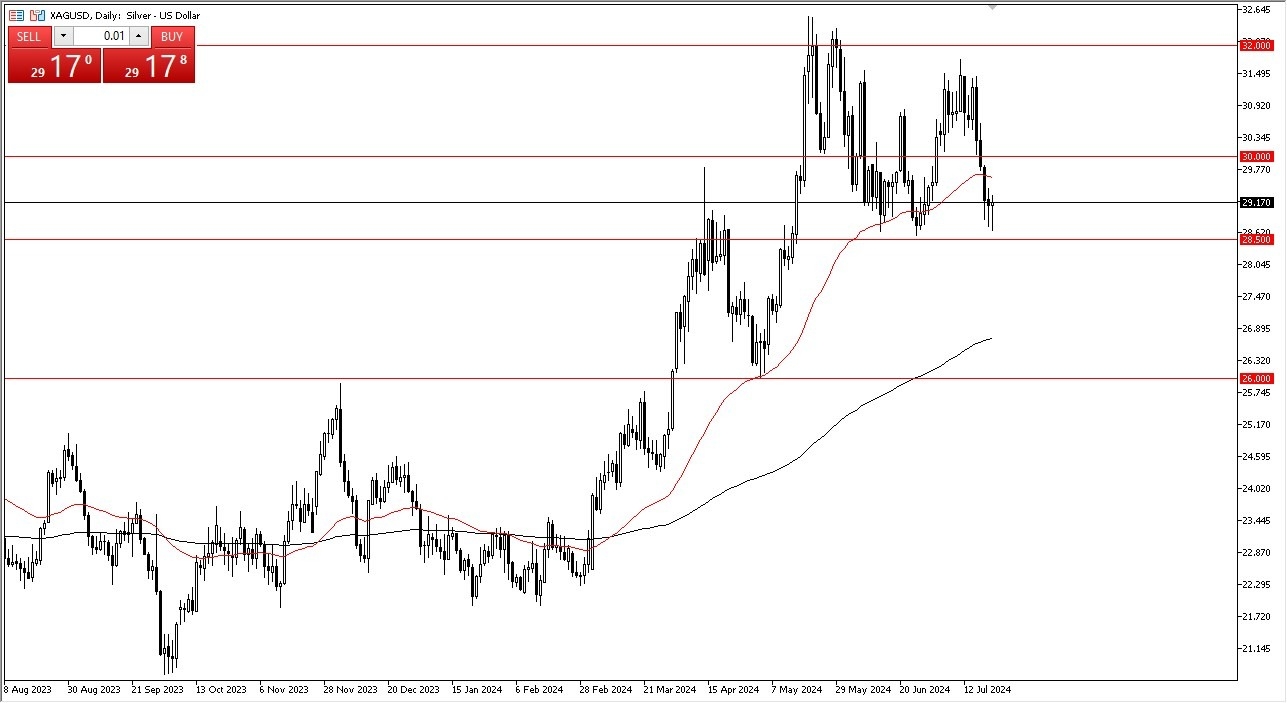

- As you can see, the silver market has initially fell a bit during the trading session and turned around to show signs of life.

- With that being the case, I think you've got a situation where traders continue to look at this through the prism of finding value.

If and when they find value, they continue to jump into the market. Now, having said that, it's obvious that the $28.50 level is an area that I think a lot of people will be paying close attention to, and therefore, it'll be interesting to see how it holds up. With that being the case, I think the market will continue to see a lot of buy on the dip attitude, and the silver market will continue to be very influenced by the US dollar and interest rates around the world.

Top Forex Brokers

Remember, This Pair Can Be Dangerous

This is a market that's typically quite volatile, and therefore you have to believe that it is probably only a matter of time before you get wiped out. If you go into big because of this position, sizing is essentially everything here, and you need to make sure that you are not overextended. Silver does tend to act like gold, but it is not gold, so never forget that it is a much bigger contract, to begin with.

As far as sizing is concerned. And as a result, you can get hurt really quickly if you are not careful. Nonetheless, this is a market that I think given enough time will probably continue to be somewhat noisy and positive. But I also believe that you are going to have to ride through a lot of volatility and hang on to it if you do in fact decide that you want to get long. I don't have any interest in shorting silver, although if we were to break down below the $28.50 level, it could open up the possibility of a move down to the 200 day EMA.

Want to begin trading the Silver forecast and daily predictions? Get our Forex brokers to open a demo account with here.