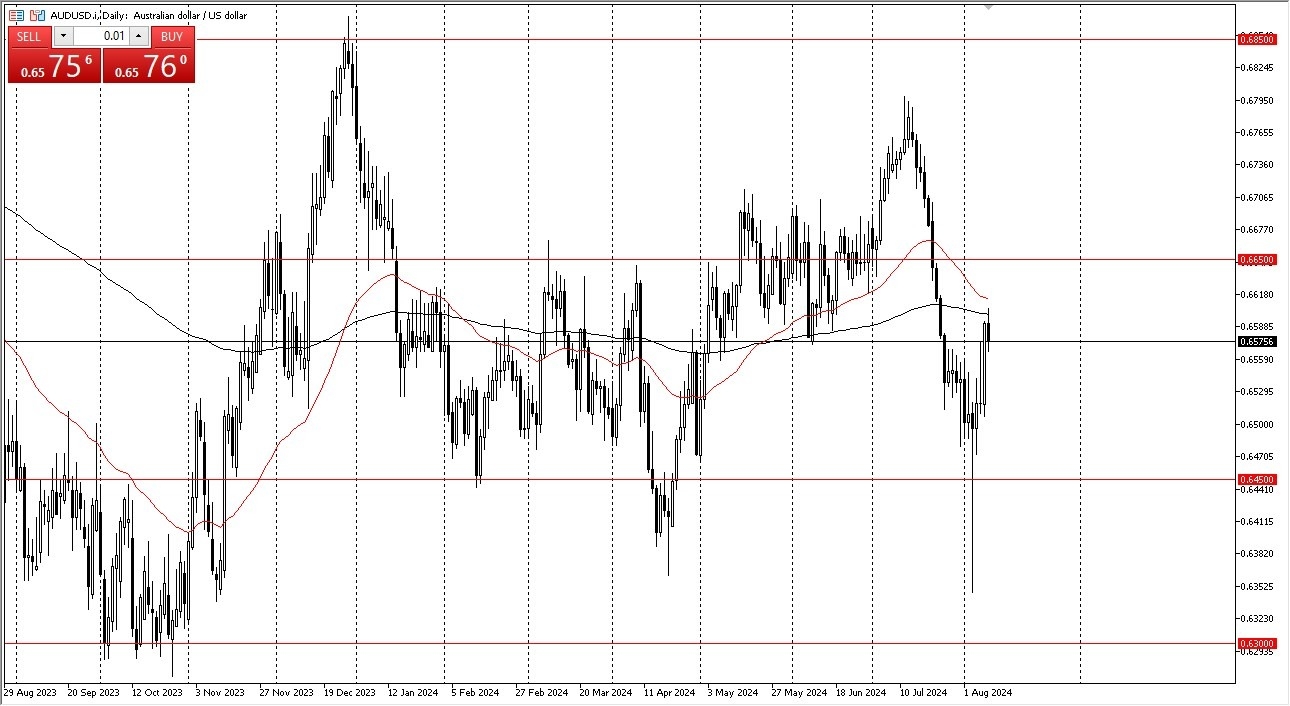

- It’s obvious that the AUD/USD pair is struggling with the 200-Day EMA, as we have pulled back just a bit.

- By doing so, it looks like the market is going to continue to see a lot of noisy behavior, and ultimately, I also think that you’ve got a situation where traders are going to be somewhat cautious as we have been in a range bound market for quite some time.

Over the last couple of years, the Australian dollar has essentially gone sideways. Yes, we get an occasional move to the upside, or perhaps an occasional move to the downside, but ultimately, we have stayed within a somewhat well-defined range. The AUD/USD market has been very difficult to trade in the longer term, but if and when you get a little overbought or perhaps oversold, then we played the range yet again.

Top Forex Brokers

Lackluster Performance

I believe that the Australian dollar will continue to show a bit of lackluster performance, as it is a market that is highly sensitive to risk appetite, commodities, and the Asian markets and economies overall. This is a market that has been very bullish over the previous couple of days but let us not forget that we had initially plunged quite drastically. The market breaking through the 0.6450 level has triggered a lot of short covering, and now the question is whether or not the market is going to continue to rally from here.

I suspect that this point in time, the Australian dollar will continue to be very noisy, but I do think that we know that there are a couple of levels worth paying attention to. It’s not only the 0.6450 level, but I also believe that the 0.6650 level above will continue to be a significant resistance barrier. If we can break above there, then we could open up the possibility of a move to the 0.6750 level. Regardless, I think you need to be cognizant of the volatility that is inherent on short-term charts in this market.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from.