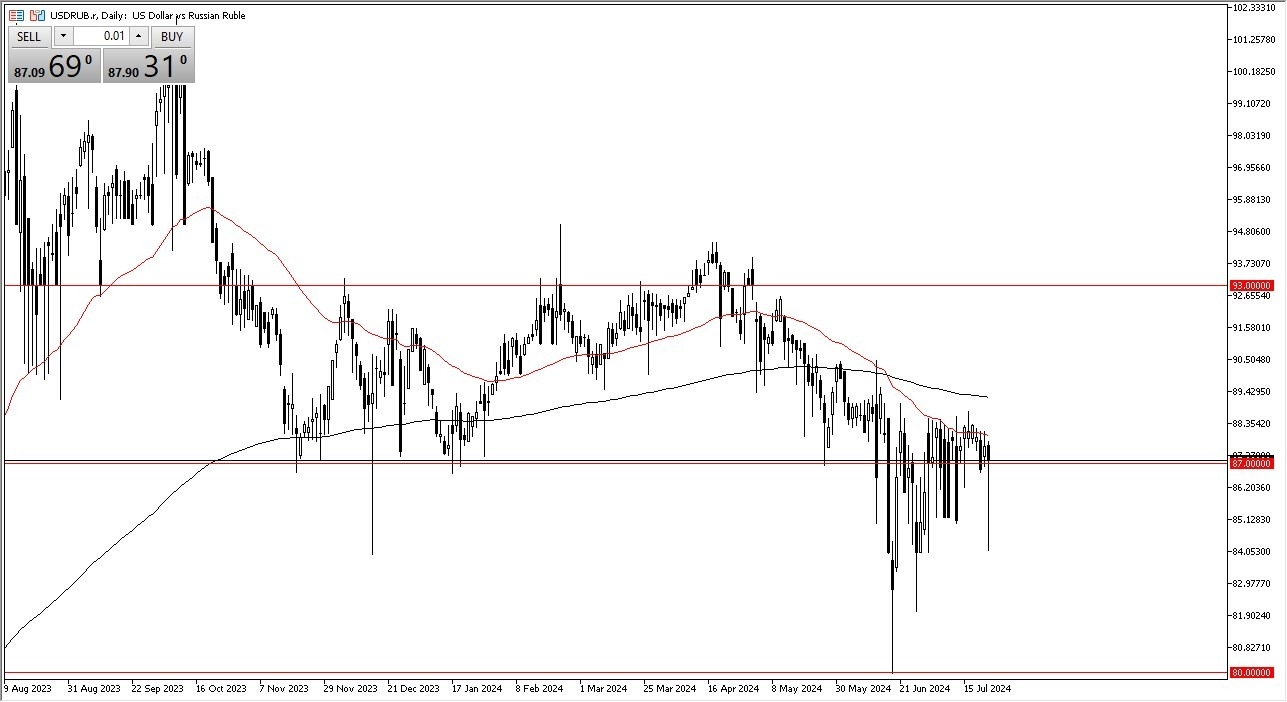

- It's easy to see that initially, the ruble strengthened during the trading session on Tuesday, but the US dollar has recovered quite nicely.

- At the end of the day, we are hovering around the 87 rubles level, which is an area that we have seen a lot of action at previously.

We had the 50 day EMA just above to offer a significant amount of resistance, but if we can break above that level, then it's likely that the market could go looking to the 200 day EMA. The shape of the candlestick is a hammer, so it does suggest that we may see a bit of a bounce here, but we'll have to wait and see how this plays out.

Top Forex Brokers

On a Breakout, I am Buying

At this point I would need to see the US dollar break above the 88.50 ruble level to start buying. But at that juncture, I think we could see a bit of a move to the upside. Otherwise, if we break down from here, we could see the market drop towards the 84 rubles level again, and then again to the 80 rubles level where we have massive support.

In general, this is a market that I think continues to see a lot of buy on the dip behavior, just simply due to the fact that there are a lot of geopolitical concerns out there. And of course, the ruble has to deal with a lot of sanctions that the US dollar just simply does not have against it. So, with that being said, this is a market that I think continues to be noisy, but I do think that there is a significant amount of support just below.

So, if we do start to sell off a bit, then it's time to start buying again. At least that's the way the market has been behaving over the last couple of weeks. Whether or not that holds. We'll have to wait and see, but it certainly looks like it could.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Russia to check out.