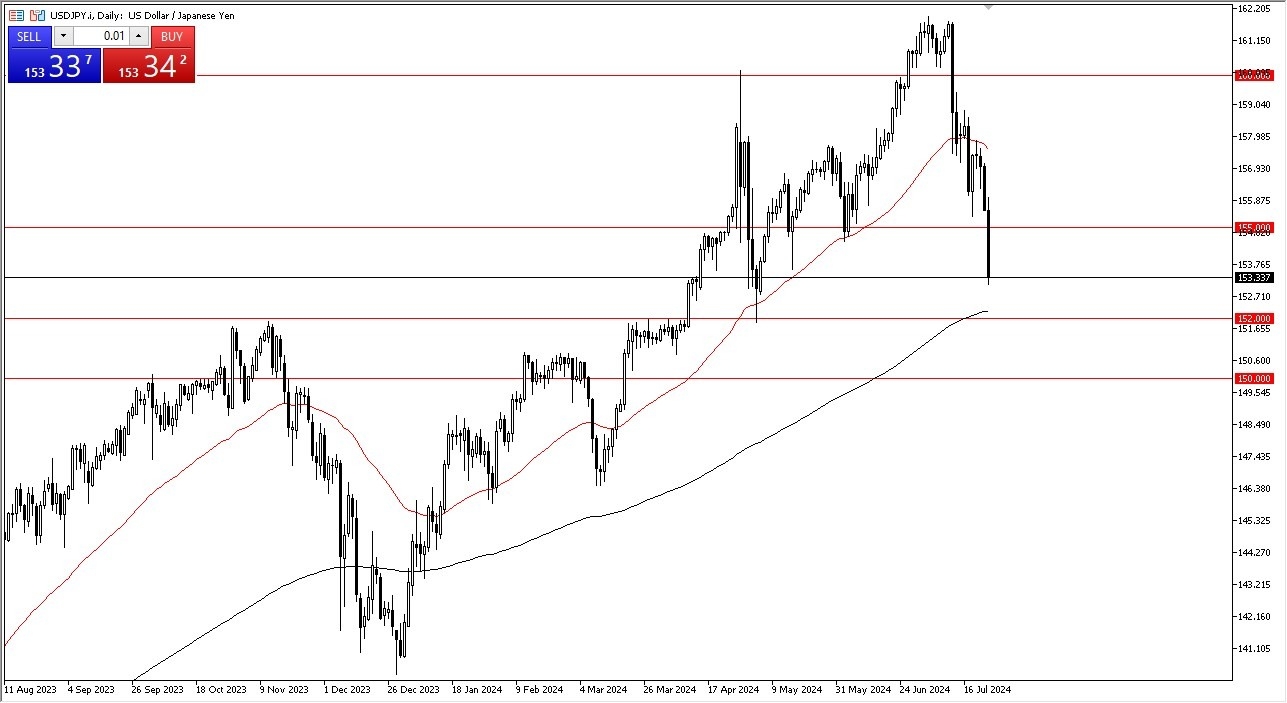

- In my daily analysis of the dollar against the yen, the first thing that comes to mind is that we not only broke down below the 155 yen level, but we have collapsed below it.

- As PMI numbers around the world continue to be a bit of a mix, the reality is that the Japanese may have intervened overnight because the action was quite brutal, and we are starting to hear murmurs of that.

- So maybe the Bank of Japan continues to get involved in the FX markets, but ultimately given enough time, I do think that you have a value opportunity just waiting to present itself.

I Won’t be Gambling Here

I'm not necessarily going to be in the mood to try to gamble here. I think that what we need to see is a little bit of stability and then a bounce. I thought we had that a couple of days ago, but we don't have that yet. The 152 yen level is an area that not only features the 200-day EMA, but it's also the previous resistance barrier, so I think with that being the case, it does make sense that market memory lifts the dollar there.

Furthermore, it'll be interesting to see how traders approach the yen and the interest rate differential. But at this point, you would have to assume that interest rates are probably going to shrink a little bit, at least in the futures markets. So that'll be interesting. All things being equal, this is a market that is still in an uptrend, but man, are we getting hammered. And I think this is something that you need to pay close attention to because this could be a sea change, but we are not there yet. That being said, USD/JPY is a pair that I have no issues holding, but I think there will be better opportunities in this pair to get involved at a better price. Remember, you are looking for the USD to be “on sale” and supported.

Ready to trade our daily forex forecast? Here are the best forex brokers in Japan to choose from.