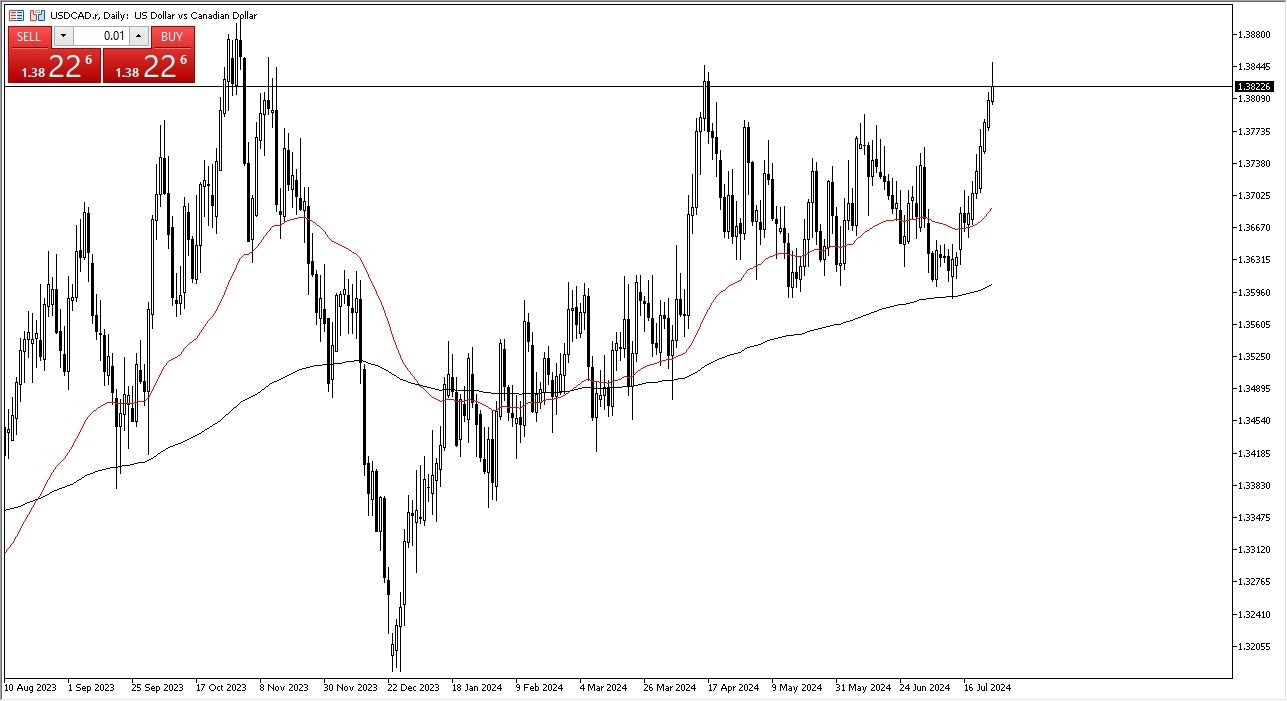

- The US dollar has extended its run against the Canadian dollar to the upside, and in my daily analysis, I can see that this asset still favors the US dollar over the Canadian dollar.

- This is especially as the Bank of Canada has shown itself to be dovish, as Ottawa cut rates this week.

- Ultimately, this is a market that should continue to go higher, but we are a little extended so it would not surprise me at all to see a little bit of a pullback.

Advance GDP Surprise

The American Advance GDP came out hotter than expected, and therefore it should continue to drive the US dollar higher, as the Canadian economy of course is going to suffer from lower rates, but at this point in time, it looks like the 1.38 level being broken to the upside suggests that we are going to go higher over the longer term. All things being equal, I do expect a little bit of a pullback, but the GDP numbers in the United States will more likely than not continue to be a driver of the greenback over the longer term.

Top Forex Brokers

The 1.37 level underneath is an area where you could see a lot of support, with the 50-Day EMA offering a bit of technical support if we do pull back, as it is jumping into the same neighborhood. All things being equal, I’m looking for opportunities to get long again, but I certainly would not be chasing this market all the way up at these elevated levels. In fact, you have to keep in mind that when you trade this market you are looking for some type of value in a very choppy and sideways market overall. This is mainly due to the fact that the 2 economies are so highly intertwined, with Canada providing a lot of raw materials to the United States, and therefore it is somewhat of a symbiotic relationship like we had seen in the past between the European Union in the United Kingdom.

Ready to trade our Forex daily analysis and predictions? Check out the best currency exchange broker Canada for you.