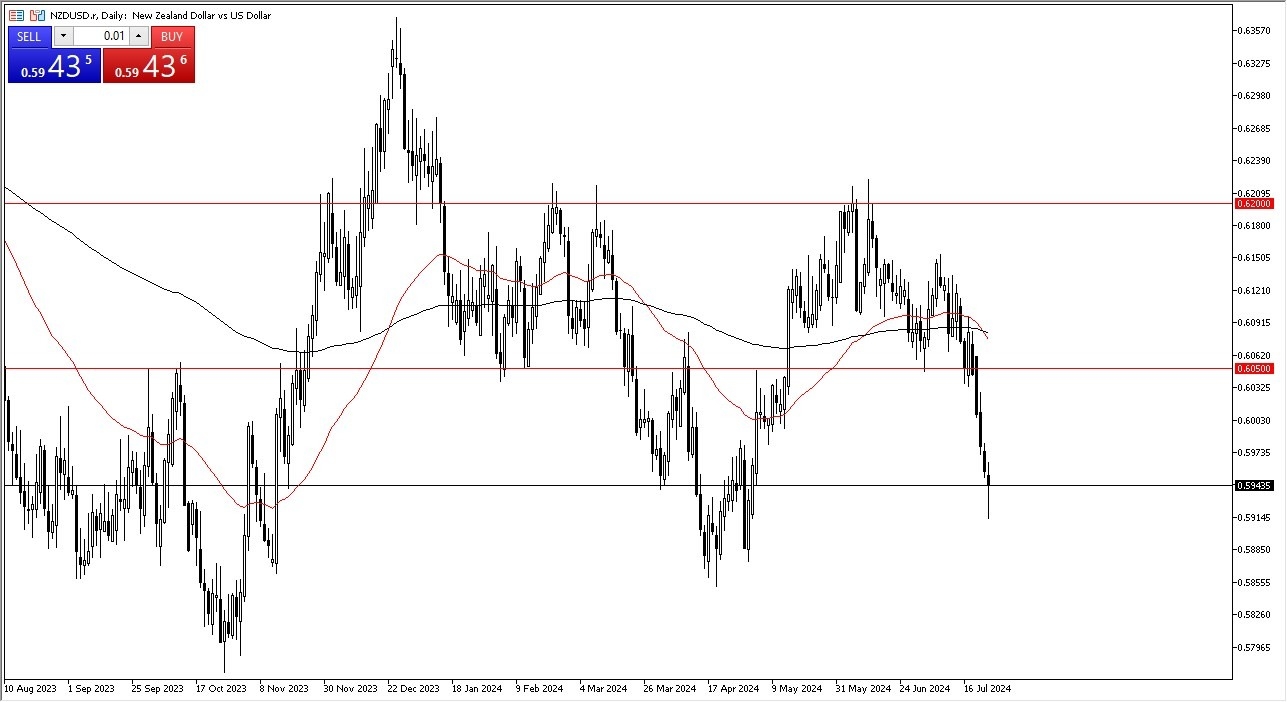

- I recognize immediately that we had gotten oversold, which is something that I've talked about over the last couple of days.

- We have since seen a little bit of a bounce, and therefore I think we've got a situation where the PMI numbers in the United States coming up weaker than anticipated, or I should say a bit mixed, probably has people looking at this through the prism of a market that is going to continue to be very noisy, and perhaps continue to cause volatility.

With this, the NZD/USD market is a bit overextended, and therefore, I think a bounce makes a lot of sense. If we do bounce from here, the 0.6050 level is an area that has been important multiple times, and I do think that would be your target. For what it is worth, we have had the 50-day EMA cross below the 200-day EMA, kicking off the so-called death cross.

Top Forex Brokers

Negative Technical Signal

The death cross of course is a very bearish turn of events from a technical analysis standpoint. And therefore, I think a lot of people will continue to look at this as maybe a bearish market, but I do think in the very least we need to see a little bit of a recovery because the New Zealand dollar has fallen off so hard. Underneath current trading the 0.59 level should continue to offer plenty of support.

So, I think all of this ties together for a short term opportunity. That doesn't mean that it will be easy for the New Zealand dollar to rally from here, but I do think that it makes more sense than not due to the fact that the U S dollar has strengthened so rapidly that sooner or later there will be a bit of profit taking, and therefore we are going to see a bit of a move to the upside in general. This market has a lot to do in order to prove itself, but we look as if we are trying to start that process.

Ready to trade our Forex daily analysis and predictions? Check out the most trusted forex brokers NZ worth using.