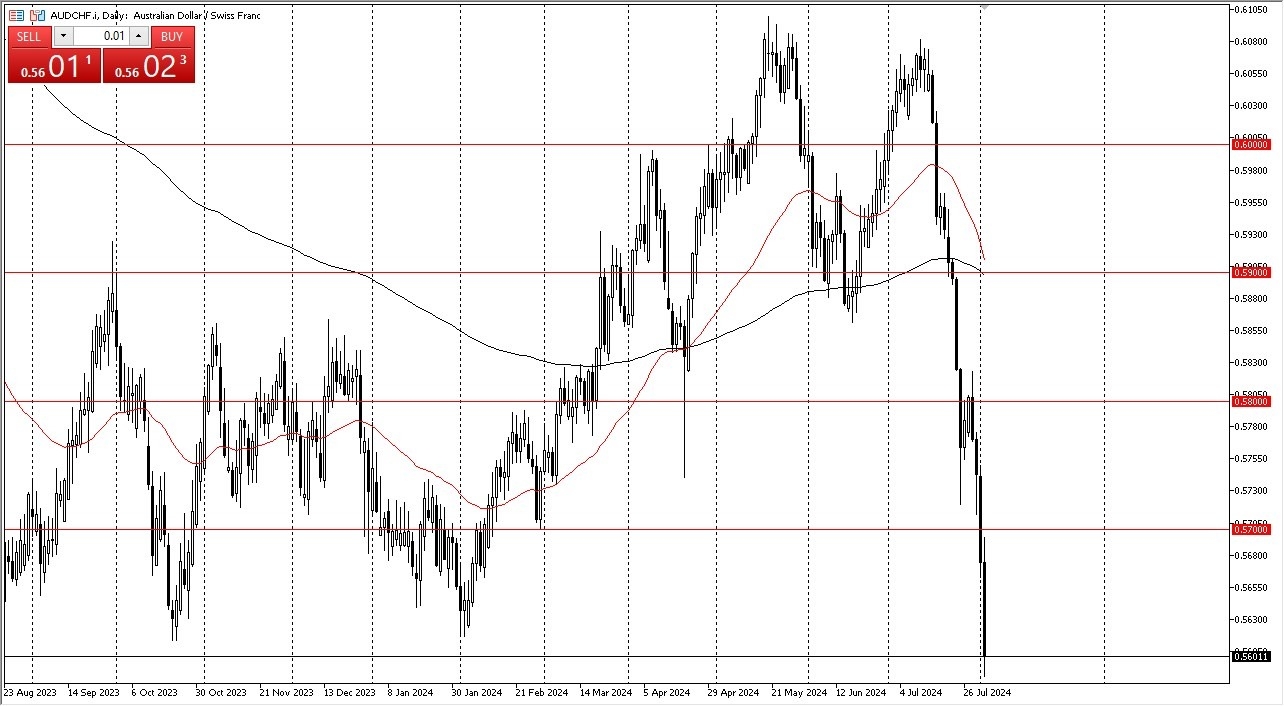

- In my daily analysis of the Aussie dollar against the Swiss franc, it's plain to see that the negativity continues.

- We have formed a fresh new low.

- When you look at the longer term charts, it's about as low as it gets.

So, with that being the case, one has to wonder will the Swiss National Bank lose their sense of humor? I don't know that that's the case. I don't think they can do much about this panic move. This isn't necessarily about the Australian dollar. This is about the Swiss Franc. Everybody is running to the Swiss Franc for help and safety. Now the Australian dollar is slamming into the 0.56 level.

Top Forex Brokers

It seems like we lose a handle every day or so. And that of course is an absolute panic move. That being said, I do think that we go lower. However, I don't want to chase this trade. I want it to be a situation where we look at this through the prism of a market that continues to see a lot of noisy behavior and the occasional rally probably comes in that we can start shorting.

Shorting Rallies

I would like to short rallies that show signs of exhaustion after a bounce. I don't necessarily want to chase it all the way down here because it's already dropped so far in just a matter of a couple of weeks. In fact, two weeks ago, we were five handles above where we currently are right now. The 50-day EMA is now getting ready to cross below the 200-day EMA kicking off the death cross but that's normally a late sign of what's going on. Because of this I don’t use that as a signal in and of itself, but I know a lot of systematic traders will be paying close attention to it. This is a market that a lot of people pay little attention to, so it tends to fly under the radar of most traders. This is too bad, because it is clearly one that has moved right along with risk appetite.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.