Potential signal

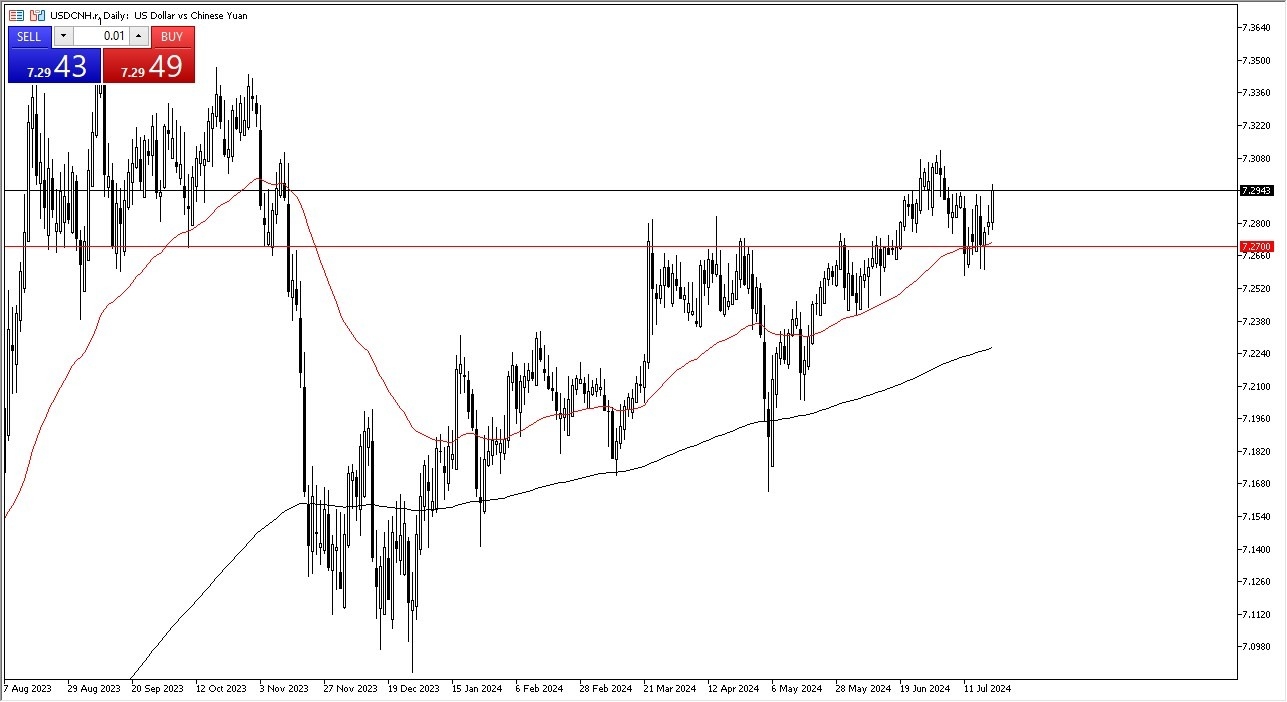

- I am a buyer of the USD/CNH pair at 7.30 above.

- I would have a stop loss at 7.2680, and a target of 7.35 above.

The Chinese Yuan has lost value during the early hours on Monday as the prime rate came in about 10 basis points less than anticipated. Because of this, it looks like China may be having a little bit of economic pressure. And at this point, I think short-term pullbacks will continue to be thought of as buying opportunities with the US dollar.

Top Forex Brokers

Fed Isn’t Cutting. Yet.

After all, the Federal Reserve is nowhere near cutting rates at this point. With this being the case, I think you've got a situation where traders will continue to hang on to the green bank against the yuan, as there are so many questions asked about the Chinese economy overall. Underneath, we have the 50 day EMA and the 7.27 level, both coming into the picture to offer support. To the upside, the 7.31 level above has offered a bit of resistance right along with the 7.35 level.

This is a market that's been marching higher for some time, and I think that is going to continue to see that as a scenario where you're just simply following the longer term trend. Keep in mind this pair is typically very choppy, but it does tend to trend for long periods of time. That's exactly what happebed since the end of last year. So not much has changed, but it's probably worth knowing that it is a sizable candlestick that we are forming for the day on Monday. And therefore, I think you've got a shot of where we go higher, although it will be very noisy to say the least.

Ultimately, this is a play on Asian growth and of course global growth in general. After all, China is the world's factory, and a lot of people will continue to look at it through the prism of whether or not there is going to be enough momentum and growth to warrant the Chinese yuan strengthening over the longer term.

Start trading our daily Forex signals! Get our top Forex brokers we recommend to open demo accounts with here.