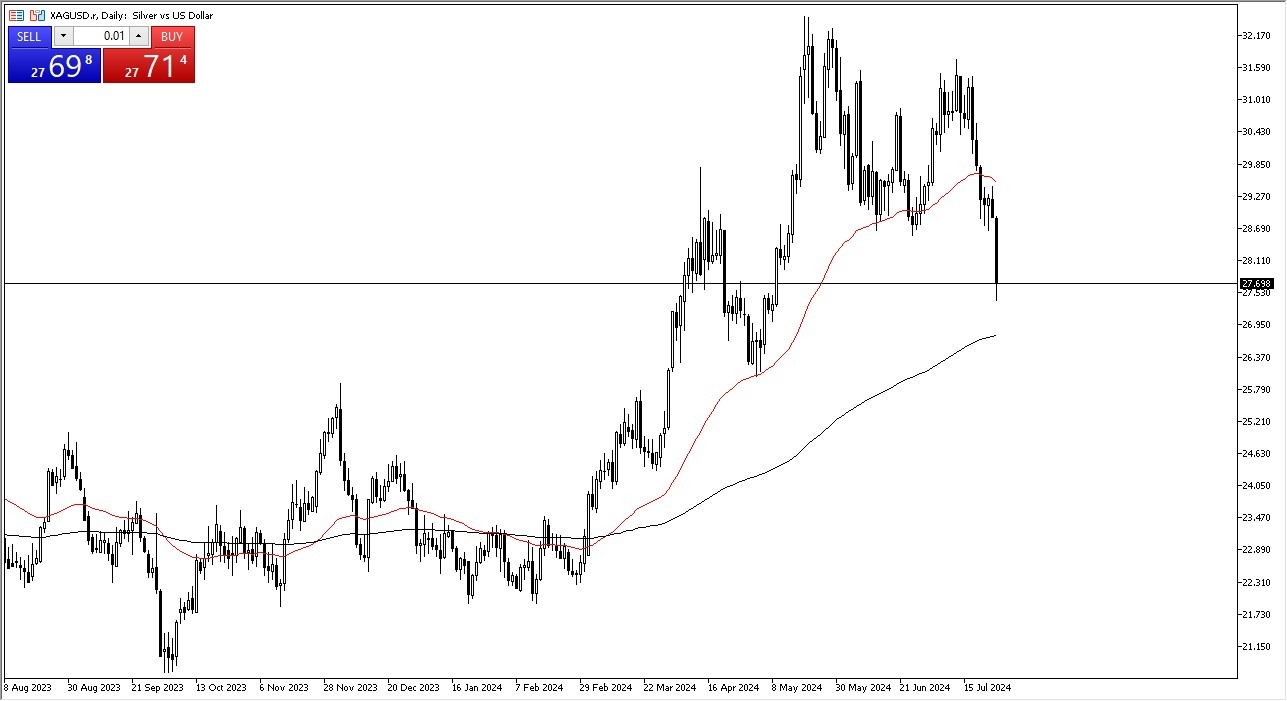

- In my daily silver analysis, the first thing I notice is that we dropped roughly 4% overnight, as the panic and the computerized continuation of noise continues.

- Ultimately, the market has broken well below the $28 level, and perhaps more importantly, broke down below the $28.50 level, an area that I had been looking at as a major support over the last several months.

- Not only did we break down below that level, but we absolutely collapsed after that as everybody ran for the hills.

That being said, there is the 200-Day EMA near the $26.75 level that’s coming into view, which is roughly a dollar a lower than where we opened up at during the New York session. Silver could be a big winner if we see a huge turnaround in risk appetite, but I don’t want to be the first trader in the market, because nobody needs to die a hero. It’s more prudent that you let bigger money come into the market and show you when it’s time to think about going long.

Top Forex Brokers

That being said, I don’t necessarily want to start shorting the market either, because if we get some type of short covering rally, you could find yourself down quite drastically in short order. This is not a market to play around with when there is a lot of trouble out there, so with that being said you are better off being on the sidelines in the short term. After all, the size of the candlestick on the Thursday session was so brutally negative that I think it’s difficult to imagine a scenario where we wouldn’t see some type of follow through.

Silver is not Gold

Unfortunately for most retail traders, they believe that silver and gold are the same thing. They are most certainly not, as silver has a little bit more in the way of industrial usage, and of course it is a much bigger contract in general. I didn’t say that it had more volume, just that the contract itself was bigger. The margin is higher for futures contracts for reason, because it tends to jump around quite drastically. With that being the case, I’m sitting on the sidelines and waiting to see whether or not this market can recover.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.