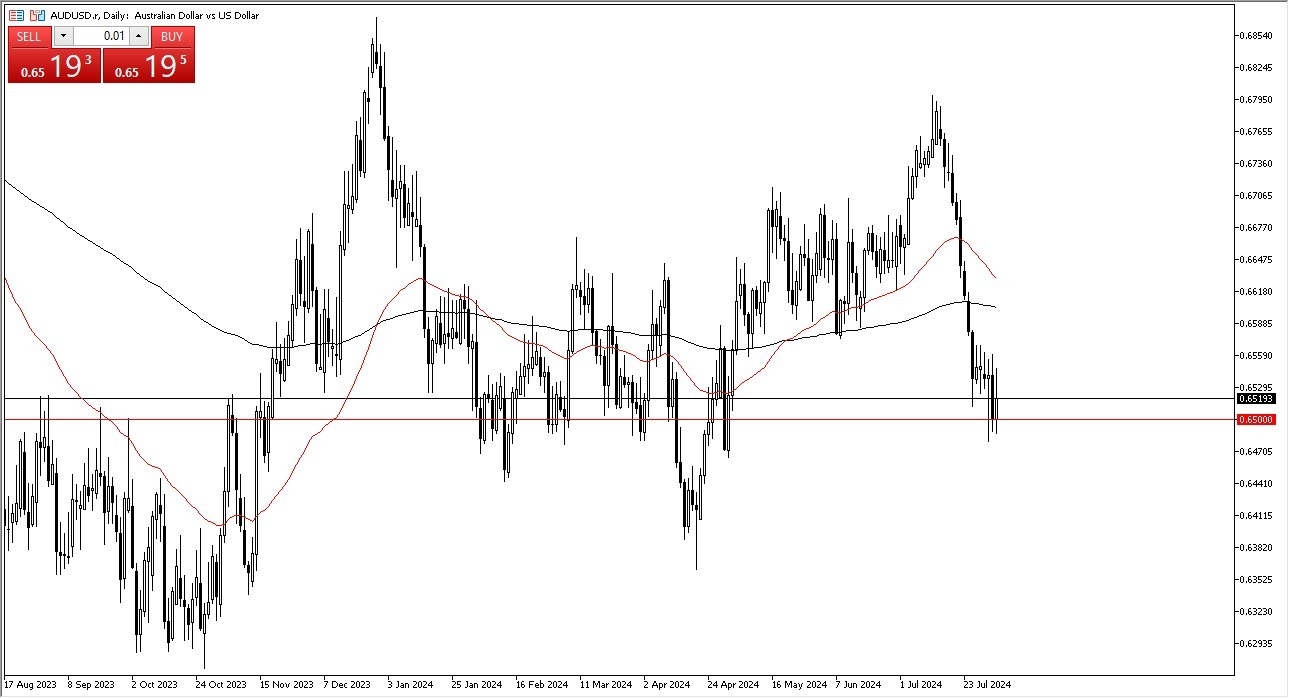

- The Australian dollar has gone back and forth during the trading session on Friday.

- It’s obvious that this asset is going to continue to be very volatile as we are hanging around a large, round, psychologically significant figure.

Underneath, we have the 0.65 level offering that support, and I think it extends down to the 0.6475 region. As long as we can stay above that level, then it’s likely that we could continue to see a little bit of a buy on the dip mantra here, but I think it’s only short-term. We need to see some type of momentum reenter the market in order to get bullish on the Australian dollar, and it is probably worried that the Chinese market continues to see overall economic weakness, which of course directly influenced the Australian dollar, as Australia is a major proxy and the commodity provider for the Chinese economy.

Top Forex Brokers

A Breakout is Needed

In order to start buying this pair, I need to see the AUD/USD market break above the 0.6575 level, and even then, I would need to see the US dollar shrinking everywhere. While the major source of volatility during the trading session on Friday was that the United States only added 114,000 jobs for the previous month, the reality is that people will go running to the greenback in order to find a little bit of safety. Money flies into the US Treasury markets, which makes quite a bit of sense as people are more worried about protecting their wealth at this point than trying to expand it.

Whether or not this holds through the weekend remains to be seen, but clearly this is a situation that could be very noisy. I am already hearing pundits on Wall Street excusing the numbers as a bit of an anomaly and give you an idea as to the fact that maybe it’s a “one-off due to weather factors”, the reality is that the overall economy has been softer in America for some time, so it’ll be interesting to see whether or not traders catch up to it.

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.