZD/USD chart, and the USD/CHF chart simultaneously. If they all start to turn in the same overall direction, then you could have the beginning of a rather significant long position.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers to trade with worth using.