- The Australian dollar has rallied a bit, and the daily Australian dollar analysis suggests that this asset is going to continue to remain very range bound.

- With that being said, I think this is a market that eventually will have to make a bigger decision, but right now it’s obvious to me that the trading public has no idea what to do with risk appetite currently.

- After all, the Australian dollar is highly levered to commodities and Asia, and with that being said, the market doesn’t know what to do with risk when it comes to this currency.

Range Bound

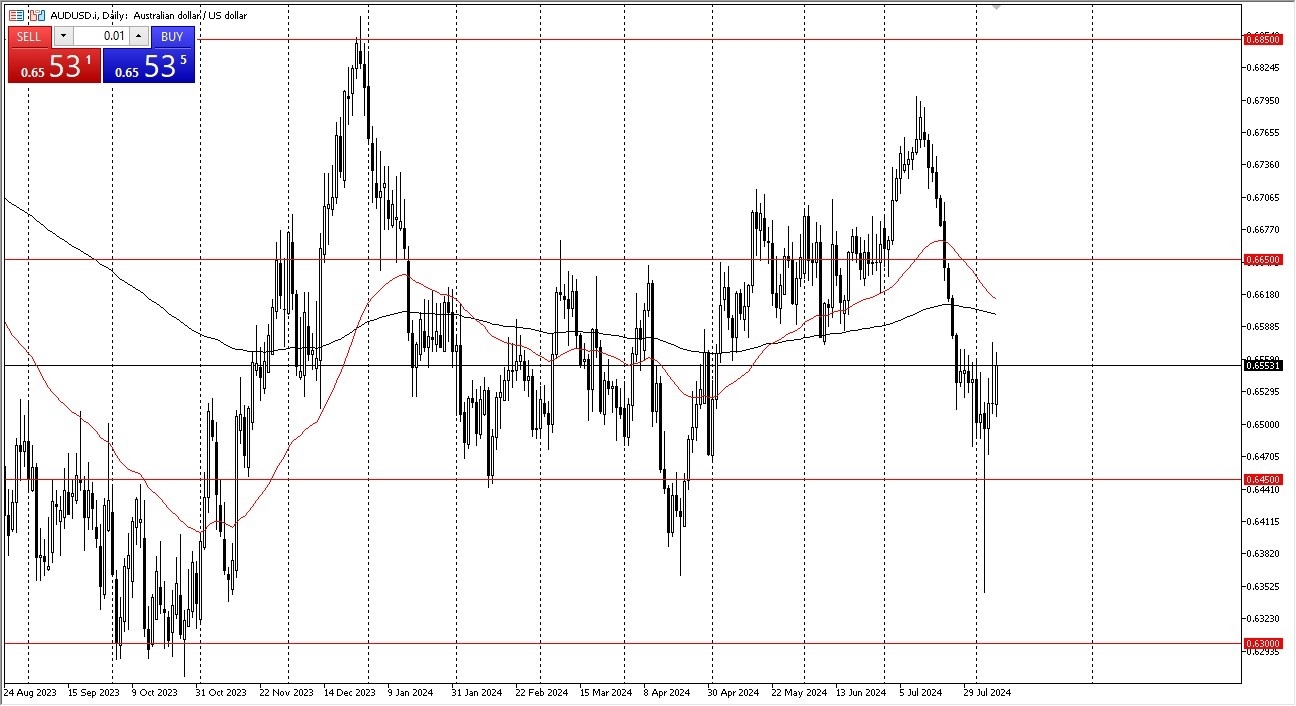

This is a market that has been range bound for some time, and I think that will continue to be the way going forward. The 0.6450 level underneath is a massive support level, and an area that I think you will continue to see defendant, unless of course we get some type of major panic. The market sees a lot of resistance above at the 0.6650 level above. Furthermore, we also have the 200-Day EMA and the 50-Day EMA just above in order to offer a significant amount of resistance. In general, this is a situation where I think the market just doesn’t know what to do, and therefore it would not surprise me at all to see this market hang around this range for a while.

Top Forex Brokers

One thing that I do notice is that selloffs do continue to get bought into, therefore I think you get a situation where we will try to hang out in this area, and to stay within this 200 point range. That being said, if we do panic out there, the US dollar course will get bought into. I think there is much more risk to the downside when it comes to risk appetite than the up. The central banks around the world look like they’re ready to start cutting rates, but sooner or later cheap money becomes a bad sign. I think we are very close to that scenario.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.