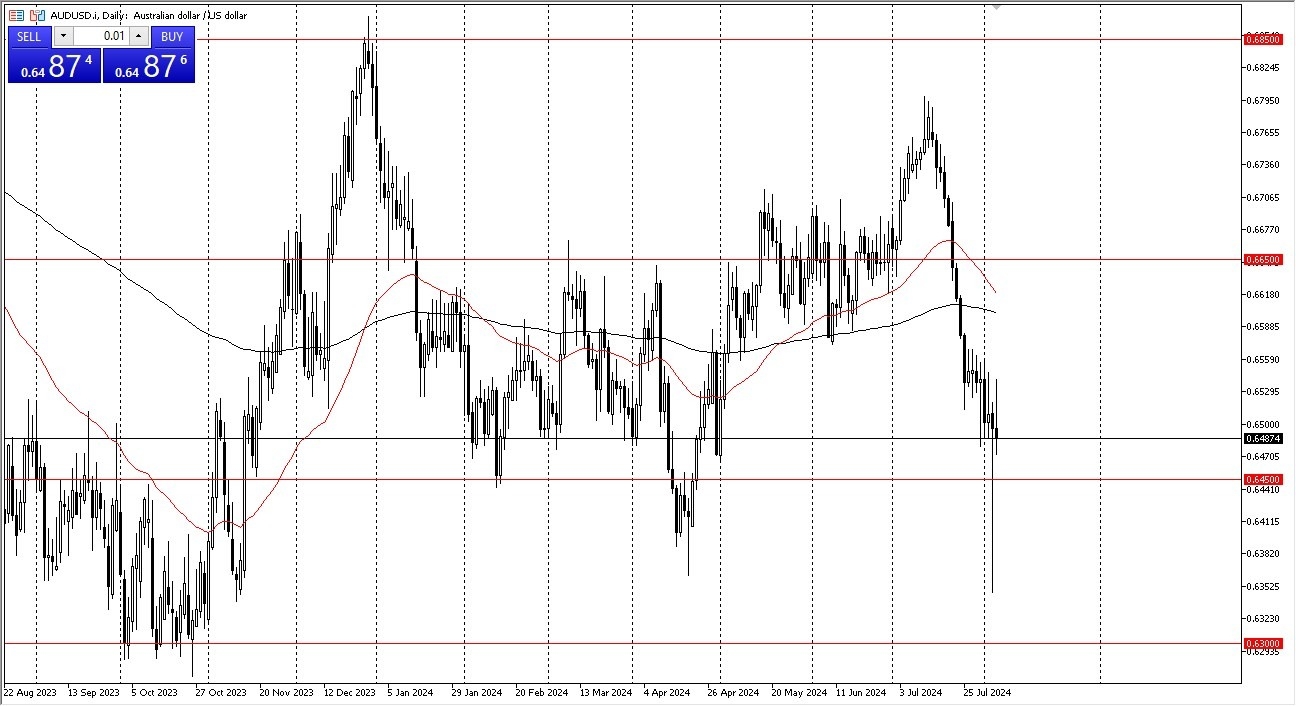

- The first thing that you see when you look at the chart is that the Australian dollar simply doesn’t seem to be willing to hang on to gains for a significant amount of time.

- It’s also worth noting that the Australian dollar is highly levered to the Chinese economy as well as global growth in general as it is a major currency that represents commodities overall.

All things being equal, this is a market that I think continues to see a lot of volatility, because quite frankly it is difficult to imagine a scenario where commodity demand is going to skyrocket in this type of financial environment. Quite frankly, this is a market that I think as long as we continue to see a lot of uncertainty, rallies will continue to get sold into.

Top Forex Brokers

Several Levels

There are several levels that I’m paying attention to in the AUD/USD currency pair. The 0.6450 level is an area that I think continues to see a lot of support attached to it, but it has been violated during the massive Monday selloff. If we were to break down below that level, then the next level I would be watching the 0.6350, where we had bounce from during the Monday short covering rally. After that, we could see a move toward the 0.63 level underneath which has a lot of historical support attached to it.

All things being equal, the upside is going to be much more difficult to rally toward, but if we were to break above the 0.6560 level, that would be a very bullish sign, perhaps sending the Australian dollar looking toward the 200 day EMA, perhaps even the 50-Day EMA on its way to the 0.6650 level above. This obviously would be a very bullish turn of events, but right now I just don’t see how the market has the strength or the gumption to get to that area in this type of environment. At best, I suspect that the Australian dollar will be noisy and sideways overall.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners in Australia worth using.