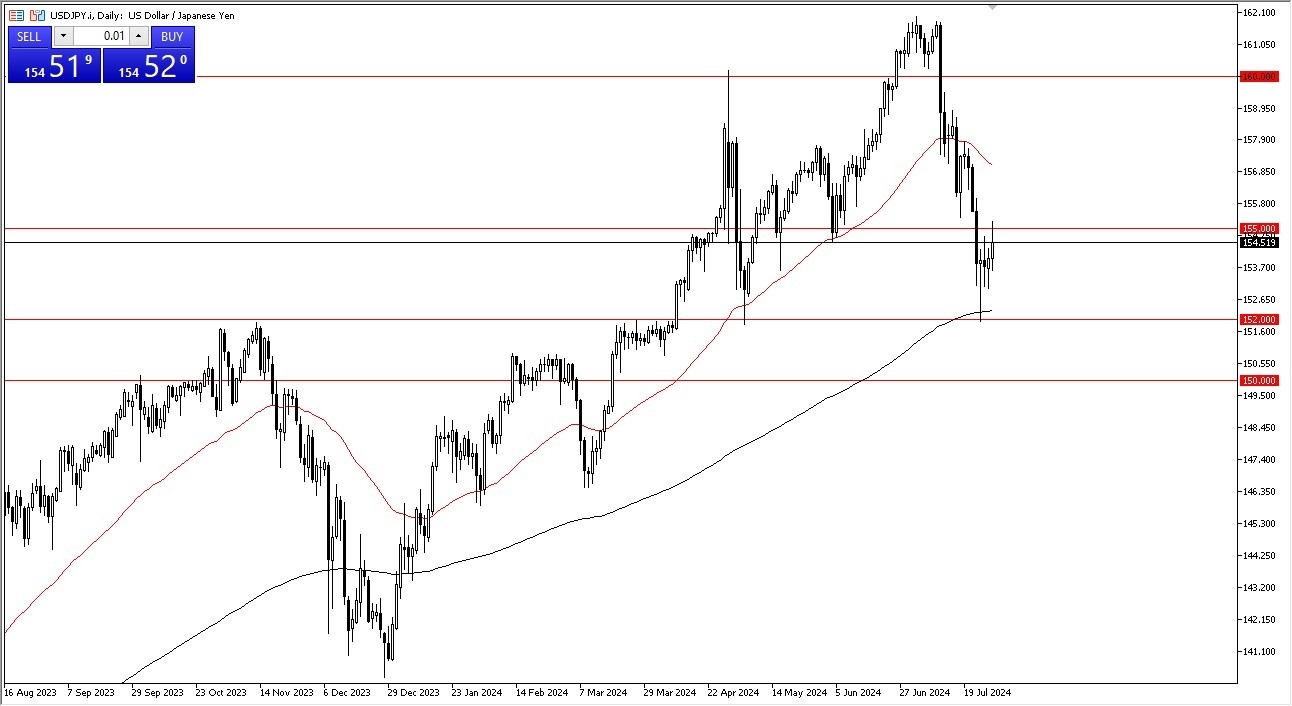

- The US dollar rallied a bit during the trading session on Tuesday to reach above the 155 yen level, but we have seen a little bit of a pullback.

- All things being equal, this is a market that I think continues to see a little bit of a buy on the dip attitude because of the interest rate differential.

- That being said, the market is likely to continue to see value hunters coming in, especially as we have the Bank of Japan and of course, the Federal Reserve meetings coming that could cause havoc in this pair.

Keep in mind that this is a situation where every time we pull back, there will be buyers looking to get involved to get paid at the end of the day. The market breaking out to the upside could open up the possibility of a move to the 157 yen level, which is where the 50-day EMA currently sits.

Top Forex Brokers

Support Sits Below

That being said, the 200-day EMA is sitting below, near the 152 yen level and offering significant support. This is a large round psychologically significant figure that has been both support and resistance previously, so it does make quite a bit of sense that we have the possibility of the market going higher over the longer term even if we do approach that level.

With both of the central banks having statements on the same day, I would anticipate a lot of noise. And I think at this point in time, the most important thing you can do is keep the position size reasonable. But I think clearly at this point in time, you have to look at this through the prism of whether or not you want to get paid at the end of the day, or if you want to pay somebody else. The interest rate differential will be that huge regardless of what these central banks do, which are likely to stand still this particular month. So, I don't know if it changes anything. The statement in the press conference could have a lot to say going forward, especially with the Federal Deserves case. But really at this point, it still looks like a buy on the dips.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.