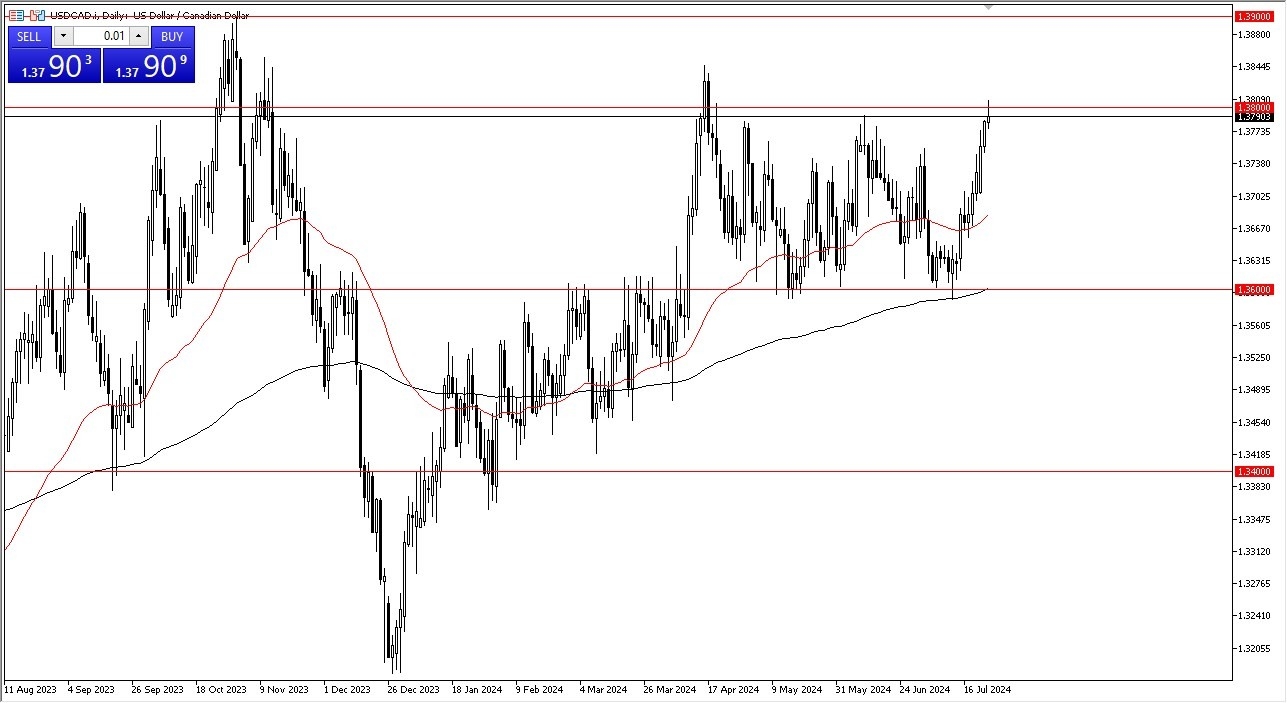

- In my daily US dollar against Canadian dollar analysis, I noticed that the 1.38 level is an area that has been important multiple times in the past and it has been again on Wednesday.

- Keep in mind we had a Bank of Canada announcement during the day on its interest rate monetary policy, etc. and they did cut interest rates by 25 basis points.

- They also suggested that there were more to come but at the same time we got PMI numbers around the world looking a bit lackluster and mixed.

Traders at this point are probably banking on the Federal Reserve having to cut later this year as well so that might be part of the reason why we have not broken out. Plus, you also have to keep in mind that traders have already priced most of this in.

Top Forex Brokers

Hesitation, Again at this Point

We are starting to show signs of hesitation, so we could get a little bit of a pullback, and if we do, we could drop all the way back down to the 1.36 level where the 200-day EMA currently resides and still be in the same consolidation range. We will have to wait and see, but that is a potential action. If we were to break above the 1.3850 level, then it's likely that we could go looking to the 1.39 level.

However, we are stretched, so I think it all makes a certain amount of sense that we get a little bit of a pullback in order to entice people to come in and buy the greenback over the Canadian dollar. In general, I don't want to short this USD/CAD pair. I do believe it goes higher over the longer term, if for no other reason than a slowing US economy is like a wrecking ball to the Canadian economy and if that is the case eventually, we will see the greenback gain but we are a little overdone at this point in time, but I am not looking to go against the grain and start shorting here either.

Ready to trade our Forex daily analysis and predictions? Here are the best Canadian online brokers to start trading with.