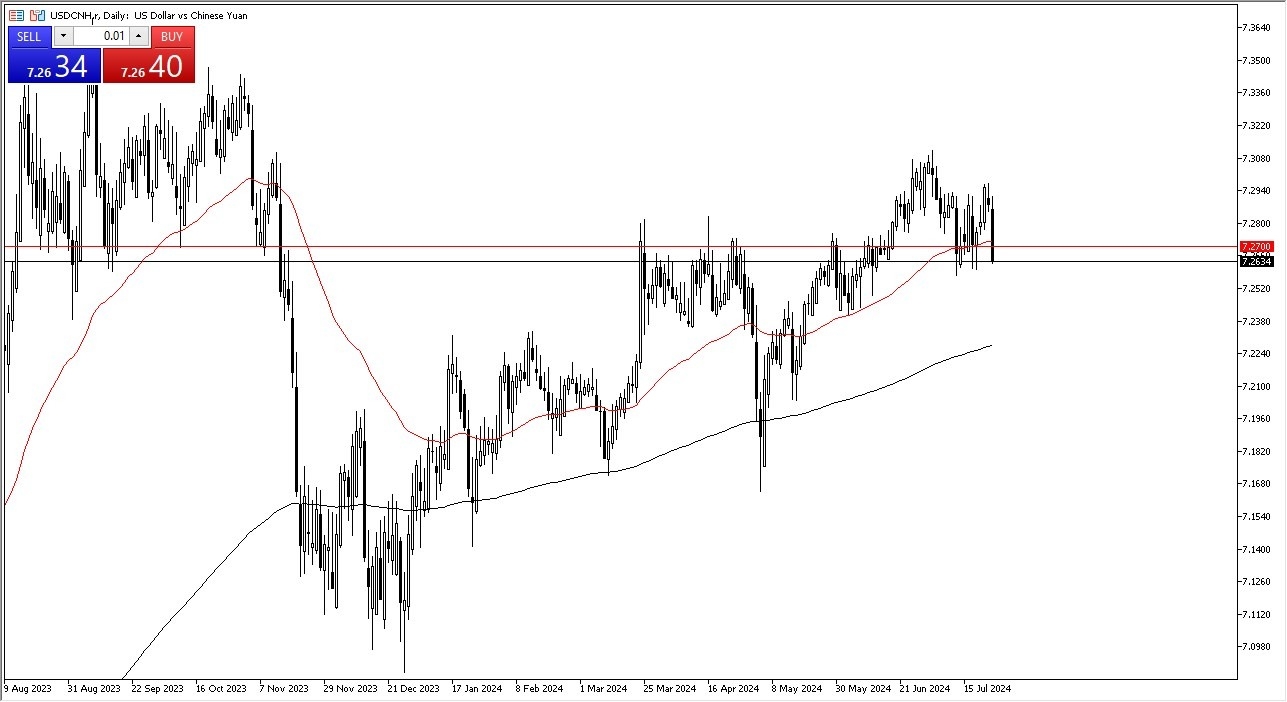

Potential signal:

- I am a buyer of this pair, with a stop loss at the 7.249 level.

- The target for me will be the 7.2750 level.

- It's easy to see that the market continues to see a significant amount of volatility.

- But at this point, I think the thing that needs to come to the forefront is the fact that we have fallen towards the crucial 7.25 level, which has been massive support more than once.

Top Forex Brokers

With that being said, I think you've got a situation where traders are going to continue to look at this market through the prism of a noisy affair as the 7.27 level seems to be a bit of a magnet for price. We are just simply going back and forth trying to figure out what to do with ourselves next. I do think that ultimately this is a market that will see buyers jumping in as China certainly has its own issues, so I don't think this is just a US dollar issue although it certainly is during the day on Wednesday.

PMI Numbers Cause Noise

Keep in mind that PMI numbers around the world were a bit of a mixed bag, and that directly influences China. So, with that being said, this is a market that will continue to be very noisy, but I do think that eventually we will rally, perhaps trying to get back to the 7.29 level. If we were to break down below the 7.25 level, then the 200-day EMA would come into play. And in that environment, I suspect that you would see the US dollar weaken against pretty much everything. So ultimately the market is one that I think you have to be cognizant of the rest of the world but pay attention to the US dollar index. If it starts to fall, that could put downward pressure here, but the Chinese will only let the Yuan appreciate so much before getting involved setting the reference rate, that type of thing that they do on a daily basis but setting it more in favor of a weak Chinese yuan. So, while this fall is rather significant, it's probably nowhere near enough to get something like that going. And therefore, I think you have to look at this as a market that despite all the noise is still simply consolidating.

Ready to trade our daily Forex forecast? Here’s a list of some of the top regulated brokers in China to check out.