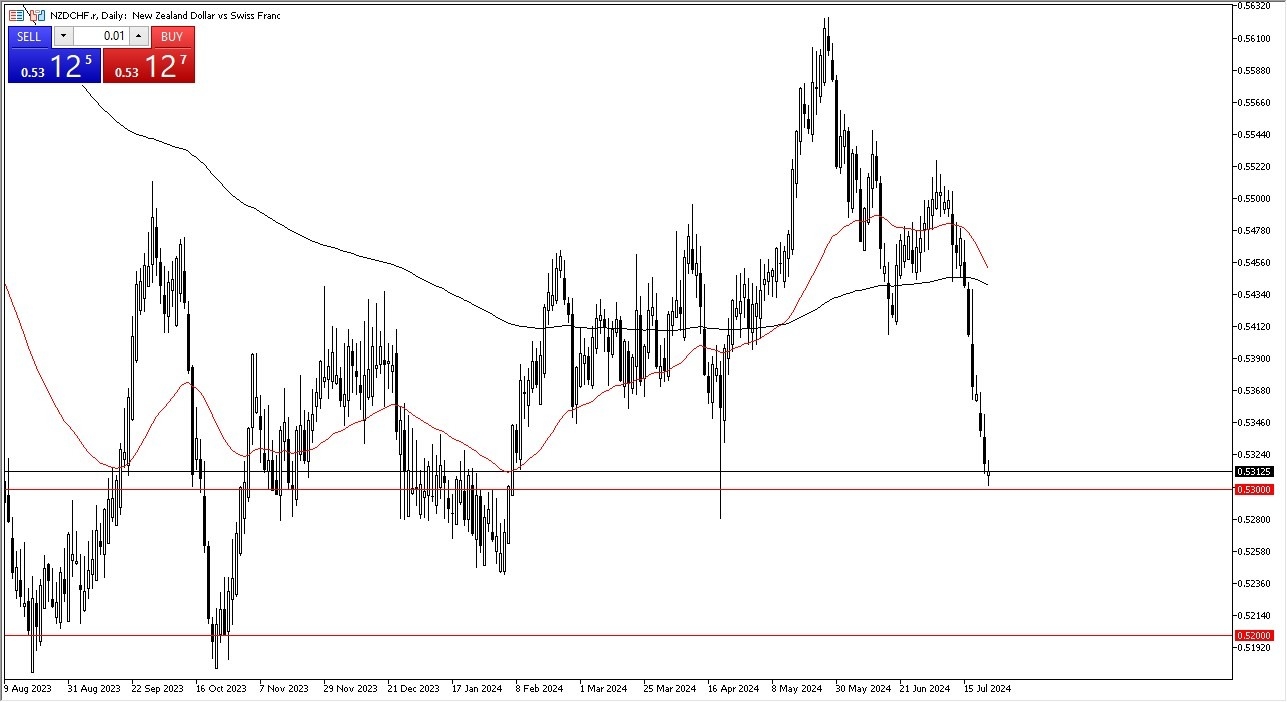

- The 0.53 level is offering a certain amount of support.

- This does make sense considering just how oversold the market had been for a while, and quite frankly, just how this is a market that tends to be very choppy overall. So, a massive sell off like that is in fact a bit of a rarity.

And therefore, I think at this point you have to ask the question, who would be left to settle the New Zealand dollar? This is especially true when you are talking about the New Zealand dollar against the Swiss franc, as it's not exactly the most common pair. The 0.53 level seems to be offering significant support. But even if we were to break down below there, I believe that there is a lot of support that extends all the way down to the 0.52 level.

Top Forex Brokers

I Will Buy Sooner or Later

In other words, I find this is a market that I will be a buyer of sooner or later, but I need a little bit of action to tell me it's time to dip my toes in the water. If we can break above the high of the trading session on Tuesday, then it would be the breaking of the top of a neutral candlestick, and it would at least be something worth putting some money into.

It's probably worth noting that the Swiss franc has slowed down during this session, and several of my other trades against the Swiss franc have worked out for the session. And as a general rule, the franc tends to move in the same direction against most currencies. That being said, the New Zealand dollar itself has been really weak, so that is what makes this particular market interesting due to the fact that, quite frankly, when it does snap back, if we are in the process of watching the Swiss franc lose strength across the board, we could really see a big move here.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers for beginners to choose from.