- The US dollar has been somewhat sideways during the last couple of sessions, but especially on Tuesday.

- All things being equal, this is a market that does look a little bit stretched.

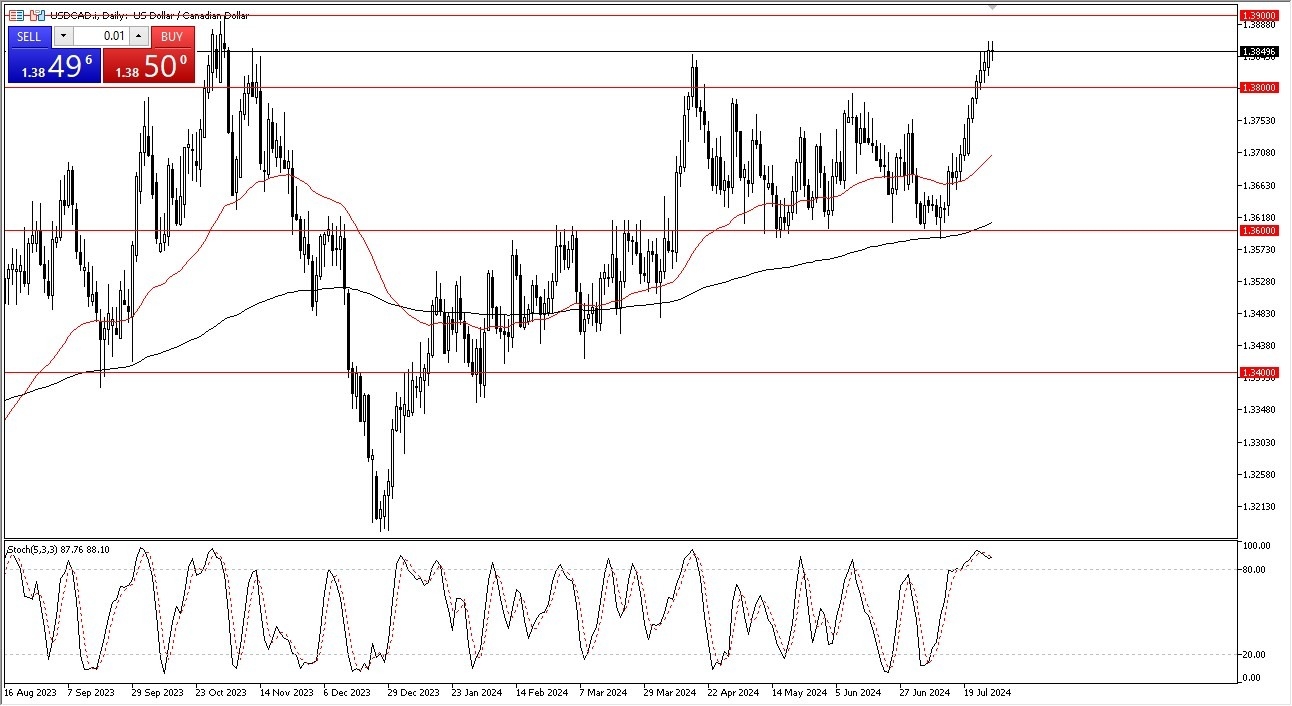

- And I'd point out that the stochastic oscillator is crossing over in the overbought condition.

- So, it does look like we could get a little bit of a pullback.

I think a lot of this comes down to not only being overbought, but also the fact that the Federal Reserve has a meeting and interest rate decision on Wednesday. And I think that will move this USD/CAD pair quite significantly. The question at this point is, can we break down enough to offer value with the US dollar? The 50 day EMA is sitting around the 1.37 level and rising.

Top Forex Brokers

On a Pullback

So, I would like to see a pullback to that area, but I don't know whether or not we have that type of move just waiting to happen. We could pull back to the 1.38 level, which is an area that I think also offers support, but ultimately this is a market that I think eventually we could try to break above the 1.39 level. The 1.39 level is an area that a lot of people had paid attention to back in the middle of 2023 and therefore market memory comes into play, and it could be a bit difficult to get above. Either way I would say that with the way this pair has stretched the momentum is certainly going to suffer. That being said, it's worth noting that the Federal Reserve is expected to stay flat during the Wednesday session as far as changing monetary policy, but it'll be all about the statement.

The Bank of Canada has cut a couple of times now, so it makes sense that the US dollar continues to strengthen against it. And although I do think that we have a pullback coming, the reality is that's just a simple buy on the dip situation from everything I see here. It's not a market that I want to start selling anytime soon.

Ready to trade our Forex daily analysis and predictions? Check out the best currency exchange broker Canada for you.