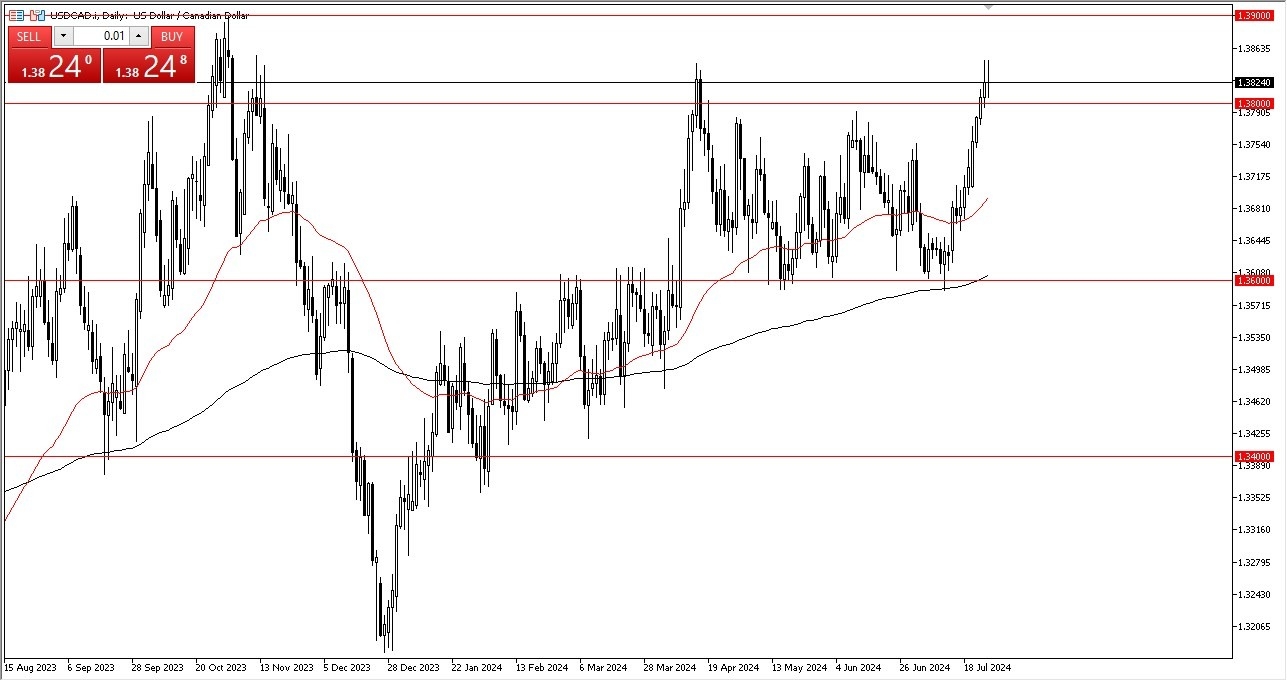

- The US dollar saw a little bit of trouble against the Canadian dollar during trading on Friday, as there is a lot of noise just above the crucial 1.38 level.

- It's worth noting that the Bank of Canada recently has cut rates for the second time, and that of course favors the market going higher over the longer term, as the US dollar of course offers more in the way of interest.

That being said, there are traders out there banking on the Federal Reserve cutting later this year, and perhaps even more influential in this pair right now is the fact that we are overextended. A little bit of a pullback would make a certain amount of sense, especially if we were to drop towards the 1.3750 level, an area underneath that I see as minor, but potentially supported.

Top Forex Brokers

The 50-day EMA sits underneath there as well, so that also comes into the picture, but far above both of those is the 1.38 level, a large round psychologically significant figure that could have a bit of market murmur attached to it as well. Keep in mind that the Canadian economy is highly sensitive to the US economy, meaning that the USA is by far Canada's biggest customer. So, if the US economy suddenly starts slipping, that's actually better for the dollar than it is the Canadian dollar most of the time.

A Lot of Noise Just Waiting to Happen

That of course comes with a grain of salt because a lot of other things can be going on. But in general, that seems to be what happens. I do think that pullbacks will have value hunters coming back into the market, eventually trying to get to the 1.39 level above, which is a major round figure in an area that we had seen a massive swing high at back in the fall of 2023. In general, I do think we're going higher, but I prefer to find value and take advantage of dips.

Ready to trade our Forex USD/CAD analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from