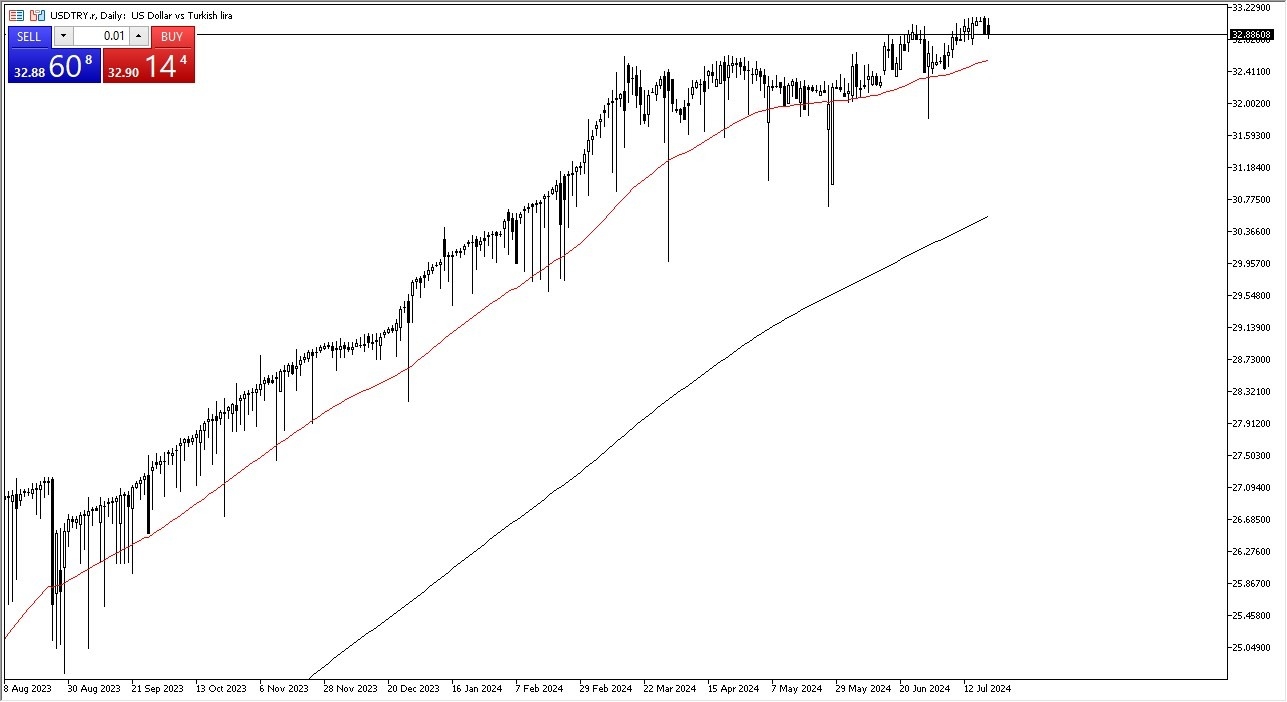

- The US dollar initially tried to rally a bit against the Turkish lira and then gave back those gains to essentially end up where we started for the session after gapping higher.

- All things being equal this is a pair that has been in a massive uptrend for some time and I don't think the people were jumping in to buy the Turkish lira despite the fact that the Turkish lira is backed by the larger interest rate.

- It's a ridiculous 50%. So that does make for at least some support for the currency. But the fact that a 50% interest rate can't necessarily keep this market from selling off as far as the lira is concerned, tells you pretty much everything you need to know.

Risk On / Risk Off

Furthermore, we have a scenario where if there's a major risk off attitude to the world, and it certainly could be, at this point in time, we could see the USD just take off against the lowly Turkish lira. The 32 level underneath could be a bit of a base on any type of correction.

Top Forex Brokers

It's is worth noting that during certain times of the day, we do have a lot of volatility, mainly when lira traders are involved. But really, I think any sharp drop to the downside will more likely than not attract a lot of inflows that people are willing to jump all over.

With this in mind, I think this is a market that is going to continue to be very noisy, but it will be very positive over the longer term. I have no interest in shorting this market, mainly due to the fact that even though it does pay a lot in the way of interest, it's essentially the same thing as swimming up a river, against all of the momentum. In general, I believe this is a market that does continue to see quite a bit of inflow every time there is an opportunity. We are getting a lot of noise in this market occasionally from a day-to-day perspective, which offers buying opportunities.

Start trading the Turkish Lira forecast. Get our list of recommended Forex brokers in Turkey here.