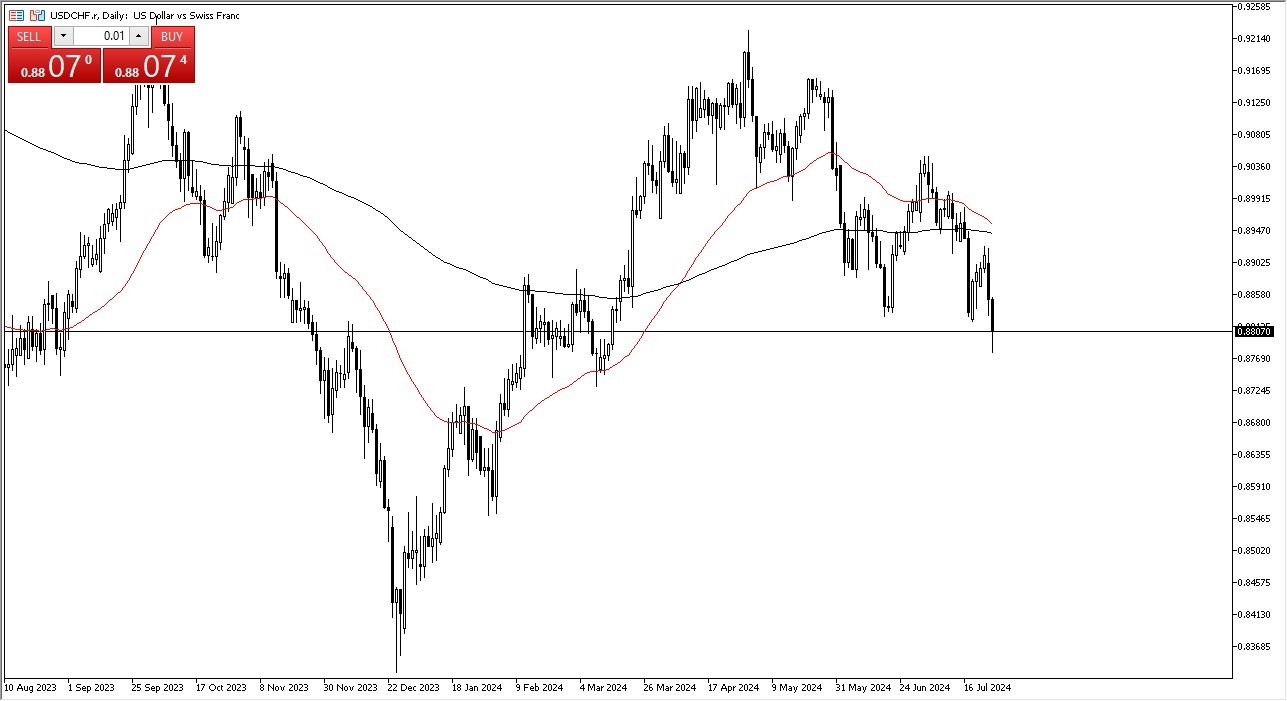

- In my daily USD/CHF analysis, it’s easy to see that the 0.88 CHF level is an area that we have a certain amount of support.

- All things being equal, the US dollar has been drifting lower against the Swiss franc in a bit of a safety trade, as the Swiss franc is one of the few currencies out there that is actually considered to be “safer than the dollar.”

In general, this is a market that also have to pay close attention to the idea that the 50-Day EMA is starting to drift a little lower, and perhaps could even start to cross the 200-Day EMA in order to form a “death cross.” With that being said, I think this is a market that continues to see a lot of volatility, but if we turn right back around to break above the 0.8850 level, that could be a bullish sign, perhaps opening up the possibility of a move to the 0.8920 level.

Technical Analysis

The technical analysis does look a bit weak for this pair, but I think given enough time once we get a little bit of stabilization with risk appetite, traders will continue to look at this as a market that pays you at the end of every day, and you need to take advantage of that if and when we get a turnaround. Ultimately, this is a pair that I do like going to the upside with, but we just don’t have the momentum to do that quite yet. If we can wipe out the losses from the early part of Thursday, then we might have an opportunity to put a small position on this pair.

Top Forex Brokers

If we break down below the 0.8750 level, then the market is likely to drop down to the 0.85 level, which would be even more appealing to me from a longer-term standpoint. I don’t necessarily want to short this market, so therefore I’m just ignoring that type of price action, because quite frankly eventually we go back to the interest rate differential as the GDP numbers in America showed early during the Thursday session in New York.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.