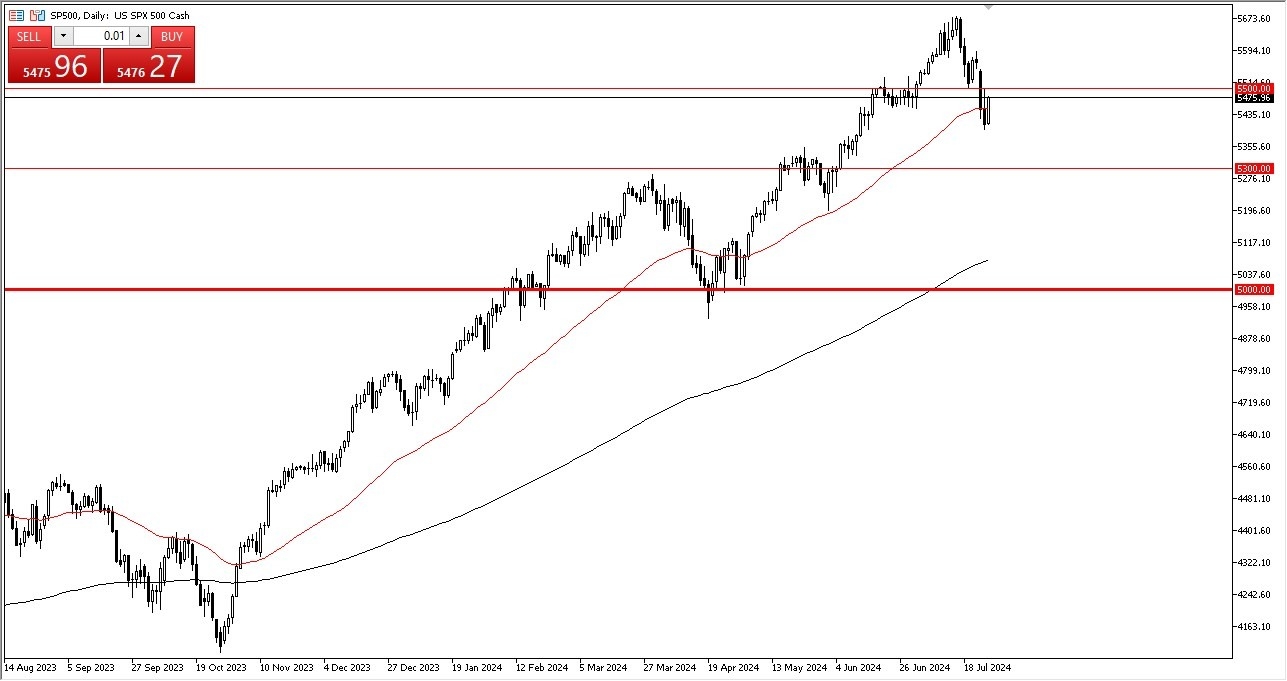

- The first thing I notice is that we are breaking above the 50-day EMA.

- The question now is whether or not we can continue to rally and go looking to the 5500 level. Anything above there could open up quite a bit of short covering and we could see this market really take off to the upside.

- It's worth noting that although the last couple of weeks have been somewhat brutal, we have turned around quite nicely.

- And therefore, it's likely that we will eventually see this market truly try to take off to the upside.

In general, the stock market is a one that you don't want to be short of anyways, as it's an index that's not equal weighted, and of course, that means that it's not even designed to fall. As long as the major players out there, the biggest stocks, of course, are doing fairly well, this is a market that really has no real shot at falling for a significant amount of time. It looks like traders are starting to finally dip their toe back in the water due to the fact that we have seen such a bullish candlestick and the fact that we are closing this way at the end of the week is also a very bullish turn of events and suggests that perhaps there isn't enough conviction to stay short during the weekend. That's a very dangerous thing to do because the market can gap drastically to the upside pretty well with what you would expect.

Top Forex Brokers

My Opinion on this Market

All things being equal, I do think that the selling may be about over, but for me it's breaking above the 5500 level that will truly drive that point home. I certainly would not short this market. In general, it's a bad idea to short indices about 90% of the time anyway. Until we see otherwise, I have to assume the uptrend continues in this market, as well as most other equity markets.

Ready to trade our daily forex analysis? Here’s a list of some of the best CFD trading brokers to check out.