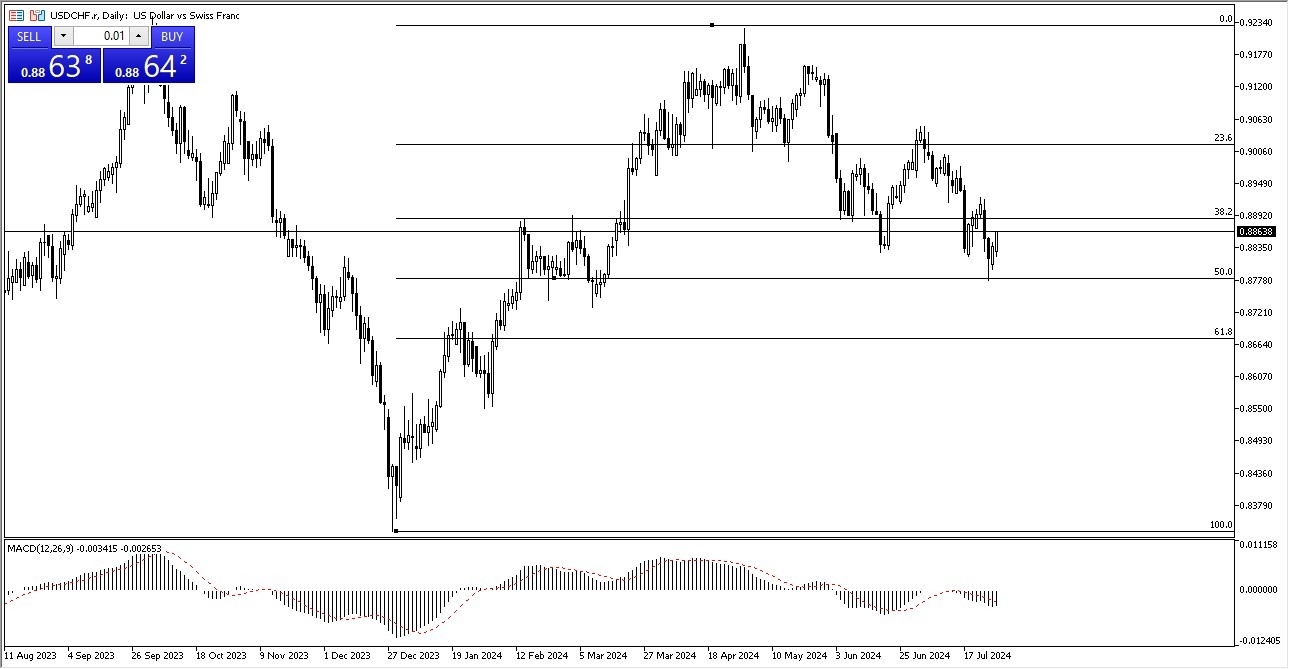

- The first thing I notice is that we have bounced from the 50% Fibonacci retracement level, an area that of course, a lot of people will be paying attention to.

- Ultimately, this is a market that I think will be very noisy, but when I look at the interest rate differential, it makes a certain amount of sense that the US dollar continues to climb.

After all, this is a market that has seen traders get paid at the end of every day for holding it. So the inevitable pullback, of course, was short lived. In fact, it looks like we are trying to send this market back to the upside. And if we can break above the 0.89 level, I think that will bring in more FOMO. If that were to happen, this could send this market moving higher, but only time will tell. It should also see the USD gaining against most other things at the same time.

Top Forex Brokers

At that point, we could very well continue to climb towards the 0.9250 level where we had pulled back from previously. The alternative scenario, of course, is that we break down below the 0.8780 level and then drop towards the 61.8% Fibonacci retracement level. In general, this is a market that does tend to move with risk appetite as both are safety currencies.

SNB Has Already Cut. Will the Fed?

But keep in mind with the Swiss National Bank cutting rates earlier this year and a lot of questions out there as to whether or not the Federal Reserve will be cutting anytime soon. It does make a certain amount of sense that we would continue to see upward pressures overall period. With this, the market continues to be noisy, but I think we are starting to turn around, especially now that the moving average convergence divergence indicator is starting to climb as well.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.