Gold

Gold has been very noisy this past week, but at this point in time, it looks like we are doing everything we can to turn things around. The resulting candlestick ends up being a hammer, and this tells me there are buyers underneath, and that the uptrend will try to reassert itself. With this being the case, I suspect that this is a market that will go higher over the longer term. There are plenty of geopolitical issues out there to keep the Gold market bullish, as well as falling rates.

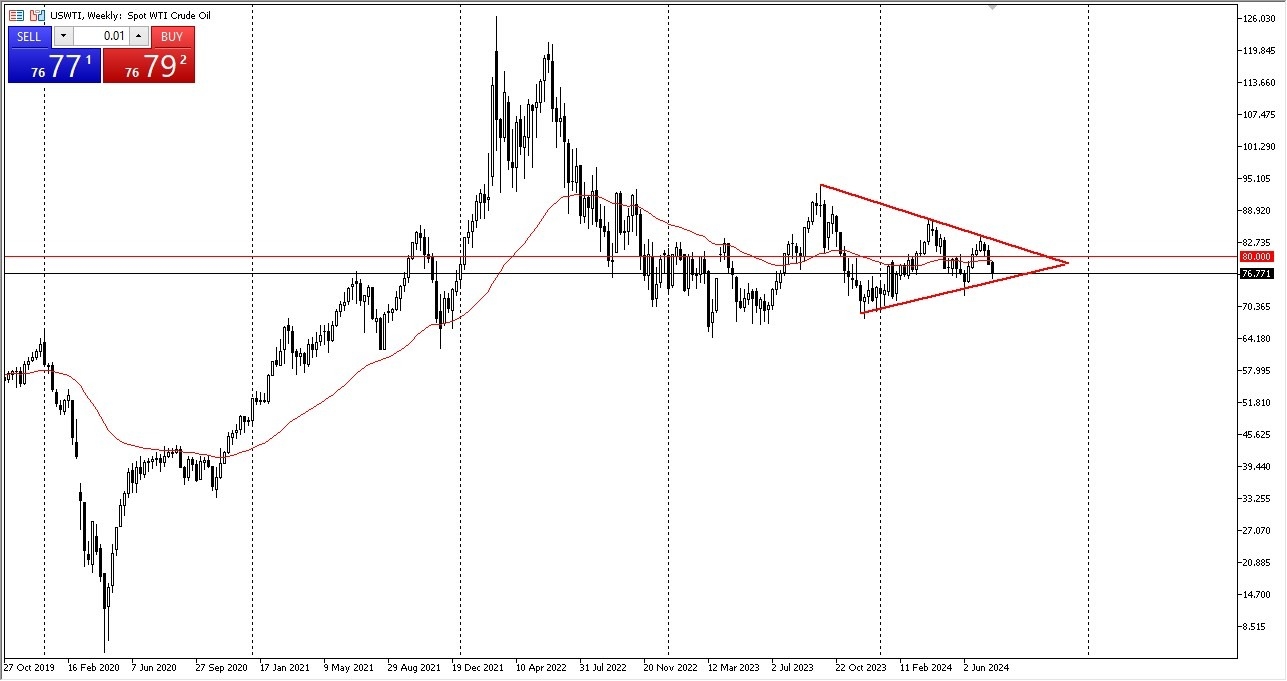

WTI Crude Oil

The West Texas Intermediate Crude Oil market has fallen during the course of the week, as it looks like we are going to continue to see a lot of noisy behavior. At this point in time, the market is likely to continue to see a lot of support just below, and therefore I think it is likely that this market will remain in a huge range going forward. As things stand right now, we are testing the uptrend line of a major symmetrical triangle, and therefore wouldn’t surprise me at all to see a little bit of a recovery in price.

Top Forex Brokers

S&P 500

The S&P 500 has been all over the place during the week, but I would be remiss if I didn’t point out the fact that this ended up being a bit of a negative candlestick that has recovered. In other words, we are not quite neutral, but it certainly looks like the stock market is trying to recover. You can see this across the equities markets, and therefore I think it’s probably only a matter of time before we start going long yet again. Breaking above the 5500 level should open up the possibility of this market testing the highs again. If it breaks down, then I see massive support at the 5300 level.

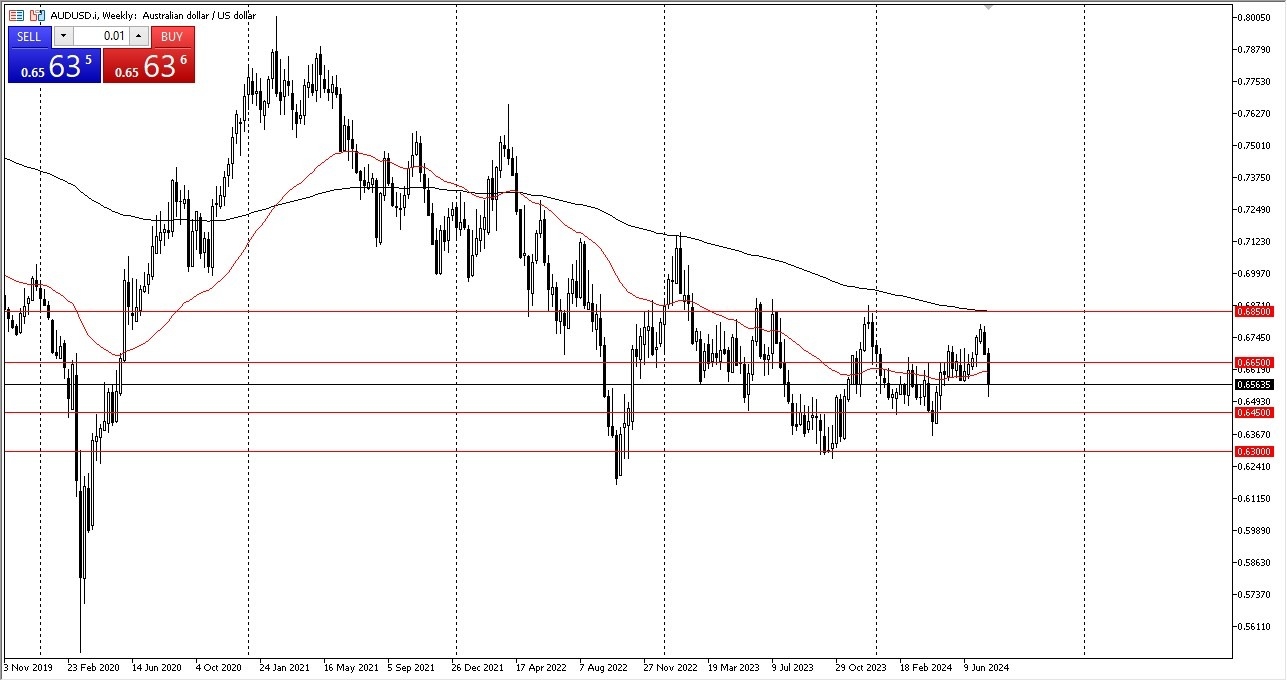

AUD/USD

The Australian dollar has plunged during the course of the trading week, breaking down to the 0.6550 level. Ultimately, the market is going to go looking to the 0.6450 level if we do fall, but if we turn around and rally, I think the most important thing that we are going to pay attention to is the 0.6650 level above. In general, the AUD/USD market is a one that I think continues to see a lot of noisy behavior, and perhaps even best described as a sideways market going back several years with the 0.6850 level being the ceiling, and the 0.63 level being the floor.

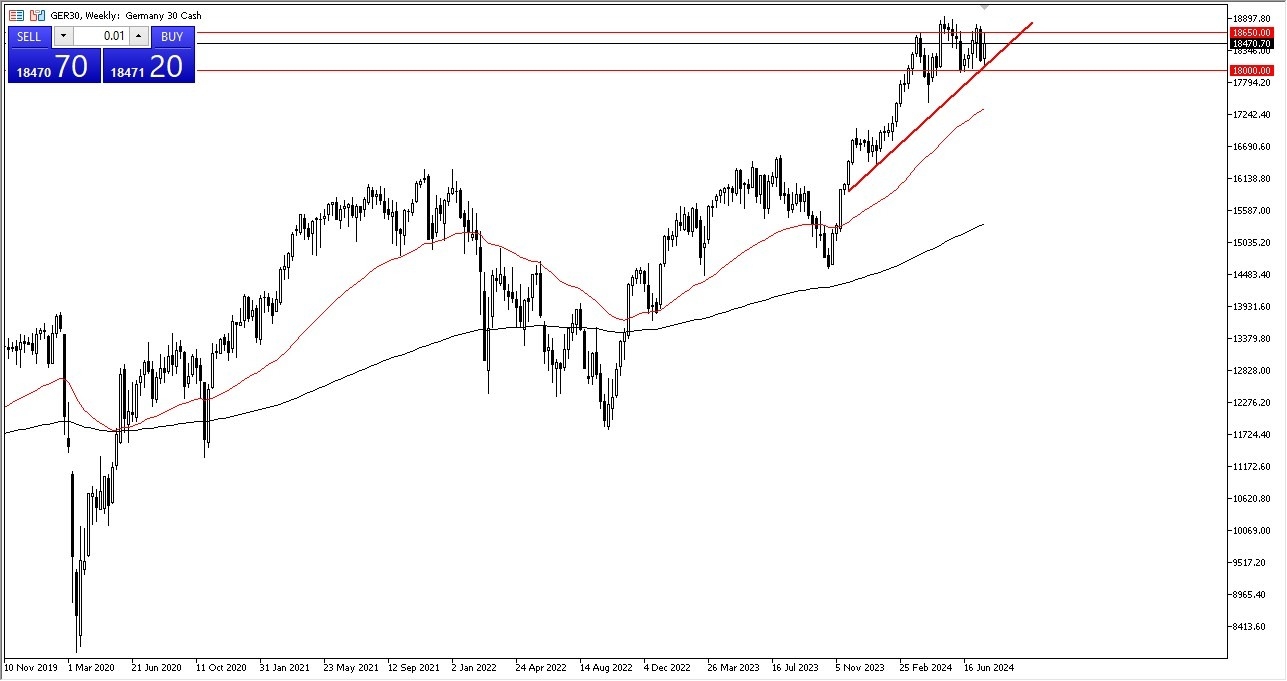

DAX

The German index has been very bullish during the course of the week, slamming into the €18,650 level. That being said, at one point we really sold off and now we have recovered quite nicely from a major trend line. In general, this is a market that I think continues to see a lot of noise, and therefore I think we’ve got a situation where traders are going to continue to look at this through the prism of a binding value, and if we can break above the €19,000 level, I think it’s very likely that we will continue to see more traders jump into this market and take advantage of the overall uptrend. At that point, I would anticipate the DAX going to the €20,000 level.

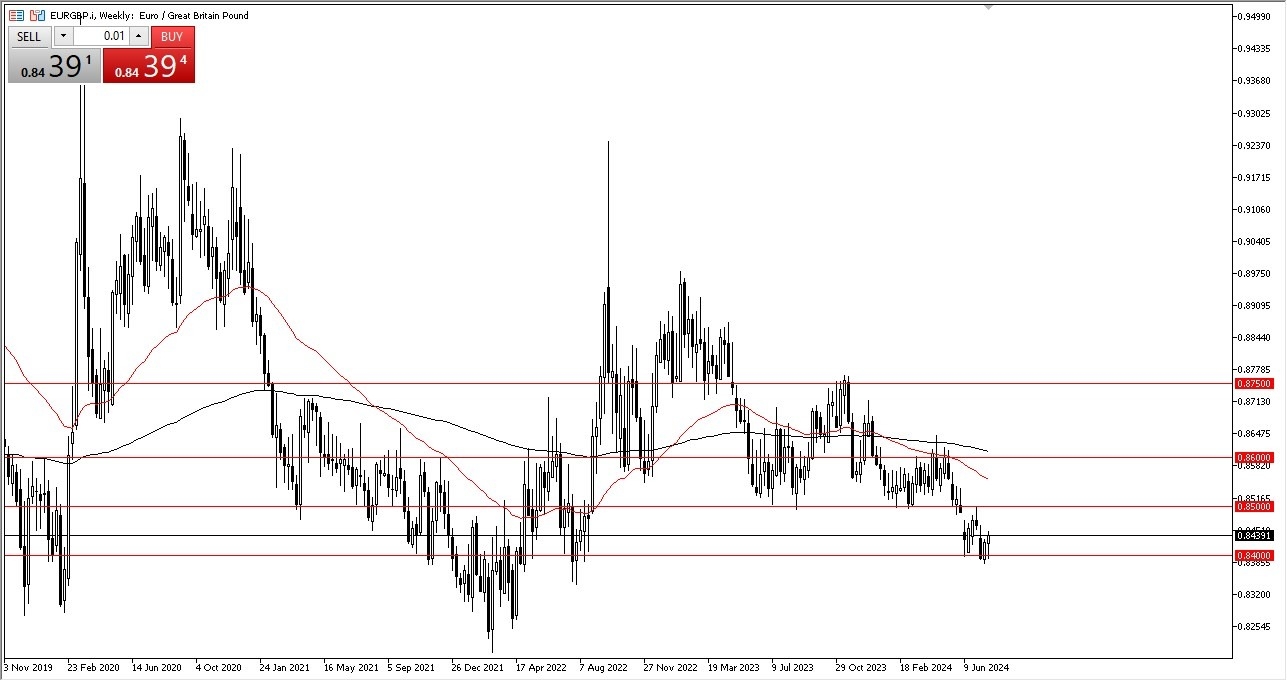

EUR/GBP

The euro initially fell during the course of the trading week to test the 0.84 level. At that point, the market then turned around to show signs of life as we ended up looking very bullish. By doing so, the market ended up forming a hammer for the week at an extraordinarily low level, and therefore I think you’ve got a situation where the euro probably becomes a real value. If we can break above the 0.85 level, that would obviously be a very bullish turn of events, and therefore allow even more people to jump into the market. On the other hand, if we break down below the 0.84 level, it’s likely that the market will go looking to the 0.83 level below.

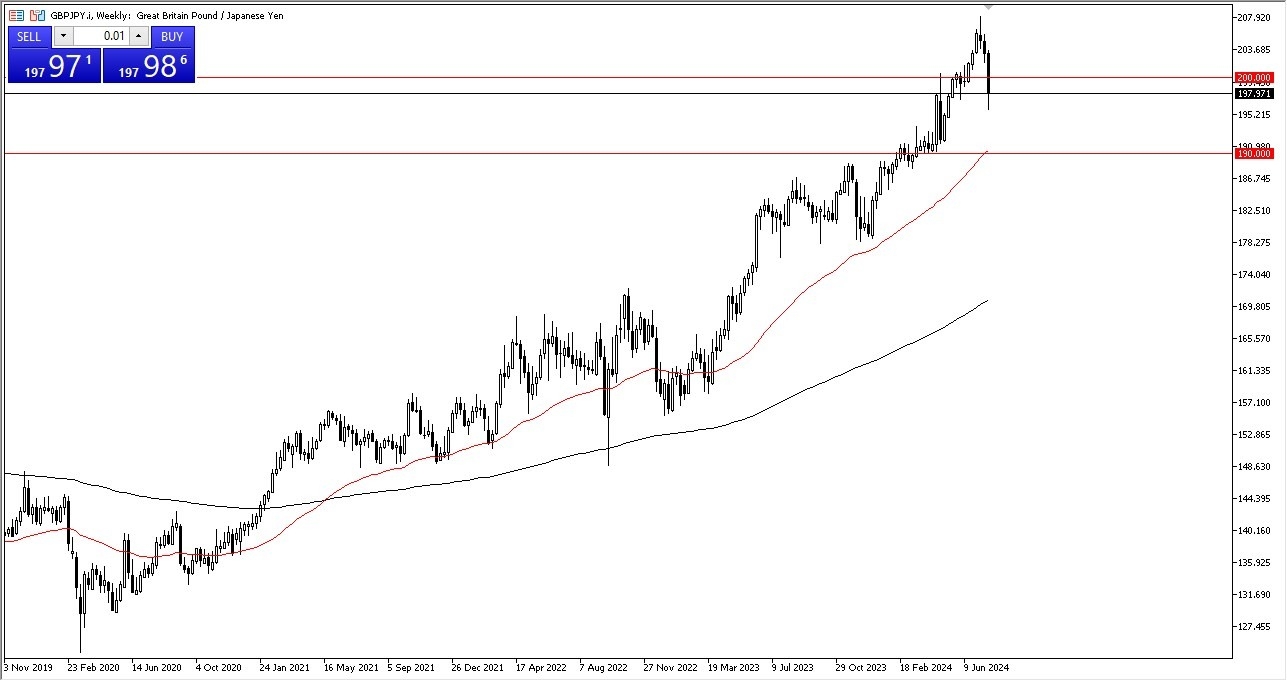

GBP/JPY

The British pound plunged against the Japanese yen during the bulk of the week, but it’s worth noting that the Thursday candlestick ended up being a massive hammer. The Friday session of course was somewhat sideways and neutral, so it does make quite a bit of sense that we would continue to see a lot of noise going forward. That being said, I think we are stabilizing and if we start to see a move above the ¥198.50 level, I think we will first attempt to break the ¥200 level, and then eventually go looking to the ¥206 level. I have no interest in shorting this pair as the interest rate differential is so strong.

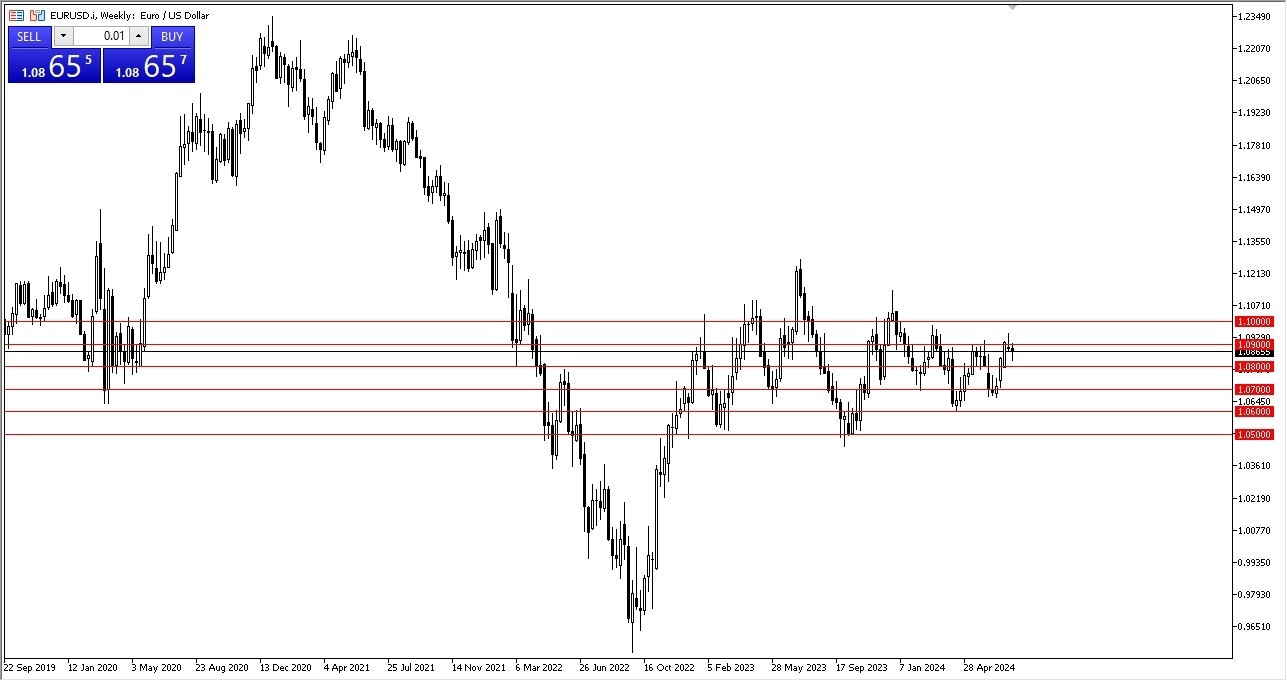

EUR/USD

The euro initially plunged against the US dollar during the week, but then turned around to show signs of life in order to form a hammer. This was preceded by a massive shooting star at the 1.09 level, so I think the EUR/USD pair is going to end up being massively neutral, and even if we do break out to the upside I suspect that you have a situation where it has more to do with the US dollar weakness than euro strength overall. I remain fairly flat in neutral in this pair.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.