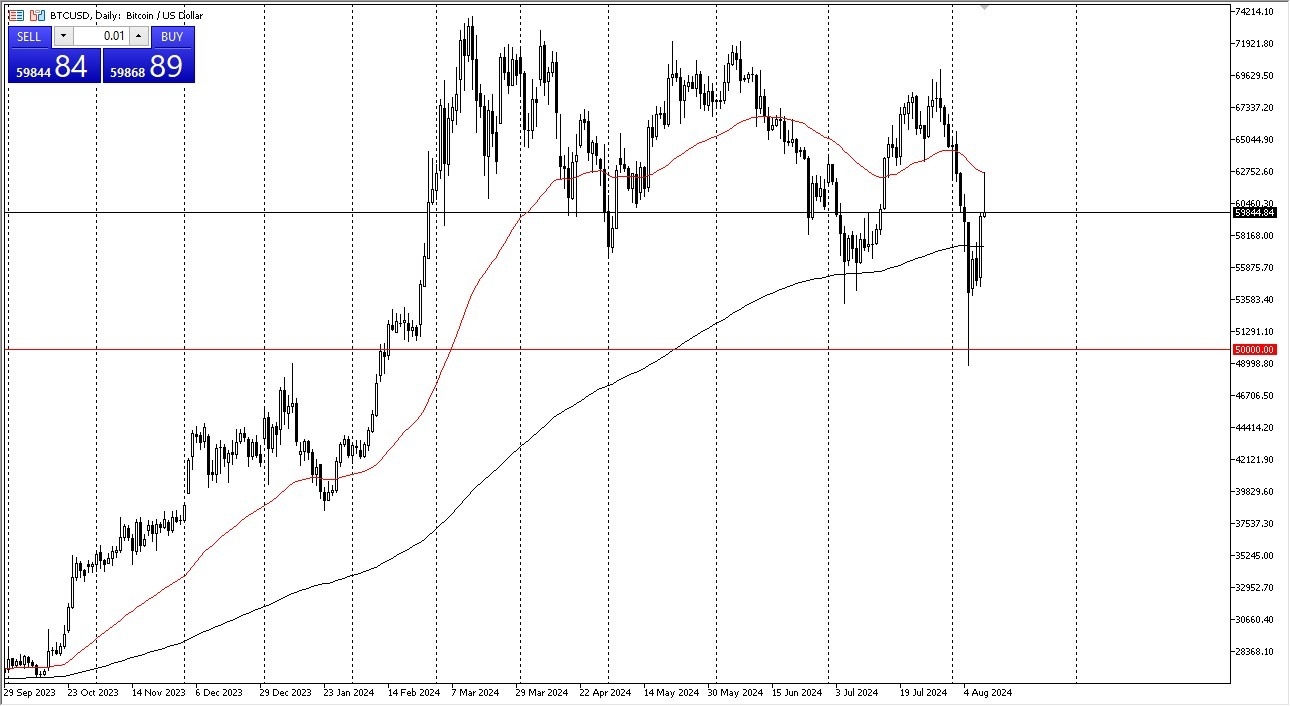

- The first thing I notice is that bitcoin reached the 50-Day EMA but have since collapsed a bit to show signs of weakness.

- With that being the case, I think it makes a lot of sense that we would continue to see trouble here, as market participants continue to look at this through the prism of whether or not there is enough risk appetite out there to keep the bitcoin market afloat.

Bitcoin Does Not Operate in a Vacuum

You need to be aware of the fact that bitcoin does not operate in a vacuum to say the least. All things being equal, the bitcoin market will continue to be very noisy, and of course we have to deal with the fact that the market recently collapsed. Underneath, we have the $50,000 level operating as a bit of a floor in the market, and as long as we can stay above there, the market is probably somewhat okay. However, if we were to break down below the bottom of the wipeout candlestick from Monday, that probably sends bitcoin reeling to the downside for a rather big move.

Top Forex Brokers

If that were to happen, that would obviously be very negative, and at that point in time I think you would probably see a generalized “risk off move” around the financial markets. With this, I think that bitcoin will be one of the least favorite markets, but it’s also worth noting that bitcoin has bounced quite drastically during the week, and that of course could be due to the fact that Wall Street is so heavily invested in it now. After all, it’s hard to sell the idea of an ETF if it doesn’t hold its value.

Because of this, I still slant toward the upside in this market, simply because Wall Street will treat it like an index, and therefore there will be artificial buying from time to time in order to keep the prices afloat. If we can break above the 50-Day EMA, then I think the market is likely to go looking to the $60,000 level above.

Ready to trade daily forecast & predictions? We’ve made a list of the best Forex crypto brokers worth trading with.