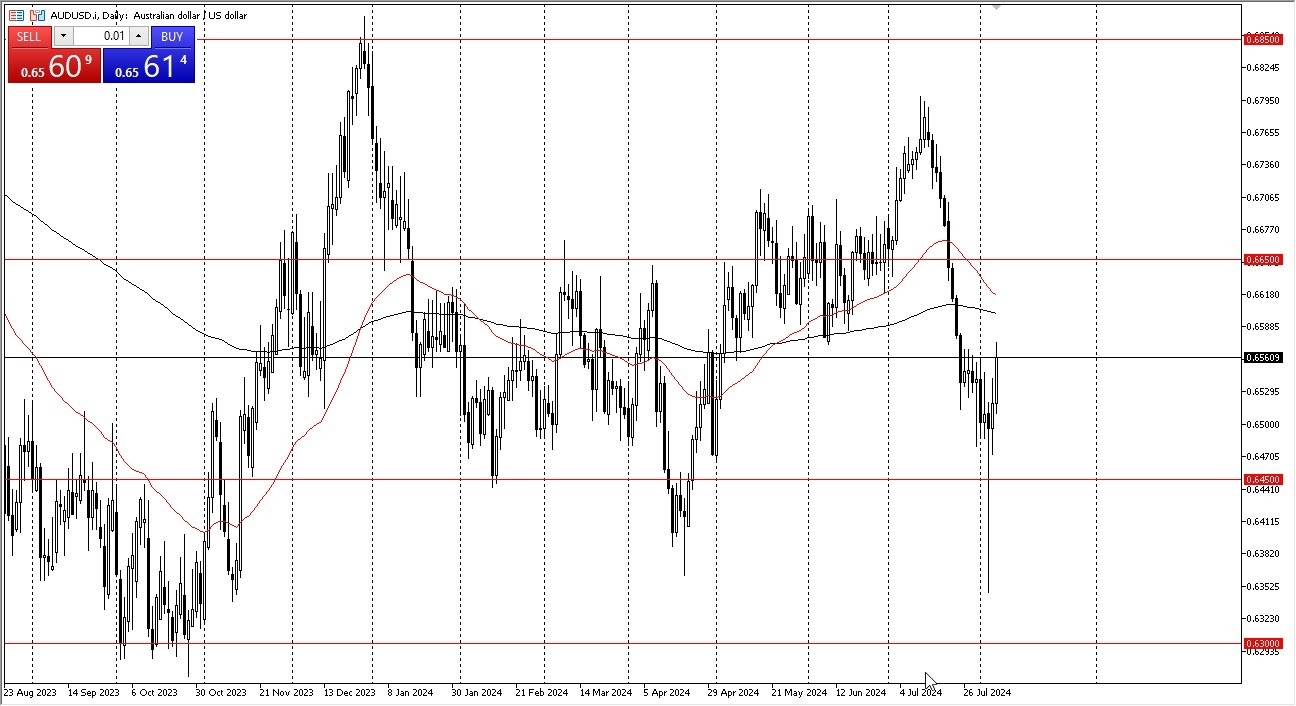

- We are trying to break above the 0.6550 level, which is an area that has been rather resistant.

- If we can break above that level, then the market could go looking to the 200-Day EMA, but at this point in time the upward momentum does make a certain amount of sense, as we had gotten so sold off.

Bank of Japan

The Bank of Japan had stated overnight that the central bank may not be raising rates any further, due to the fact that the markets were far too volatile. With this being said, it looks as if the market can hold the central bank policies, and therefore it’s likely that the loose monetary policy will continue to be the case coming out of Japan. If that does in fact end up being the case, then it’s likely that we have a situation where the carry trade comes back into vogue, and people start to look for more risk.

Top Forex Brokers

Keep in mind that the Australian dollar is considered to be a “risk on currency”, and a lot of people will look at it as such. The US dollar of course is likely to be looked at as a safety currency as usual, so a lot of this will come down to what other markets are doing. Pay close attention to stock markets, and of course commodities markets, because they can give you a bit of a “heads up” as to how things are going to play out.

Ultimately, this is a pair that I think will remain somewhat Range bound, with the 0.6450 level underneath offering massive support, while the 0.6650 level above will offer massive resistance. In this environment, I just don’t think we have anywhere to be, and you need to be very cautious about trying to get too aggressive. Sure, we could rally in the short-term, but longer term it’s very unlikely to be a huge move without some type of major shift in the fundamentals.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.