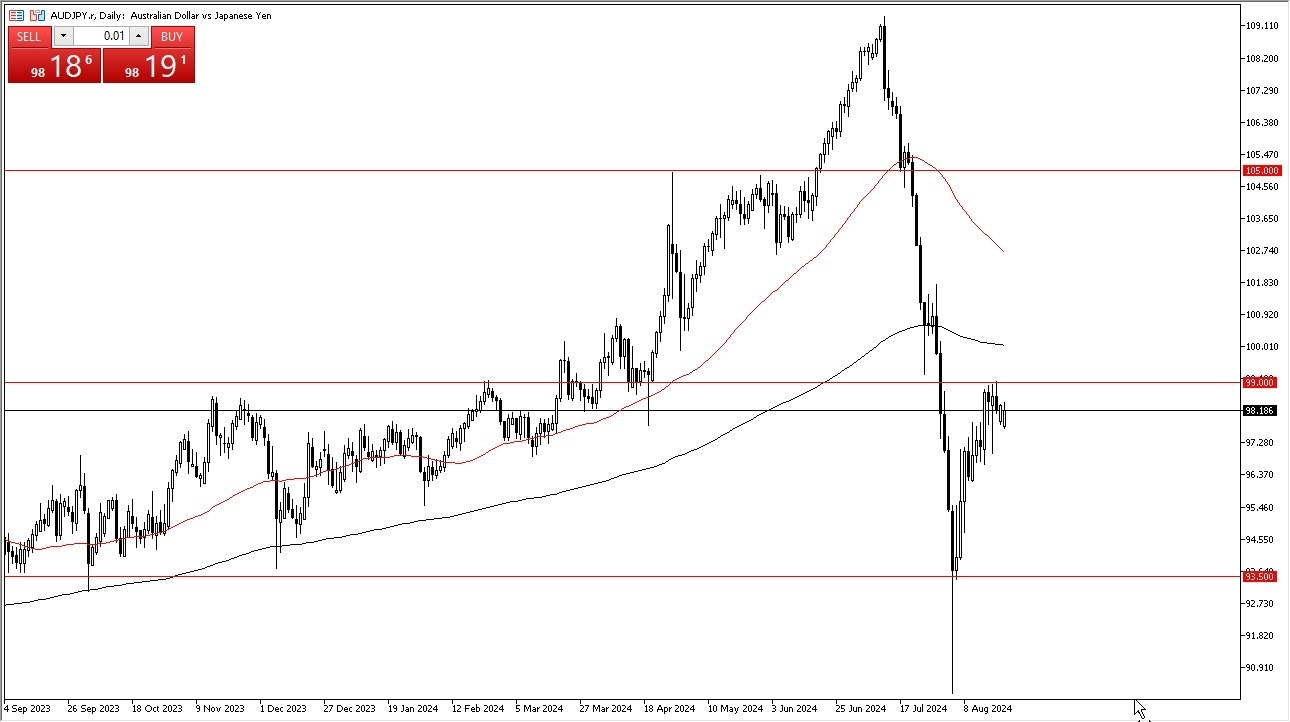

- In my daily analysis of the Aussie dollar against the Japanese yen, the first thing I notice is that the 99 yen level has been a big barrier.

- This is a barrier that if we can break above, I think will catch the attention of a lot of traders.

- That being said, we also have the 100 yen level just above where the 200 day EMA sits at. So, there is a lot of potential noise just above.

- The market has shown a bit of resilience over the last couple of weeks after being completely hammered. The carry trade coming out of Japan has been squashed, but the question then becomes, will it return?

The interest rate differential between the Australian dollar and the Japanese yen is wide enough to drive a truck through, and that's probably not going to change drastically anytime soon. As traders start to think about the possibility of higher rates for longer, as central bankers at the Jackson Hole Symposium are now starting to spout off, they aren't entirely convinced.

Top Forex Brokers

The Japanese Yen

That could drive the Japanese yen lower against most other currencies as people take advantage of that interest rate differential again. We've seen the knock-on effects in the British pound against the Japanese yen, the US dollar against the Japanese yen, and the Australian dollar against the Japanese yen during the session.

For me, it's more or less going to be about the technical analysis and whether or not we take off to the upside. If we can, then we'll challenge the 200-day EMA and above there, I think you really start to see the buyers accelerate. Pull banks at this point in time, I think have a massive amount of support at a couple of places, but most notably the 93.50 yen level, which I see as the floor in the market at the moment. We've seen a lot of technical damage done, but at this point in time, it looks like we are at least trying to turn things around.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.