- In my daily New Zealand dollar analysis, I see across the board that the Kiwi dollar has lost quite a bit of momentum after it initially tried to rally on Monday, but then gave back gains.

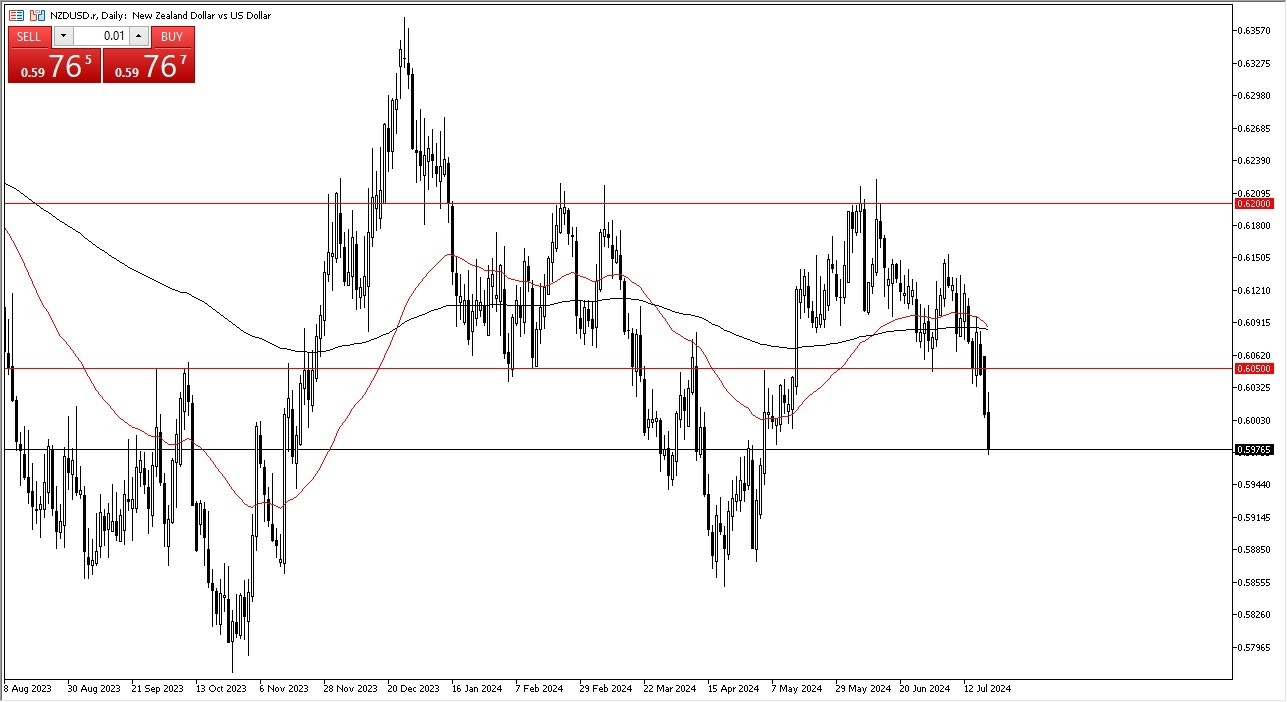

- Against the US dollar, the 0.6050 level seems to be an area that's difficult to overcome, and the fact that we turned around the way we have suggests to me that we are ready to continue to drop from here.

- The 0.59 level underneath could be a significant support level.

At this point, it's probably worth noting that we've seen the Kiwi dollar just fall apart against almost everything. Part of this might have something to do with the Chinese data overnight with the prime rates being cut. That of course suggests that perhaps China has some issues.

Top Forex Brokers

New Zealand Sensitive to China Overall

If that's going to be the case, then New Zealand will be a direct victim of this as the New Zealand economy is so heavily dependent on exports to China and other places in Asia. Keep in mind that commodities also have a major input on what happens with the Kiwi dollar and commodities have looked pretty miserable over the last couple of days. So, it all looks like we are going to drop from here in the Kiwi. The other argument could be made that if we can turn around and break above the 0.6050 level, then we may have a path to reach the 0.67 level above. That could be a target, but at this point in time, we would have to see a massive turnaround as far as momentum is concerned.

Ultimately, it appears that New Zealand is suffering at the hands of a lot of external issues, and as long as that's going to be the case it's very difficult to start buying the Kiwi dollar. With this, I think you continue to see a lot of “fade the rally” behavior going forward.

Ready to trade the New Zealand Dollar analysis? Get our top Forex brokers that work in New Zealand here.