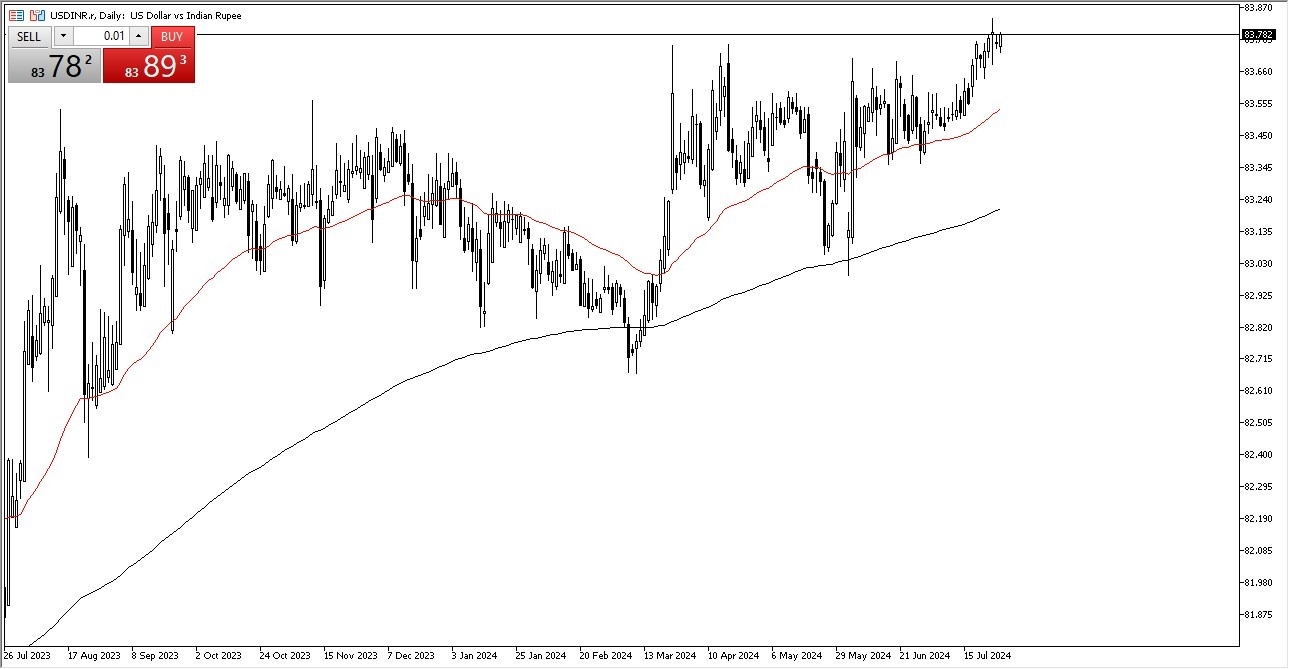

- The US dollar initially pulled back just a bit in the early hours on Monday, only to turn around and show signs of life and rally against the Indian rupee.

- This is a market that's been in an uptrend for a while, so none of this should be a huge surprise, and therefore I think you have to look at this from the prism of a market that is doing everything it can to continue the overall upside.

- The 84 rupee level sitting above I think is your short-term target. And given enough time we could even break above there.

That's going to be especially true if we get a big risk off type of event or movement. In the meantime, I believe that short-term pullbacks will be buying opportunities in this USD/INR pair as the market continues to be heavily driven by risk sentiment. And of course, the Indian rupee is pretty far out there on the risk appetite spectrum. The 83.50 level is significant support right along with the 50 day EMA. And then again, we see significant support at 83.35 underneath.

Top Forex Brokers

Rates are Everything

I do believe that if interest rates start to really take off in America, that could be the death knell for this pair. But at the same time, as there are concerns about overall global growth, that's not good for the Indian rupee. And I do think that the uptrend will continue over the longer term. After all, in times of concern you will see a lot of people jumping into the greenback for safety, while running away from the smaller currencies. Beyond that, you also have to worry about India and its exposure to China and the rest of emerging markets in Asia directly, which makes it much more sensitive to the risk appetite of global investors. With that being said, I think we continue to see this market grind its way higher.

Ready to trade our daily USD/INR Forex analysis? Here’s a list of some of the best forex brokers in India to check out.