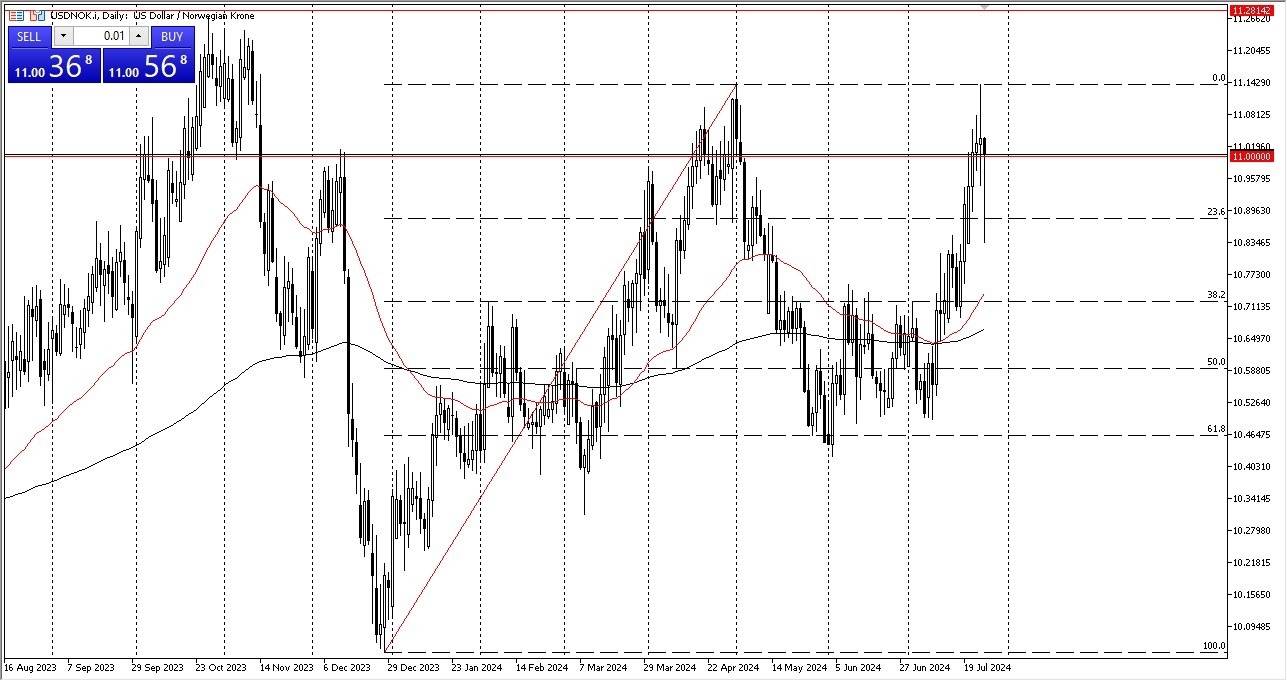

- The US dollar plunged against the Norwegian krone during the trading session on Friday to reach down to the 10.83 level before turning around and ripping to the upside and hanging about the 11 level.

- The market, of course, is one that will continue to be very noisy, and it's probably worth noting that now that we are back to the 11 level, it's likely that we will continue to see upward pressure and an attempt to get back to the 11.15 level.

- In general, I think this is a situation where traders are trying to break this potential double top and go look into the 11.28 level.

Short-term pullbacks continue to see plenty of support, not only at the 10.83 region, but the 38.2% Fibonacci retracement level, right around the 10.72 level. That's also where you see the 50-day EMA, and then after that, the 200-day EMA.

Top Forex Brokers

Keep in mind this is a market that is generally very noisy and choppy, as although they are both fairly important economies, the Norwegian krone is a smaller currency, so this is a pair that tends to have widespread from time to time, and of course will have an erratic movements occasionally, due to the fact that depending on the time of day, it can get a bit then as far as volume is concerned.

I still favor the upside overall

In general, this is a market that I do believe eventually does break out, but it's going to be difficult to make that happen. We are a little overextended with this. I think you have to believe that a little bit of patience probably goes a long way here on short term dips offering that value. Keep in mind that the Norwegian krone is highly influenced by crude oil, although the US dollar itself represents an economy that produces plenty of oil also. So, with that being said, this can also be moved mainly on the idea of the US dollar shrinking and showing weakness around the world.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.